No Results Found

The page you requested could not be found. Try refining your search, or use the navigation above to locate the post.

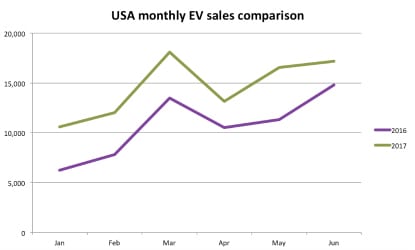

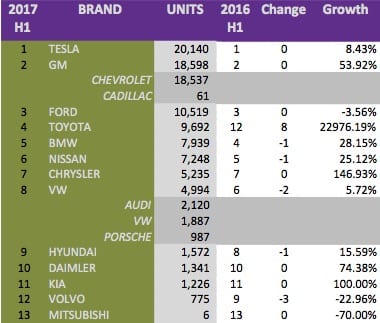

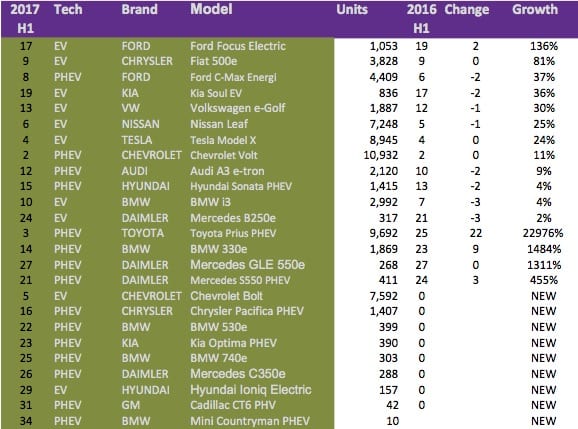

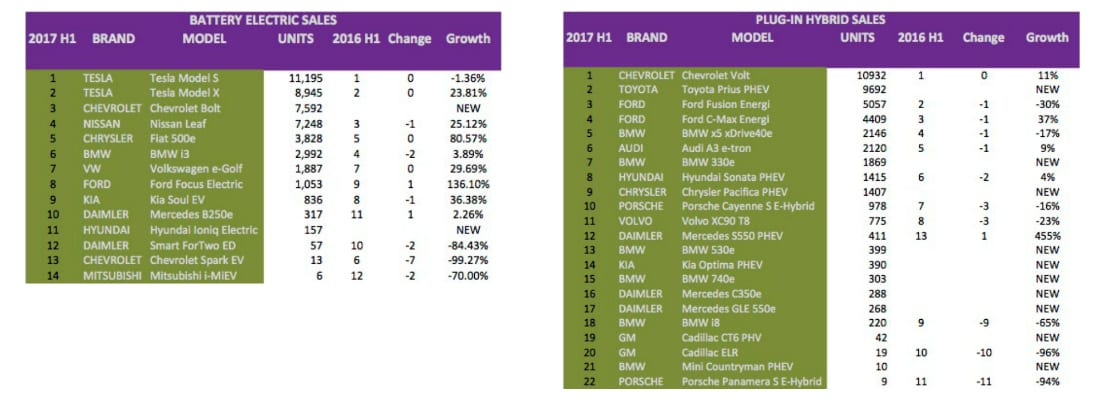

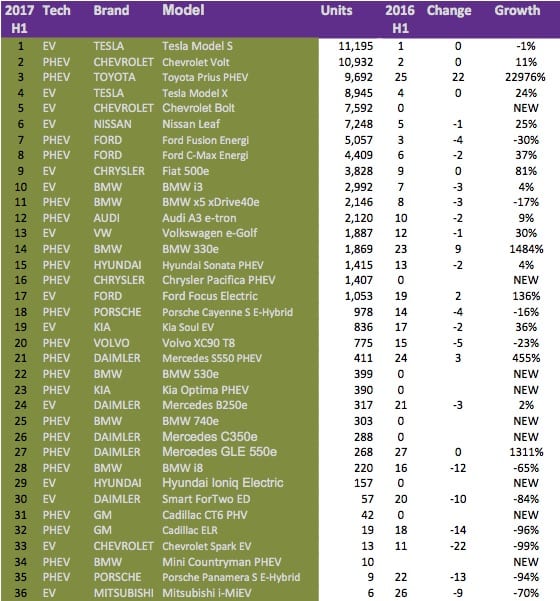

We look at the Top brands, Best and Worst Models and how the battle between battery electric (BEV) and plug-in hybrid (PHEV) technologies play out in the summary of USA EV Sales H1 2017.

The highlights for USA electric car sales in H1 2017 was:

There are no surprises in the Top 3 EV brands with Tesla holding on to its lead over GM due to a 24% rise in Tesla Model X sales. GM could not dethrone Tesla even with a new model, the mass-market Chevrolet Bolt EV up its sleeve. Improved sales in the 2nd Quarter from the Ford Fusion Energi and C-Max Energi helped the brand retain its third position fighting off the strong performance of Toyota with the new Toyota Prius which was placed third at the end of the first quarter.

Most brands showed improved sales growth over the first half of the year with only Ford, Volvo, and Mitsubishi showing declining sales. The Volkswagen Group showed a declining trend as the year progressed and mustered the lowest growth. The declining fortunes of the German automaker can be attributed to the Volkswagen e-Golf not being able to compete on range with the new mass-market Chevrolet Bolt being sold in the same price bracket. Chrysler showed the highest growth after Toyota buoyed by the new Chrysler Pacifica and great specials on its compliance car, the Fiat 500e. The results might have been better for the US automaker, but the Chrysler Pacifica launch was delayed and then impacted by recalls and plant closure due to battery problems.

Most of the existing models showed growth lower than the overall growth due to the big number of new models to the market. Surprisingly the Ford Focus and Fiat pure electric models outperformed the market showing that the public is becoming more comfortable with range issues and the continuously improving charging infrastructure is starting to have and effect on top of the financial incentives making EVs appealing.

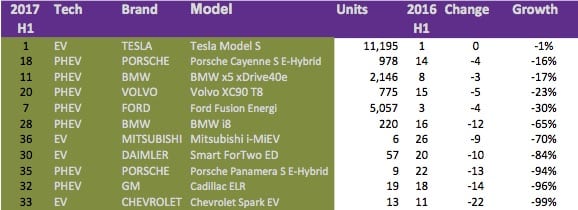

European plug-in vehicles were the biggest losers in this half of 2017 with a number of the luxury PHEV models losing big. Volvo and BMW saw some of their relatively new models losing steam. Both the BMW x5 xDrive and Volvo XC90 T8, released in 2016, lost market share in favor of the Tesla Model X. The Tesla Model S sales have flatlined although it remained the top selling BEV model. It will be interesting to see how the new Daimler Smart ForTwo ED fares in the second half of 2017. The German automaker is relaunching the brand as electric only in the USA and Canada from this summer and will offer a slightly improved model at a marginally reduced $23,800 starting price before incentives.

Battery electric vehicles are still maintaining its lead over plug-in hybrids albeit at a lower margin. BEVs took six positions in the Top 10 EV sales for the USA in the first half of 2017. The ever increasing number of plug-in models benefits the technology in the short term as it competes with only a handful of pure electric models. The Plug-in hybrid category benefited mostly from the release of the new Toyota Prius and to a lesser extend the Chrysler Pacifica. The Tesla Models X and S constitute nearly 44% of all BEV models showing the company’s dominance in the sector. The commanding position will improve even more with the release of the Model 3 in the second half of 2017 which might add about 40,000 units depending on the production ramp-up. The release of the Tesla Model 3 and new Nissan Leaf, expected by the end of the year, should help pure electric vehicles outperform the more dirty plug-in hybrids in the second half.

Be sure to check out our new presentation of all EVs since 2010 to gain great insights on all auto brands and their electric vehicle strategies. We have also created presentations per technology type BEV, PHEV, and FCEV.

The page you requested could not be found. Try refining your search, or use the navigation above to locate the post.

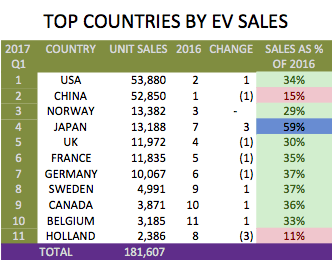

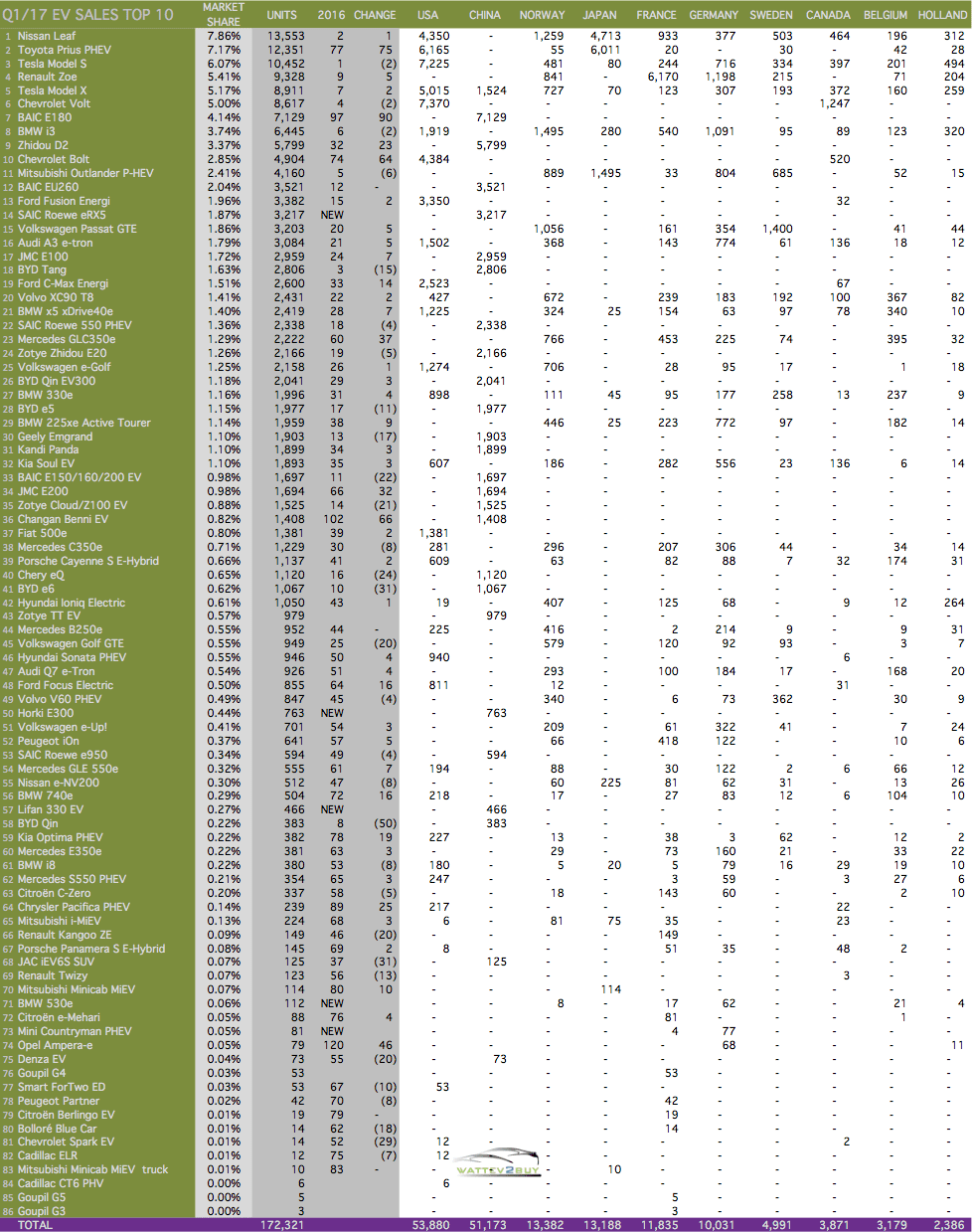

Now that all the Q1 data is in we can do a detailed dissection of the hottest quarter in EV history in which nearly 200,000 electric vehicles was sold. The headline data is that nearly 180,000 EVs were sold in the top 10 EV countries. Battery Electric Vehicles (BEV)  outperformed Plug-in Hybrid Vehicles (PHEV) by a long shot. A total of just over 106,000 BEVs were sold while only around 70,000 PHEVs moved off the dealership floor in the top 10 countries.

outperformed Plug-in Hybrid Vehicles (PHEV) by a long shot. A total of just over 106,000 BEVs were sold while only around 70,000 PHEVs moved off the dealership floor in the top 10 countries.

One of the standout data points is USA EV sales which overtook China as the best market for electric vehicles in Q1, making the USA the top EV country in Q1. The worst performer was The Netherlands, who fell out of the top 10. The Netherlands disappointing performance over the last couple of quarters does not bode well for the European country was seen, next to Norway, as one of the proponents of the technology. Only last year still did the Dutch Government contemplated a goal to be 100% electric by the middle of the next decade. It is unclear what caused the drop in EV sales in the Netherlands.

When comparing this quarter’s EV sales by country to their respective totals for 2016 one can see that the pace of EV sales picked up in most. If one should expect that by the end of Q1 EV sales should equate to roughly 25% of 2016, it is only China and The Netherlands that are underperforming. Chinese EV sales have lagged in January due to technical factors including a clampdown on EV subsidy fraud and the annual Chinese holiday, in which most industries shut down. Chinese EV sales have picked up the pace in the following months and the quarter still ended up 30% over the same period of the previous year. It can be concluded that EV sales for the first quarter in China are historically weak and Q1 2017’s performance is by now way an indication of a trend. Furthermore, the Chinese Government last week announced a plan to dominate the electric vehicle sector which should help the country to regain its stature. Japan, on the other hand, has picked up the strongest pace and has already achieved EV sales equal to 59% of its total 2016 sales. The Japanese EV market has the least variety of EV models available to consumers, and it is anticipated that the introduction of more models will stimulate the market further. Germany is the second best performer helped by a 77% improvement in EV sales on a year-to-year basis.

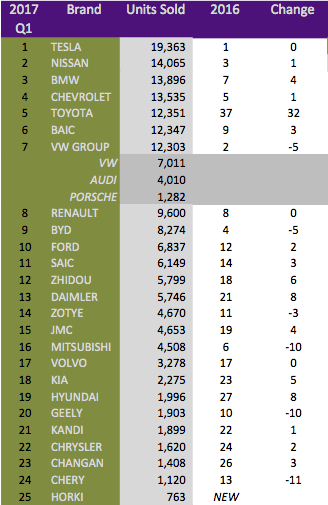

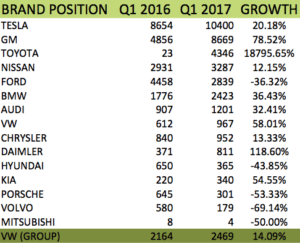

The top EV brand in the Top 10 EV Countries is Tesla for the second year running. Tesla announced in its April trading update that it sold just over 25,000 Models S and X globally. It is important to note that the figure repo rted includes vehicles being shipped, while country sales data shows vehicles registered. Toyota is back in the Top 10 list of EV brands on the back of a well-received new Toyota Prius. Chevrolet did not shoot the lights out with its new mass-market EV, the Chevrolet Bolt / Opel Ampera-e. Most of GM’s sales came from the Chevrolet Volt PHEV. The company is criticized for producing a limited amount of the Bolt and is being labeled as a compliance company for that, a term used for auto manufacturers that only sell EVs in Zero Emission states to gain credits. The big losers included VW, BYD, and Mitsubishi. BYD has been the Top EV manufacturer for 2015 and 2016 globally and was at the number three position for most EVs sold since the start of the decade. Competition from the likes of BAIC and SAIC is the main reason for the companies bad performance. Up til 2016, BYD had the advantage of being first to market, but some new models that can compete on performance and quality with BYD entered the market since 2016. (This sentence could very well be used for Tesla in a couple of years). Mitsubishi fell a staggering ten places as the company has not updated its popular Outlander PHEV or introduced new models as a replacement.

rted includes vehicles being shipped, while country sales data shows vehicles registered. Toyota is back in the Top 10 list of EV brands on the back of a well-received new Toyota Prius. Chevrolet did not shoot the lights out with its new mass-market EV, the Chevrolet Bolt / Opel Ampera-e. Most of GM’s sales came from the Chevrolet Volt PHEV. The company is criticized for producing a limited amount of the Bolt and is being labeled as a compliance company for that, a term used for auto manufacturers that only sell EVs in Zero Emission states to gain credits. The big losers included VW, BYD, and Mitsubishi. BYD has been the Top EV manufacturer for 2015 and 2016 globally and was at the number three position for most EVs sold since the start of the decade. Competition from the likes of BAIC and SAIC is the main reason for the companies bad performance. Up til 2016, BYD had the advantage of being first to market, but some new models that can compete on performance and quality with BYD entered the market since 2016. (This sentence could very well be used for Tesla in a couple of years). Mitsubishi fell a staggering ten places as the company has not updated its popular Outlander PHEV or introduced new models as a replacement.

The Top 10 EV models are still lead by the Nissan Leaf, a phenomenal performance by the 7-year-old EV. The Toyota Prius replaced the Tesla Model S in the top two while the Tesla Model X performed the best of the 2016 Top 10 cohort. Newcomers Chevrolet Bolt, BAIC E-180, and the Toyota Prius replaced the BYD e6, BYD Tang and Mitsubishi Outlander in the Top 10 EV models list for Q1.

Please use the comment section below to share your thoughts on the EV market.

Note on data: The detailed data above does not include the UK, who keeps their EV data more secret than Donald Trump does classified information.

The page you requested could not be found. Try refining your search, or use the navigation above to locate the post.

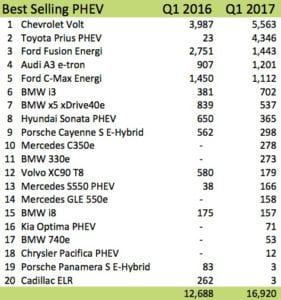

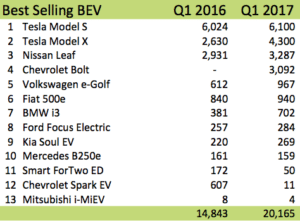

We look at the Top brands, Best and Worst Models and how the battle between battery electric (BEV) and plug-in hybrid (PHEV) technologies play out in the summary of USA EV Sales Q1 2017.

The highlights for USA electric car sales in Q1 2017 was:

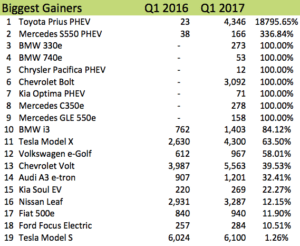

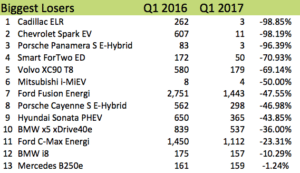

There are no surprises in the Top 3 Electric Vehicle Brands as Tesla remained on top, due to increase sales of the Tesla Model X, and GM and Toyota brought new models to book. Quarter 1 2017 was the first full quarter for the Chevrolet Bolt, the world’s first mass-market car. The Chevrolet Bolt‘s performance was rather disappointing, with sales dropping from a January high. The reason can be one of two, either GM‘s slow roll-out is to blame, or most buyers are waiting for the Tesla Model 3. Toyota’s only Plug-In Hybrid (PHEV) vehicle, the Toyota Prius Premium, performed remarkably well, taking in consideration that the battery capacity and range does not offer a real advantage to its competitors.

The bad boy on the block was Ford, barely hanging on to the Top 5 list of electric cars. Were it not for Porsche’s bad performance in the VW Group; the German automaker would have unseated Ford in the Top 5. BMW dropped out of the Top 5 list as Toyota entered the list in the third position. Daimler showed commendable improvement while Hyundai and Volvo joined Ford on the losing side. Nissan still shows consistent growth with its only electric vehicle, the Nissan Leaf.

Of the new electric vehicle models that came to market in this quarter, the Toyota Prius Premium, a PHEV outperformed GM‘s Chevrolet Bolt, a BEV by nearly 30%, a disappointing performance for the first mass-market electric vehicle. Both Mercedes-Benz and BMW had two more models in this quarter compared to 2016, with the Mercedes-Benz C350e and Mercedes-Benz GLE 550e outselling the BMW 330e and BMW 740e.

The Mercedes Benz S550 PHEV, BMW i3 2017 and Tesla Model X were the best performing existing models, although for the BMW i3, its the 50% improvement in battery capacity that attributed to its increase in sales.

The Tesla Model S sales remained flat on a year-to-year basis, despite continued improvements in its software and hardware.

Sales of the Cadillac ELR fizzled out completely in anticipation of the release of the Cadillac CT6 PHEV this month. Both the Porsche Cayenne and Panamera showed big losses in sales from a year ago, impacting on total growth for the VW Group. Judging from the Ford models sales slump, it is clear the century-old automaker needs to reassess it electric vehicle strategy. The big drop in the Volvo XC90 T8 can be attributed to the challenge faced by all automakers coming late to the electric vehicle party. To enter the electric vehicle market, lagging brands alter existing models to include batteries but in the process lose performance as drivers complain about smaller fuel tanks.

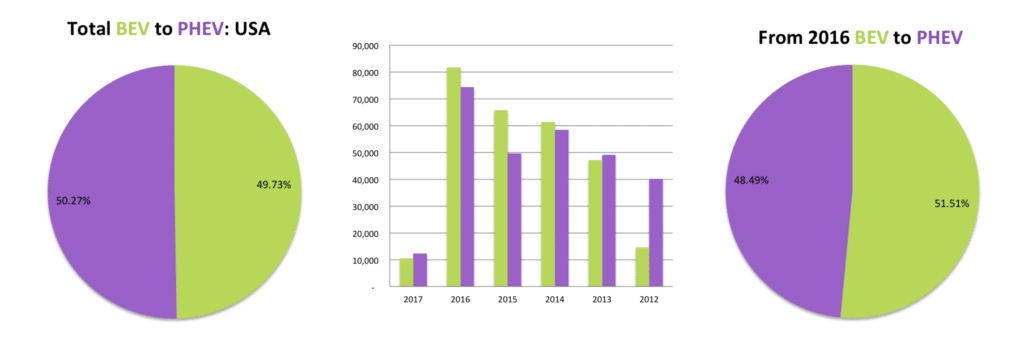

Battery Electric Vehicle’s (BEV), of which nearly half is constituted by the two Tesla models, outperformed plug-in hybrid electric vehicles. Over 20,000 BEV units were sold in the first quarter of 2017 compared to just under 15,000 a year ago. Q1 2017’s 19.2% increase in sales showed a slight improvement for the technology on Q1 2016 when BEV outsold PHEV with 17%. The USA is one of the few countries where BEV vehicles outsold PHEV’s since 2016, read our blog on the Top 10 EV Markets.

In total there is 13 BEV models and 20 PHEV models available in the USA market in 2017 so far. Consumers had a choice of seven new PHEV models in Q1 2017 and one BEV compared to the same period in 2016.

New model’s coming to market in the next quarter include three plug-in hybrids, the Cadillac CT6 PHEV, BMW 530e, and the Porsche Panamera 4 E-H, while only one BEV, the Hyundai IONIQ Electric will be released, should there be no surprises from Tesla on the Model 3.

Please leave us a comment on your thoughts regarding the electric vehicle models available to the US consumer.

Note on data used: For comparison purposes, the BMW i3 sales data was assumed to be divided in two, to accommodate for the BMW i3 BEV and REx PHEV

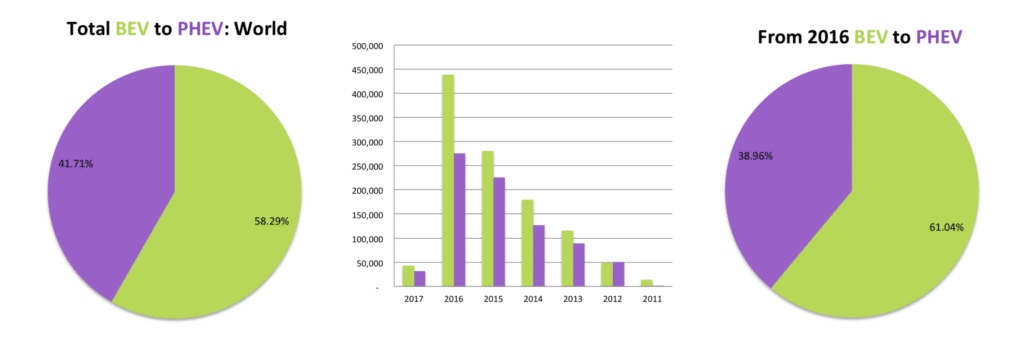

Battery Electric Vehicles (BEV), also known as pure electric vehicles, has outsold plug-in hybrid electric vehicles since the start of the decade. Intuitively one would have thought that because of the high cost of battery cells at the onset of electric vehicles that Plug-in Hybrid Electric Vehicles (PHEV’s), such as the Toyota Prius, would have been the best first step to enter the market, which the company initially did until it abandoned the technology. Traditional auto manufacturers (Big Auto) in general did not take electric vehicles seriously, leaving the task to start-ups such as Tesla to develop solutions for the consumer. In the auto industry, it is easier for new entrants to enter with new technology than compete with Big Auto, churning out engines from plants which cost has already been recovered. Thus leaving Big Auto at a disadvantage as they have to invest in research and infrastructure, playing catch up with the disruption.

The big driver’s behind the performance of BEV’s has been:

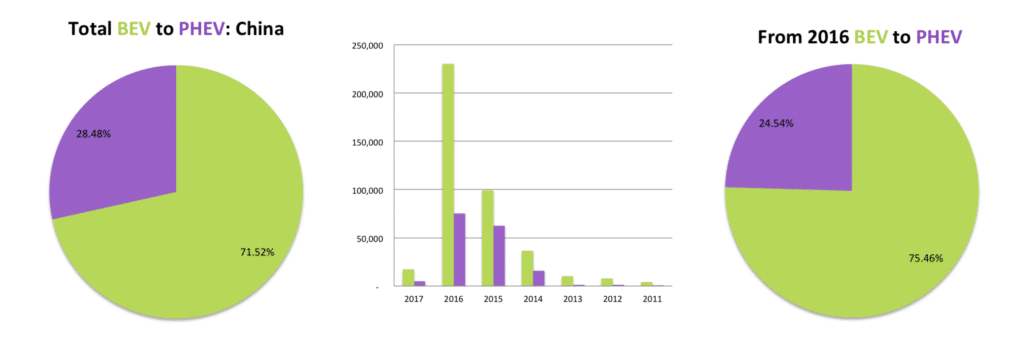

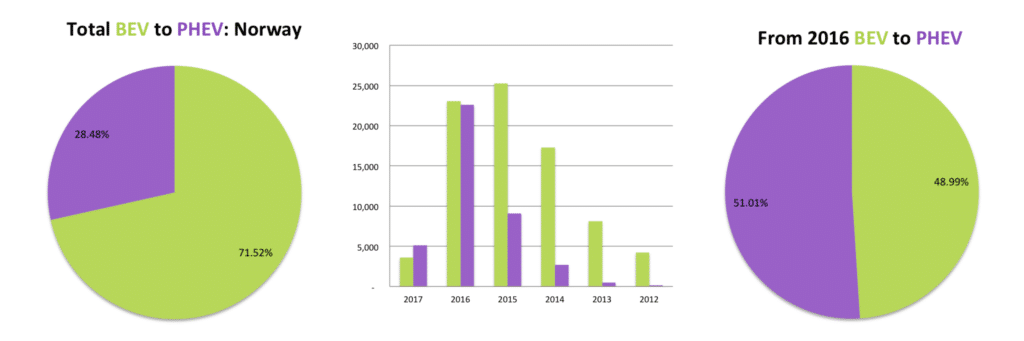

It is expected that the trend for BEV’s should remain favorable as technology and cost improvements and more automakers plan to bring BEVs to market by the end of the decade. Analyzing the Top 10 EV markets, which represent over 90% of all EVs sold, however, show the opposite. Surprisingly, at closer inspection, PHEV’s are gaining on BEV’s in the majority of the Top 10 EV markets. In our study below we compare the proportion of BEV’s to PHEV’s in the Top 10 EV markets by plotting all EV’s sold from the start of the decade to EV’s sold since 2016, when most automakers changed their electric vehicle strategies. (For more detail follow the links to the different countries for a complete breakdown of sales per model and year in that country).

Chinese BEV’s, not always the most beautiful looking cars, have performed very well since the start of the decade and even more so over our test period from 2016. There are only three PHEV’s of any value worth mentioning in China, namely the BYD Qin, BYD Tang and SAIC Roewe 550, which combined sales accounted for around 18% of all EV’s sold since the turn of the decade. 2016 for the first time saw larger sedans taking over from the micro BEV’s, with the BYD e6, BAIC EU260, and Geely Emgrand entering the Top 4 list in the country. It is clear that with aggressive government support sales for BEV’s are ever increasing in the world’s Top market for EVs.

The home of Tesla and compliance vehicles, the USA, is the second largest market for electric vehicles. Stripping out Tesla, which accounts for nearly 40% of all BEV’s sold in the country will provide a completely different picture than above, where the BEV and PHEV ratio mirrors a presidential race. Most Big Auto brands are represented in the country, and when we say country, we can be forgiven to say California, where it’s Air Resource Board developed the Zero Emission Vehicle Program, targeting 15% of all vehicles to be ZEV’s by 2025. The ZEV Program supports the adoption of BEV’s by forcing automakers to sell a certain percentage of Zero Emission Vehicles. The ZEV program has been adopted by nine other states, which in total account for around 30% of all new vehicle registrations in the USA. The result is that even automakers with no EV strategy, including Fiat Chrysler, are selling what is called “compliance vehicles,” being converted plug-in variants of existing models, such as the Fiat 500e and Chrysler Pacifica. GM has also been labeled a compliance company by some, even though it introduced the first mass-market EV, the Chevrolet Bolt. The argument against GM is that it only released the Bolt it the ZEV States while it produces an uninspiring amount of 30,000 vehicles. On the other hand, GM is supporting the fight against clean air regulations and Tesla‘s direct sales model, effectively trying to halt the progress in the EV sector.

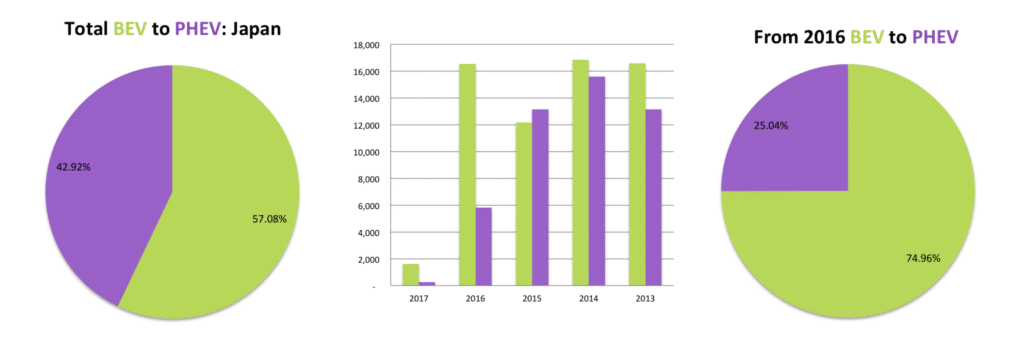

Japan, the fourth largest of the Top 10 EV markets, with China, is one of the few countries in the Top 10 list where BEV’s are outselling PHEV’s. In the case of Japan BEV’s contributed to around 75% of all EV’s sold. The country is however not the best example of expanding BEV sales. Only three brands contribute to over 90% of the sales through four models, namely the Nissan Leaf (EV), Mitsubishi Outlander (PHEV), Mitsubishi i-Miev (EV), and Toyota Prius (PHEV), which production was halted in 2015 for re-release in 2017. No great analytical deduction can be made other than a 40% increase in Nissan Leaf sales and 50% drop in Mitsubishi Outlander sales in 2016 resulted in the shift in favor of BEV’s.

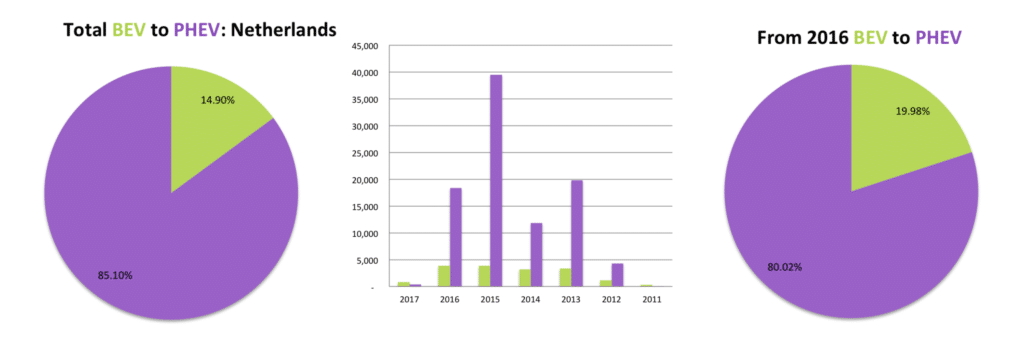

The Netherlands is a big hope for the EV sector. The country targets an 100% electric fleet by 2025. However, the data don’t really show encouragement for zero emission vehicles in a country one would have guessed would be ideal for BEV’s due to the relatively short distances within its borders ( sorry if this does not sound very Euro-centric). BEV sales have stagnated since 2013 with the Nissan Leaf and Tesla making up most of the market. The EV’s sector is dominated by PHEV’s from Volkswagen, Audi (also VW), Volvo, BMW, and Mitsubishi. The Mitsubishi Outlander PHEV is a big hit, cornering nearly 25% of the EV market in the Netherlands. The country also has the highest international sales of the Mercedes C350e, Volkswagen Passat GTE, Volvo XC90 T8 and V60 PHEV.

The Netherlands is a big hope for the EV sector. The country targets an 100% electric fleet by 2025. However, the data don’t really show encouragement for zero emission vehicles in a country one would have guessed would be ideal for BEV’s due to the relatively short distances within its borders ( sorry if this does not sound very Euro-centric). BEV sales have stagnated since 2013 with the Nissan Leaf and Tesla making up most of the market. The EV’s sector is dominated by PHEV’s from Volkswagen, Audi (also VW), Volvo, BMW, and Mitsubishi. The Mitsubishi Outlander PHEV is a big hit, cornering nearly 25% of the EV market in the Netherlands. The country also has the highest international sales of the Mercedes C350e, Volkswagen Passat GTE, Volvo XC90 T8 and V60 PHEV.

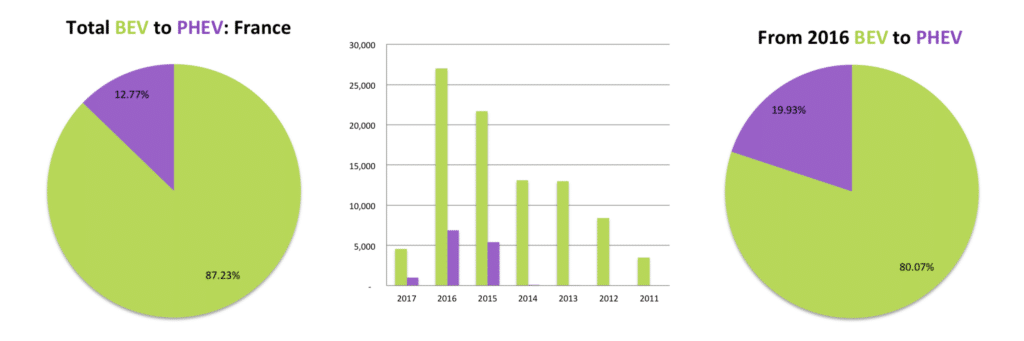

In France, the home of Renault, Citroën, Bolloré, and Peugeot is number six on the list of the Top 10 EV Markets. Here, PHEV’s have gained slightly on BEV’s but are still only 20% of all EV’s sold, while EV’s represent 1.4% of all vehicles registered in 2016. The high percentage of BEV’s is a clear indication that French automakers were more progressive in accepting electric vehicles at the turn of the decade. France also has the highest number of commercial electric vehicles, just over 15% of all EV’s, with the Renault Kangoo being the delivery vehicle of choice. France also has one of the biggest range of EV models available to the consumer, with over 50 models recorded in its official sales data.

In France, the home of Renault, Citroën, Bolloré, and Peugeot is number six on the list of the Top 10 EV Markets. Here, PHEV’s have gained slightly on BEV’s but are still only 20% of all EV’s sold, while EV’s represent 1.4% of all vehicles registered in 2016. The high percentage of BEV’s is a clear indication that French automakers were more progressive in accepting electric vehicles at the turn of the decade. France also has the highest number of commercial electric vehicles, just over 15% of all EV’s, with the Renault Kangoo being the delivery vehicle of choice. France also has one of the biggest range of EV models available to the consumer, with over 50 models recorded in its official sales data.

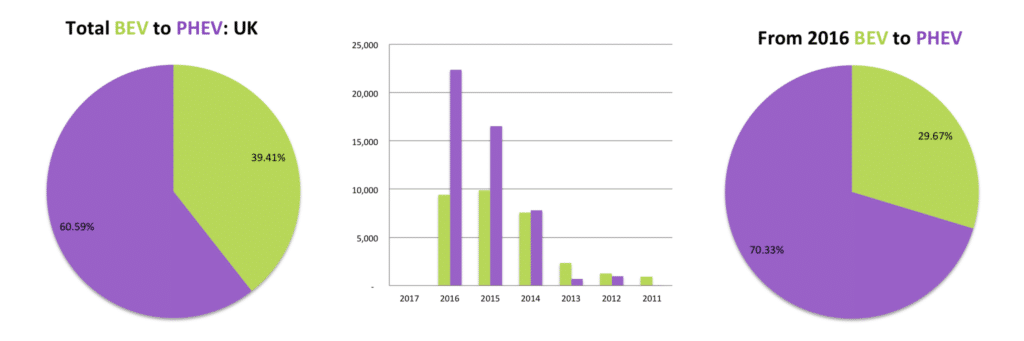

The UK market is much more excepting of PHEV’s with the trend increasing in the last year as more models are becoming available. The UK is another strong market for the Mitsubishi Outlander, where the Japanese vehicle represents nearly 30% of all EV’s sold. The world’s seventh biggest market for EV’s is also a great offset point for Germany. UK Sales for the BMW 330e is the highest in the world and sales for the Mercedes C350e is a couple of units short of the that of the Netherlands, which has the world’s most at 5,754 units. Publicly and reliable sales data for the UK is difficult to get hold of, with only the Top 5 models available up to December 2016, making a proper analysis difficult.

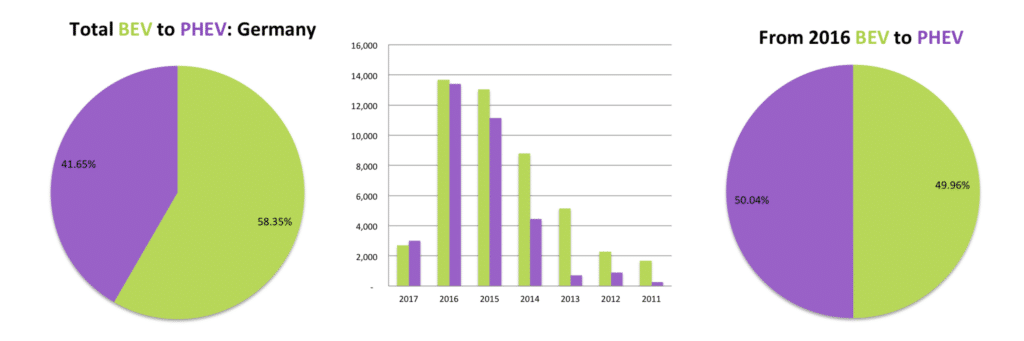

It would be surprising not to see PHEV’s beating BEV’s in the world’s 8th largest market for EV’s. Germany is home to BMW, Mercedes and VW, all brands that missed the boat on electric vehicles, now trying to catch a fast train on the back of PHEV’s. The three charts above clearly show how the release of plug-in hybrid variants of existing models since 2014 helped increase the sale of electric vehicles. Like in other European markets, the consumer is spoiled for choice in Germany.

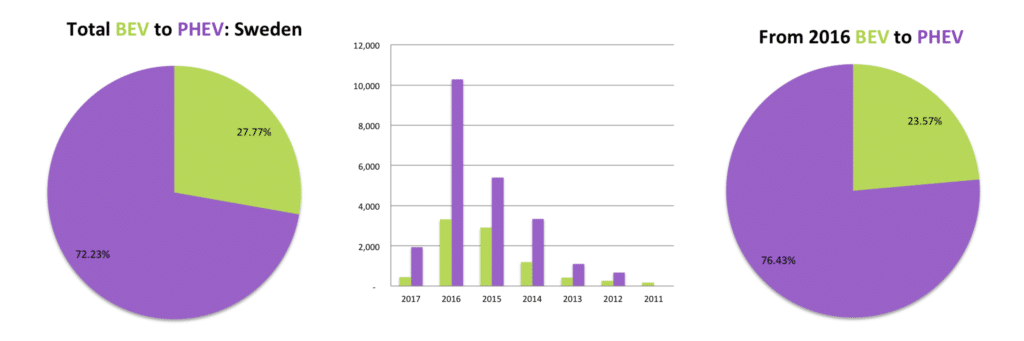

Sweden, number nine on the list of the Top 10 EV Markets and the home of Volvo also shows a big affinity for PHEV’s. The Mitsubishi Outlander again has a significant portion of the EV market, with a 25% market share of all EV’s sold. There is a significant drop between the number eight position of the Top 10 EV Markets and that of the ninth, with a 50,000 unit drop from 80,000, leaving very little to write home about. None the less Sweden commands the fourth position on the list of EV’s as a percentage of total vehicle registrations, with 3.5% of all new vehicles registered to be an EV in 2016.

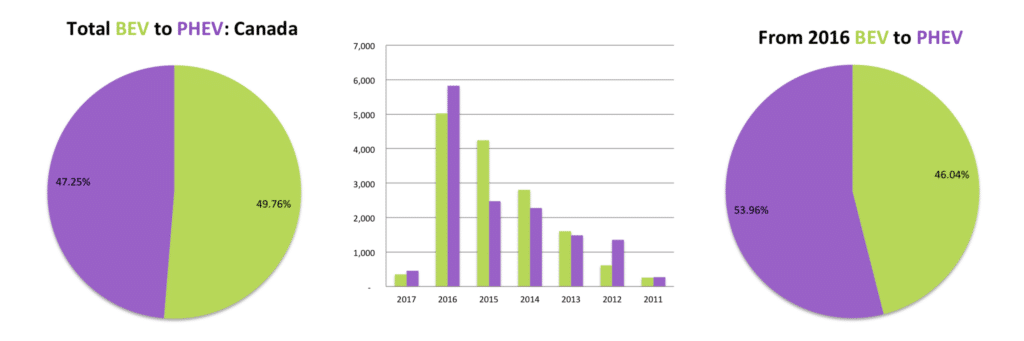

Canada in many ways mirrors the USA in trends, obviously at a much smaller scale. Just five models represent nearly 75% of all EV sales in the country, being the Chevrolet Volt, Tesla Model S, Nissan Leaf, Tesla Model X and the Smart ForTwo ED. The popularity of the Smart ForTwo makes it clear why Daimler decided to only sell electric versions of the micro car in the country.

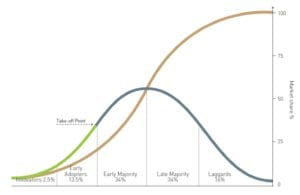

Saving the best for last. Norway, the darling of the EV sector, number three on the list of Top 10 EV markets and number one the list of EV as a percentage of new vehicle registrations. The country is now officially a growth market, reaching the take-off point for the technology, and a clear example of our thesis that PHEV’s are gaining on BEV’s. EV sales in Norway as a percentage of the total fleet for the year 2016 was at a record 29.1%. The prospects for 2017 looks even better, as in January the percentage of EV’s registered achieved a record-breaking 37.5%. At the same time, PHEV’s outsold BEV’s for the first time. Looki ng deeper into the data and drilling down into the model mix two things are starting to emerge, namely:

ng deeper into the data and drilling down into the model mix two things are starting to emerge, namely:

We can expect this trend to continue until there is a wider choice of BEV models for the consumer and charging infrastructure expanded. Let’s hope that this trend is not just another way for Big Auto to hijack and derail the drive to zero emission vehicles. In the meantime we should be grateful, that although not hardcore, PHEV’s still introduce new drivers to the pleasure of driving in full electric mode, thereby making them want a BEV next time they buy.

Notes on the data used for the study:

The page you requested could not be found. Try refining your search, or use the navigation above to locate the post.

We have designed some cool tools to compare electric vehicles. Our tools include a mobile app, charging cost calculator and EV selector. Use wattEV2Buy’s proprietary tools to find the ideal EV for your requirements and determine the cost of charging EVs.

wattEV2Buy’s easy to use EV Select tool helps identify which electric vehicle is perfect for your specific requirements. EV Select compare electric vehicles battery electric range over various vehicle types. Within four clicks you can get the perfect luxury sedan able to drive your required distance on battery power.

wattEV2Buy’s easy to use Charging Cost Calculator compare electric vehicles charging cost in your state and relate it to equivalent gasoline cost. The charging cost calculator also allows you to be specific and customize your electricity cost in kWh and provide results in miles and kilometers, making it usable all over the world.

Top 5 EV News Week 32 2020 | Cadillac Lyriq unveiled. Yet another Chinese EV startup IPO. Three new EV models launched this week.

Top 5 EV News Week 31 2020 | Successful IPO for CHJ Auto, Kandi finally enters the USA, Mitsubishi pays the cost for failing EV strategy.

Top 5 EV News Week 30 2020 | Chengdu Auto Show, Hozon Neta IPO, VW invest in China, eVito Tourer for sale