No Results Found

The page you requested could not be found. Try refining your search, or use the navigation above to locate the post.

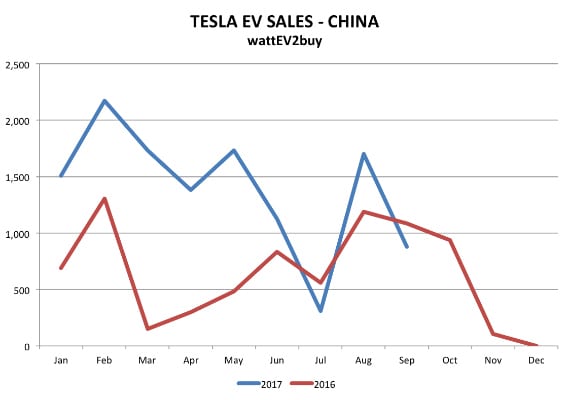

China, which accounts for nearly 40% of the global EV market, has always been one of the Tesla’s (TSLA) target markets. Tesla entered the Chinese market in 2014, early in its global expansion phase. The strategy has paid dividends and China currently is US automaker’s biggest market outside of the USA. To date, Tesla has sold around 250,000 of the Model S and Model X worldwide of which over 10% was sold in China. Tesla now accounts for nearly 3% of all EVs on Chinese roads, by far the most of any foreign-owned automaker in the electric vehicle sector.

The Chinese Government has always been very protective of its auto sector enforcing a strict 50/50 ownership policy on foreigners wanting to manufacture locally. Although Tesla is currently in negotiations to establish vehicle and battery manufacturing in Shanghai’s free trade zone, it will have to continue importing vehicles into China for at least another five years, exposing its operations to import tariffs. With China’s aggressive promotion of electric cars, Tesla will remain on the back foot to competitors with local production as Tesla models carry a 25% import tariff. Up to now, Tesla has been able to double its sales since 2015. Sales for 2017 are on track to double again despite a reduction in EV subsidies announced in January by the Chinese Government.

At some point, however, the high-end market will become crowded with local products, which will be at least 25% cheaper than that of Tesla’s imported vehicles. The introduction of the Model 3 will open a new segment for Tesla, but with delays in production, we can only see Tesla distributing the Model 3 in the Chinese market by 2019 at which point many other foreign makers will locally produce EVs. Various foreign auto brands have announced their intentions to produce a range of EVs exclusively for the Chinese market, including Tesla’s major competitors GM and the Nissan PSA Alliance.

Trade agreements announced during President Donald Trump’s recent visit to Beijing will, however, give Tesla’s sales some support. The Chinese Vice Finance Minister, Zhu Guangyao, announced on Friday the 10th of November 2017 that the country will gradually lower tariffs on imported vehicles. Minister Zhu went further announcing that the ownership restrictions on foreign manufacturers will be lifted very soon, allowing foreign auto brands to establish 100% owned plants in any one of the country’s eleven free trade zones. The minister did not give any timeframe on the easing of import duties though.

The page you requested could not be found. Try refining your search, or use the navigation above to locate the post.

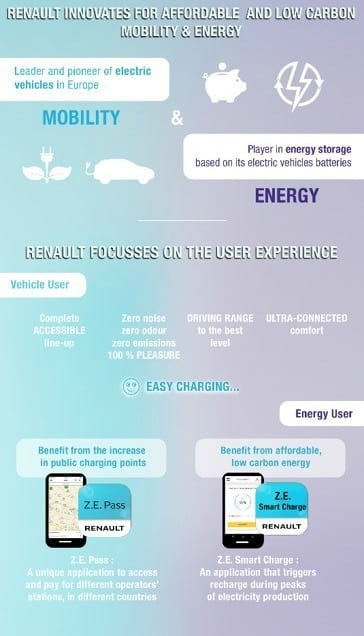

The nature of electric vehicles is much closer related to its energy source than that of combustion vehicles. Historically auto companies, as a rule, stayed out of the production of their fuel source. Since the introduction of the Power Wall and acquisition of Solar City analysts refer to Tesla as an energy company, rather than an automotive company. Now Renault wants to mimic Tesla‘s business model through the creation of a new subsidiary, Renault Energy Services, which is to specialize in energy, smart grids, and electric mobility.

Renault sees the energy and smart grid sectors as fundamental to the expansion of electromobility. The new subsidiary will focus primarily on the development of smart charging, V2G (vehicle to grid) interaction and second-life batteries by collaborating with the energy sector or investing in smart-grid related projects.

energy sector or investing in smart-grid related projects.

Gilles Normand, SVP, of Electric Vehicles at Renault said – “The creation of Renault Energy Services marks an important step forward. Investing in smart grids is key to both reinforcing the lead we enjoy in the European electric vehicle market and accelerating the EV industry’s scale-up.”

Renault sees the benefit flowing to its EV customers as Renault electric vehicles connected to smart grids will be able to pay less electricity through optimized charging.

Although it’s not a new phenomenon for auto companies to invest in energy networks for charging, the commitments were more a necessity enforced by regulation and customers than a profitable venture. Renaults move to focus on smart grids through a subsidiary would be one of the first to focus on new business profits from energy. It will by no means be the last where we see auto companies and energy providers play in the same sandbox.

The EV snowball is getting bigger by the day.

The page you requested could not be found. Try refining your search, or use the navigation above to locate the post.

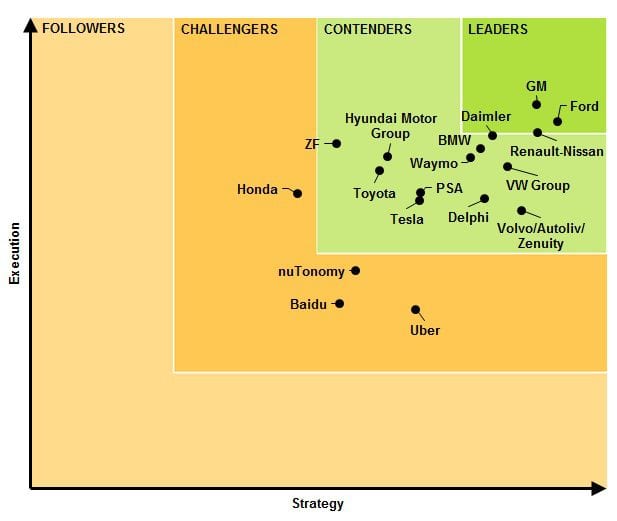

Navigant Research placed Ford and GM at the top of its autonomous driving leaderboard, surprisingly far above Waymo (7th), the pioneer of autonomous driving. Waymo was only listed as a contender, and Tesla who has already clocked over 300 million miles in Autopilot (Level 2 Autonomy) did not make the Top 10 list. Waymo, not aiming to develop a car, but rather focusing on autonomous technology has partnered with Chrysler and Ford on testing autonomous technology.Making Navigant’s findings even more surprising to us is that

Making Navigant’s findings even more surprising to us is that Waymo performed exceptionally well compared to other automakers on the list when comparing across all permit holders allowed to test autonomous tech on Californias public roads. According to CA DMV regulations, each permit holder must annually file a disengagement report, reflecting the number of events where a driver essentially has to take over from the vehicle’s autonomous mode to either prevent a traffic incident or where the system fails. Waymo posted a record 0.2 disengagements per 1,000 miles in its 2016. For a breakdown of each permit holders testing in California read our recent blog providing detailed analysis. The table below shows a summary of all the permit holders in the CA DMV program’s disengagements per 1,000 miles.

Despite Tesla aiming to have a market ready Level 5 autonomous product by the end of the year, it is only listed as a contender. Tesla is criticized by some, for being too aggressive, using its customers as guinea pigs for its AutoPilot software.

Not surprising though is that Uber features on the bottom end of the list, the controversial ride-hailing company has been in the news lately for losing its right to test in San Francisco, being sued by Waymo and a crash in Tempe, Arizona, temporarily halting its pilot program.

Tesla (NASDAQ: TSLA) shares broke through its $280 resistance level on record sales for the first quarter 2017, leading investors to re-evaluate their outlook for the company. The results showed that Tesla could deliver above market expectations. The sentiment is supported by a decrease of vehicles in shipment, of around 1,800 units. Investors are now reconsidering the poor market guidance for the company to deliver on its Tesla Model 3 promises. The Q1 sales of 25,418 units show a growth of 12% on the previous quarter, which is a massive 69% on year-on-year basis. The Tesla Model X was the star, showing around 22% growth at 11,550 units, while the Model S sales grew by nearly 6%.

Today’s intraday share movement makes Tesla’s market value more than Ford (NYSE: F) and sees it gaining on General Motors (NYSE: GM), officially making it the number two in the sector. The electric vehicle manufacturer, which some still sees as a start-up, intraday market capitalization stood at around $47.95 billion, while Ford’s value dropped to $44.91 billion, on the back of a share price that was down 5%, caused by a decrease in March sales of 7%. GM shares also suffered a sell-off of around 4% on a marginal growth of just over 1%, bringing the companies market cap well within reach of Tesla at $50.78 billion.

Both GM and Ford have missed the opportunity in electric vehicles. The automakers recently wrote to President Donald Trump, in an attack on EV’s, through the Alliance of Automobile Manufacturers, asking him to relax emission targets as they did not see consumer demand for electric vehicles justify such stringent EPA standards. Maybe investors are taking a cue from Hyundai’s shareholders, who revolted, resulting in the company changing its electric vehicle strategy in 2016.

The strong resistance of $280 which held since September 2014 saw the stock retreat after creating a double top formation at the level in July 2015. After testing the resistance for the second time, Tesla’s shares retreated to a low of $151 in Feb 2016. The first count on the breakout of the channel, which broke in January at $230, can see Tesla’s shares trade at around $320 in the near future. If all else remain equal, it will equate to a market cap of $52,2 billion, well above that of GM.

Share data, Google and Marketwatch

Tencent acquires a significant stake in Tesla. The large Chinese Internet company, with holdings in various electric vehicle companies, have acquired a significant stake in Tesla. The acquisition was made by accumulating stock over time. Tesla (TSLA) shares traded higher by around 2.2% at $276.25 in after-hour trades, bringing it closer again to the $280 all-time high resistance level.

Tencent is owned by the world’s 46th richest person, Ma Huateng of China, also know as Pony Ma. Tencent, which applications include the popular WeChat app, similar to WhatsApp, aims to leverage its tech experience in a world where connectivity and the Internet of Vehicles will drive the auto industry. The development of electric vehicle technology provides a perfect platform for tech and vehicles to meet. To this end, Tencent created a company Future Mobility and targeted an autonomous vehicle by 2020. Tencent is also a shareholder in NextEV. NextEV’s NIO brand unveiled its autonomous vision a couple of weeks back at an event in Austin Texas.

Interestingly enough, the result is that a South African company, Naspers, is now an indirect shareholder in Tesla, a company founded by native South African, Elon Musk. Naspers currently holds around a 34% shareholding in Tencent; the company made its investment in Tencent when it was a little-known start-up in 2001. At the time Naspers invested $34m for 46.5% in Tencent.

Read our related post on how disruption is drawing the world’s richest to the auto sector.

One of the few company’s being called a Tesla killer with a shot at it (however distant), the San Francisco-based Lucid Motors, today announced the pricing for its base model.

The base price for the Lucid Air will be $60,000 before Federal ($7,500) and State incentives, which compares extremely well with luxury ICE and PHEV vehicles such as Volvo, BMW, and Mercedes and delivers a superior performance being a fully electric vehicle. Some in the media billed the Lucid Air a Tesla Killer, much like Faraday Future also claimed, although FF’s claim seems very much like hot air then walking the talk. At least Lucid Motors management, beginnings, and the business plan seem much more grounded, and delivering an electric vehicle with a range of 240 miles below the Model S 60 which start at $68,000 for 218 miles seems like an aggressive shot across the bow. Lucid Air started off as Atieva, a developer of battery systems for electric vehicles.

[metaslider id=9933]

The features of the base model are listed as:

The Lucid Air will be available in a number of options, all the way to what was presented in its Alpha show car, allowing it to compete in the large luxury car segment. The complete package will cost north of $100,000 and although final options were not released the company provided a glimpse on some of them, being:

The first 255 cars of the line will be Launch Edition vehicles, priced at over $100,000 and will also have unique colors and badging, signifying their special nature.

It will take a lot to be a Tesla Killer in our viewpoint, but at least Lucid Air provides the consumer more options. No indication of a launch date has been provided, but interested customers can reserve a base model at $2,500 and the Launch Edition at $25,500 on the company’s website.

The barriers to entry into auto manufacturing became ever higher over the last 100 years before the disruption caused by technological advances in electric vehicles and self-driving technology. Most of the auto brands that were around at the turn of the century have been around for 50 years or longer; the only newcomers was a spate of Chinese brands backed by the government. For an individual to reach the top 50 position on the Forbes list from vehicle manufacturing was only possible if your parents left you a trust fund with a bunch of 100-year-old stock in a big brand. In fact, the only Forbes Top 50 billionaire from the auto sector was the German’s, Herbert and Johanna Quandt who owned nearly 50% of BMW and Georg Schaeffler (Number 39 on Forbes 2016 list) who inherited the automotive parts company, Schaeffler Group. After their passing of Johanna Quandt, the children, Susanne Klatten (Number 38) and her brother Stefan Quandt (Number 48), became the beneficiaries. Mrs. Klatten invested her fortune in pharmaceuticals, helping her to gain over her brother.

Come to the turn of the century and along came Elon Musk, risking it all on a technology that has been shunned for 100 years by big auto. Being a start-up in a market controlled by a couple of dinosaurs was not easy at first, Mr. Musk had to back himself in the first couple of rounds of fundraising for the electric vehicle company, Tesla. The table below shows that Elon Musk pretty much up until late 2008 lead fundraising and loan rounds. The risk paid off as Elon Musk became by far the richest person in the US auto sector and at the time of going to press Elon Musk jumped to the 83rd position, up from 94 in the official 2016 Forbes list of the world’s richest people.

[supsystic-tables id=105]

Other early billionaires in the technology include the savvy investor Warren Buffet and Vincent Bollore. Warren Buffet, the world’s 3rd richest individual through his Berkshire Hathaway, controlled company, Mid-American Energy Holdings in 2008 bought 10% in BYD, a Chinese battery company, now the world’s largest electric vehicle manufacturer. The Investment at the time was $230m. Berkshire Hathaway is also a significant minority shareholder in GM.

Vincent Bollore, France’s 10th-richest person with an estimated personal fortune of $6 billion dollars, started manufacturing batteries in his company Bollore Blue Solutions. The firm, situated in Brittany province, who’s batteries are cheaper than lithium-ion cells used in other electric cars, allows it to hold down the cost of his small vehicles.

Suddenly investing in electric vehicles became sexy. Chinese billionaires, mostly from the technology sector, were the first to climb into the auto sector, some more successful than others. The Chinese electric vehicle boom is fuelled by government incentives targeting that 8% of all new vehicles should be EV’s by 2018.

The tech billionaire and founder of BitAuto, an online vehicle sales platform, William Li started the Shanghai-based NextEV. The company raised $500M of an expected $1Bln already, sporting shareholders such as Tencent, who is also invested in Future Mobility, Hillhouse Capital, who also invested in UBER, Sequoia Capital and Joy Capital. The company invested C¥3Bln in Nanjing High-Performance Motor Plant to produce 280,000 electric vehicles per year. NextEv also signed a partnership with one of the largest Chinese auto companies, JAC Auto which will see them share technology, manufacturing, supply chain, marketing, and capital.

Tencent mentioned above is owned by the world’s 46th richest person, Ma Huateng of China, also know as Pony Ma. Tencent, which applications include the popular WeChat app, aims to leverage its tech experience in a world where connectivity and the Internet of Vehicles will drive the auto industry. The development of electric vehicle technology provides a perfect platform for tech and vehicles to meet. To this end, Tencent created a company Future Mobility and targeted an autonomous vehicle by 2020.

The Chinese billionaire, Jia Yueting, founder of LeEco which owns LeTV, the Netflix of China invested in two electric vehicle companies, LeEco, which developed the acclaimed LeSee concept vehicle and Faraday Future, developer of the disastrous FF91, unveiled at the 2017 CES. Both businesses are known for making bold statements and big ticket announcements just to be followed by press reports of cash flow and funding problems.

The Chinese internet giant, Alibaba, owned and founded by Jack Ma who is 33rd on the 2016 Forbes list, invested $160M in a fund where it partnered with SAIC, one of the largest Auto manufacturers in the China to develop internet connected cars. The first car to come from the partnership is the Roewe OS RX5, where OS stand for Operating System and using SAIC’s luxury brand Roewe as a platform. The software runs on Alibaba’s YunOS operating system. Jack Ma unveiled the car in July 2016. The Alibaba Connected Car will have its own Internet ID, not needing WiFi or GPS services, enabling it to connect and identify drivers  through their smartphones and wearables. The RX5 has four cameras providing it 360° vision and is voice controlled. The vehicle’s starting price is around $15,000 or C¥100,000.

through their smartphones and wearables. The RX5 has four cameras providing it 360° vision and is voice controlled. The vehicle’s starting price is around $15,000 or C¥100,000.

Alibaba beat other carmakers and tech companies to the finish line with the 2016 release of the RX5. In 2015 Toyota invested $1 billion in artificial intelligence research, while Apple invested $1 billion in Chinese ride-hailing app, Didi Chixing. BMW went into partnership with technology firms Mobileye and Intel, providing the automaker with operating systems and driving assistance software while Kia and Google partnered around the search engine’s Android Auto operating system.

Robin Li, number 90 on Forbes List and owner of Chinese search engine Baidu, partnered with chipmaker Nvidia in September 2016 to develop a computing platform for self-driving cars. Baidu recently received approval from the Californian Department of Motor Vehicles to test autonomous vehicles, in Google‘s back yard. Baidu also partnered with BMW on creating an autonomous car.

Now that the floodgates are open, billionaires from around the world are looking to enter the electric vehicle and self-driving sectors. The world’s fourth richest man, Carlos Slim of Mexico, announced this early this year that he would back the development of a Mexican-produced electric vehicle through his company, Giant Motors in a joint venture with Grupo Bimbo, the world’s largest bread maker. The strategy plays off in an environment where many US based automakers are contemplating bringing production back to the USA amidst President Trumps America First policy environment. Mr. Slim said the electric vehicle would be designed specifically for Mexican conditions.

Bloomberg reported that the JSW Group’s owner and Chairman and India’s 19th richest man, Sajjan Jindal, announced in Davos, Switzerland his intention to enter the Indian Electric Vehicle market by 2020. The metals tycoon expects the Indian government, like many other governments, will promote EVs once it’s more affordable.

It is clear that some of these businessmen are purely opportunistic, targeting to profit from regulation and subsidies for the promotion of electric vehicles.The majority, however, leverages their passions to bring better and more advanced options to the consumer at a much faster pace than what big auto ever moved in the last 50 years.

Although not mutually inclusive to electric vehicles, self-driving cars, deployable on combustion vehicles also, will drive the second phase of disruption in the auto sector over the next ten years. Self-driving car’s poster child is Google, owned by the 12th and 13th richest individuals in the world, Larry Page, and Sergey Brin. The company started testing it’s quirky autonomous vehicle as far back as 2009. Google recently spun the project into a standalone brand, named Waymo, meaning “a new way forward.” The company aims to partner with vehicle manufacturers instead of developing its own car. The first of such efforts was the conversion of 100 Chrysler Pacifica’s Plug-in Hybrid vehicles. Google, in many’s eyes, has lost the lead to Tesla, who’s progression was much faster and already has active Level 2 autonomy available in its production vehicles.

It will be interesting to compare the Forbes list of wealthy individuals ten years from now to one at the start of the century; we expect much more fresh faces who made their money from disrupting the auto sector. As a footnote, the lesson learned time and time again by dinosaurs in an industry are that they become too big, arrogant and slow, creating opportunities for new hungry entrants.

Picture: Source www.technewstoday.com

The race for self-driving cars began in all earnest in 2015 with Tesla aggressively leading the pack at the end of 2016. Tesla’s CEO, Elon Musk, is of the opinion that current hardware is already sufficient to allow Level 5 automation (full automation) as set by SAE International, an engineering association. KPMG in its 2017 Global Automotive Executive Outlook found that 37% of auto executives rated the self-driving trend as extremely important. The initial front-runner for the technology, Google Auto (now Waymo) has changed strategy from developing a car to developing systems and rather partnering with automakers than building its own car. Other than Tesla, who develop and test on the go with incremental software upgrades. Google and most other contenders are developing solutions in closed environments while being permitted to test on public roads in States such as California, Michigan, and Illinois. By late 2016 a total of 20 companies has received permits from the California Department of Motor Vehicles (CA DMV).

According to the regulations, each permit holder must annually file a disengagement report, reflecting the number of events where a driver essentially has to take over from the vehicle’s autonomous mode to either prevent a traffic incident or where the system fails. These submissions allow the public who is interested what is happening in the automaker’s self-driving test some insights, outside from what the marketing departments feed the media. Although a total of 20 permits have been granted by the end of 2016, only ten companies have conducted public tests or filed reports for the period. Here follows a summary of the reports filed by the various companies for their testing on Califonia’s public roads for the period December 2015 to November 2016. For comparison purposes, we converted the result to indicate the amount of disengagements per 1,000 miles, a measurement used by Waymo in a recent post by its Head of Self-Driving Technology, Dmitri Dolgov.

[supsystic-tables id=’88’]

Comparing disengagement results per 1,000 miles above shows, bar Tesla’s customers who have clocked over 300 million miles on Autopilot (Level 2 Automation) as at November 2016, it is clear that Waymo is aggressively accelerating its learning and showing the results for it compared to the other brands with projects on Californian roads. One must, however, take into consideration that comparing the different disengagement reports is not truly comparing apples to apples. Ford’s testing, for instance, was only on the stretch of Interstate 10 between Los Angeles and Arizona. The companies also have different strategies. Tesla aims to have level 5 automation as soon as possible while companies such as Ford aims to have autonomous vehicles for ride-hailing and sharing services only from 2021 onwards, influencing the difficulty grade of testing. To further try and unravel each company’s testing program we delve deeper into their submitted reports below.

In a bid to fast-track its electric vehicle strategy in an effort to curb pollution, the Chinese Government has called for comments on a proposal to invite foreign automakers to manufacture in the country. Current laws are designed to protect local manufacturers by forcing foreign companies to partner with the local automakers. The Chinese Government now propose to relax these conditions for new energy vehicles, providing the likes of Tesla an opportunity to produce locally and protecting their technology by not having to share it with a local partner.

Pictured is the Zinoro 1 EV, an example of how foreign manufacturers had to operate till now in China. The BWM Brilliance Joint Venture created the Zinoro premier car brand in 2013 to deepen the localization of BMW. Zinoro assembles its vehicles at the BMW Brilliance plant in Tiexi, near Shenyang in Liaoning Province north-east China. Many other manufacturers flooded the Chinese market with old technology to protect their intellectual property, hurting the consumer in the process, in a bid to just tow line in terms of government regulation.

Tesla voted the consumers darling in the Consumer Reports Annual Owner Satisfaction Survey with 91% Tesla owners responded with a “Definitely yes” when asked if they will buy the brand again. Second with only 84% was Porsche. The bottom quartile included brands such as Jeep, Nissan, Fiat, and Volkswagen, which dropped eight places. The survey included over 300,000 vehicles. Can the States who is refusing Tesla’s direct selling model, naysayers, and auto dealers refusing to get behind electric vehicles please respond to this? For the complete list follow the link.

The biggest electric vehicle-related news of the past week was the much-anticipated launch of the Tesla 100kWh battery pack. The battery upgrade allows for increased range and speed, making the Model S P100D with Ludicrous mode the fastest production car on the road. The Model S upgrade has a range of 315mi, which is about 20 miles further than a Model S 90D, and in the Model X SUV, you will be able to travel 289mi. But range, in my opinion, is becoming less of an issue as charging infrastructure is built out, and more people realize that range anxiety is mostly an old wolves tale perpetuated by petrol heads. What is more important though is how quickly you can refill the batteries to continue on your journey? Tesla is certainly also the leader in the charging wars at the moment. Other vehicle manufacturers trying to catch up with Tesla, such as VW identified 15-minute charge for 300 miles as a key deliverable, but according to the company’s CEO, Matthias Müller the target date for this challenging task which would require 800 V charging technology, is only in 2025.

When it comes to comparing cars, however, the only matrix that matters in the eye of the general public is acceleration. Measuring acceleration from 0 – 60mph over a quarter mile is also the most common matrix used to compare electric vehicles with gas guzzlers, which gave rise to a whole cottage industry of YouTube marketers posting videos of a Tesla against one or other supercar, such as the Lamborghini Aventador.

With the new Tesla S P100D in Ludicrous mode, the vehicle is said to accelerate from 0 – 60mph in just 2.5 seconds. It begs the question if it’s even morally legal for a family sedan to be able to drive at that kind of speeds. To put the figure of 2.5 seconds in context, the Audi R8 e-tron‘s electric top speed is only 3.9 seconds and in combustion mode, for lack of better word, it is only 3.2 seconds and the BMW i8 in 4.4 seconds. The Tesla S P100D even beats its own kind on paper, the Rimac Concept One, billed the fastest electric car accelerates from 0 – 62mph in 2.6 seconds.

So, be prepared for a whole lot of Youtube videos showing the Tesla Models S, seating five adults, two children, and luggage and costing around $147,000 beating anything from a Ferrari to a Porsche Spyder costing close to $1M. The YouTube video I would most like to see is the Tesla against Atieva’s converted Mercedes van, Edna.

Contributor

Ever the one for grabbing the headlines, Elon Musk recently announced that Tesla is working on an electric truck and an electric bus. While you could argue that the technology used in the electric cars of today can be readily transferred to electric trucks and electric buses, is there an argument for suggesting that Tesla should just stick to electric cars for now? Is the introduction of new products going to put pressure on the company’s cash flow and quality of products?

There is nothing wrong in planning for the future and there is no doubt that Tesla has some major plans for the months and years ahead. This comes at a time when the company is looking to roll out its new Tesla Model 3 and has faced some criticism from analysts regarding its autopilot system. In some ways we may be falling into the old trap of seeing Tesla as an automobile manufacturer when indeed it is a technology company. If we look at the likes of Apple, it has managed to transfer its technology to various platforms with the type of success many companies can only dream of. (more…)

This week saw final quarter figures from electric car giant Tesla with a tripling of full year losses to a staggering $889 million. Despite the fact that fourth-quarter figures were worse than expected shares in the company rose by 6% as ever confident entrepreneurs Elon Musk mapped out his plans for the future. However, while investors still seem to be enjoying a love affair with Tesla there are concerns that the company will need additional funding sooner rather than later.

When you consider that annual revenues at Tesla increased by 27% to just over $4 billion this does not look like a company in trouble? Indeed the company is expected to hit its capacity of 1000 cars a week during 2016 which would lead to a significant increase in sales. With the new Tesla Model 3 creating a significant backlog of orders there are high hopes that sales will perhaps increase quicker than many are forecasting. There will be manufacturing challenges, no doubt issues and problems along the way, but if Tesla can convert the majority of current Tesla Model 3 orders into sales then this would strengthen the balance sheet somewhat. (more…)

The US automobile industry has in many ways been a law unto itself for decades now although young EV upstart Tesla Motors is determined to take on the might of the archaic US dealership system. While the original idea of dealership only automobile sales across the US was well-balanced, protecting consumers and independent dealerships from the might of the automobile giants, the Internet has changed the playing field. Many have tried and failed to overturn this ancient system but the outcome of a forthcoming Supreme Court battle in Utah could have significant ramifications for the future.

Dealership associations up and down the US dominate and effectively dictate the way in which automobiles are sold. Restrictive direct sales laws in states such as Texas, Connecticut, Michigan, Indiana, Utah and others have not help the development of the electric car industry. The idea behind this system was to offer consumers a local contact point for issues, enquiries, spare parts, etc and effectively outlaw long-distance selling. However, the online sales arena has had an impact upon nearly every area of business life although the automobile industry is the last one to hold out! (more…)

Many people believe that the electric car market in its most basic form has gone past the point of no return and will be a major element of the automobile mass market going forward. This forward-thinking, forward-looking and technologically advanced industry is now looking towards the next development which for many will be autonomous vehicles. So, what is the general feeling about autonomous vehicles? Would you trust a car where you had little or no input?

One of the main problems regarding the concept of autonomous vehicles is the fact that the general public have little or no experience in this particular area. How would it work? Is it really safe? Would there be a general override in the event of problems? (more…)

You may have noticed over the last few weeks that Tesla Motors has come in for a significant amount of criticism with regards to its autonomous driving system. A recent death obviously attracted the interest of the authorities, and while there were mitigating circumstances, it seems that some areas of the worldwide press are gunning for Tesla. Elon Musk has taken the electric car industry from not even a niche market to the mass market in less than a decade.

However, is it fair for Tesla Motors to carry the whole electric car industry?

Elon Musk is a multimillionaire who has no qualms about taking on the establishment and pushing back the envelope of new technology. Having initially made his money from the electronic payment system PayPal he now has his fingers in a number of pies but his investment in Tesla Motors has taken his public image to a different level. (more…)