ONE

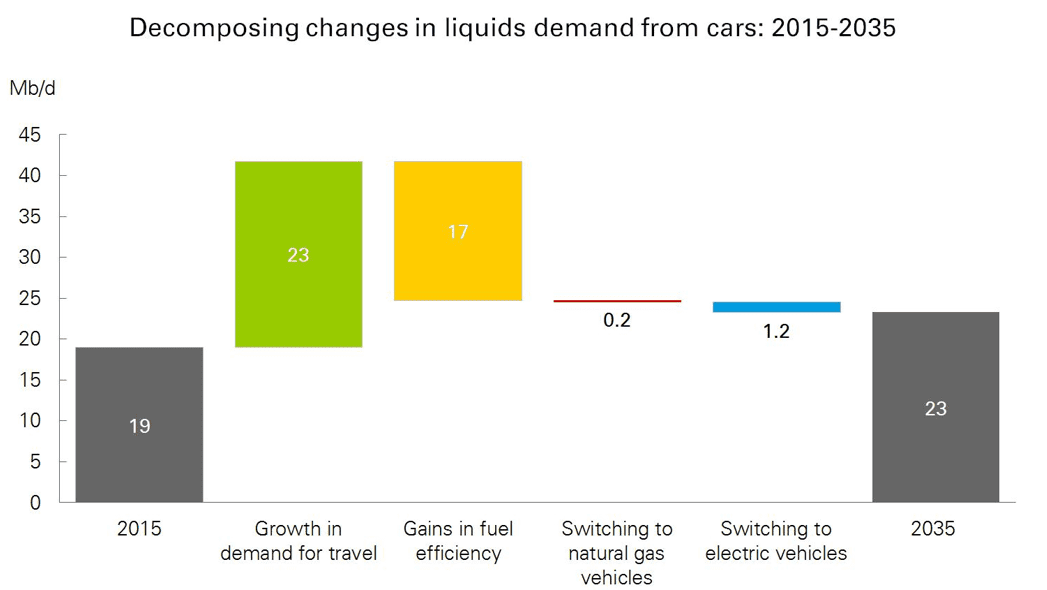

An article by OilPrice.com based on BP’s long-term energy outlook claims the electric vehicle car threat to the oil industry is overstated and a red herring for investors and other observers. The article cast doubt on if the achievability of a target of a 100 million electric vehicles by 2030, especially in a Trump era. Nonetheless, BP’s forecast still sees only a marginal effect of only 1.2 million barrels per day on oil demand if the target of around 7% EV’s by 2030 is reached. The article concludes that a bigger unknown to oil demand gains in fuel efficiencies, largely driven by more stringent emission targets.

TWO

Rumors about Apple’s secretive iCar named Project Titan has been circulating. MacWorld.co.uk speculated this week that Apple, the world’s most valuable company, has set itself a deadline of late 2017 to prove feasibility for a vehicle to rival Tesla.

THREE

Some policy gains were made this week in support for electric vehicles in the ongoing tussle targeting regulations for and against the technology. New York will from the 1st of April 2017 provide a $2,000 incentive to buyers of electric vehicles. In Wyoming, despite efforts by the Alliance of Automobile Manufacturers backed by Ford and GM to block Tesla from opening its direct sales business, the State Legislature this week approved a bill allowing Tesla to open its showrooms and sell vehicle’s without the use a middle man.

FOUR

Honda is setting itself up for failure with this week’s announcement that the much anticipated mid-sized 2018 Honda Clarity EV will only have an 80-mile range. Despite being a mid-size sedan, with the obvious space benefit it brings, the car will not even compete with smaller compact sedans and hatchbacks, such as the 2017 BMW i3 (114 miles), Nissan Leaf (107 miles) and the VW e-Golf (125 miles). The Honda Clarity EV’s direct competitors in the $30,000 to $35,000 price range, the Hyundai Ionic (124miles) and Tesla Model 3 (200 miles), will put it to shame.

FIVE

February Electric Vehicle sales data released for the USA this week reveals some interesting talking points. Overall, February sales gained a further 13.4% in January 2017 and over 55% on year on year basis. Contributors to the increase came from a nearly doubling in sales of the Tesla Model S and continued demand for the new Toyota Prius Plus. Unfortunately, the Prius in our books hardly counts as an electric vehicle due to its underwhelming continued reliance on its combustion engine. Disappointingly, sales for the Chevrolet Bolt declined over 18% from January, bringing total sales for the four months to 3,272 units, far short if one takes that at a claimed 30,000 units per annum the Bolt should have sold 10,000 units during the four months. In the car maker standings, GM retained its lead with 2,776 units over Tesla’s 2,550 units with Ford taking third place with 1,704 units.