TOP 5 EV NEWS #1 – UK EV SALES Q1 2017 BREAKS RECORDS

UK EV sales for the first quarter 2017 set new records, mostly on the back of Tesla sales. The quarter’s sales bring EV’s contribution up to 1.4% of the total vehicle fleet. The UK sales for Q1, traditionally the best performing quarter for UK car sales, was closely watched as a new Vehicle Excise Duty (VED) comes into play from the first of April 2017. The new VED rules apply for all vehicles except zero emission vehicles (ZEV). According to the VED, Internal Combustion Engine vehicles (ICE) will be liable for a levy of £1,550 spread over five years on all vehicles priced over £40,000.

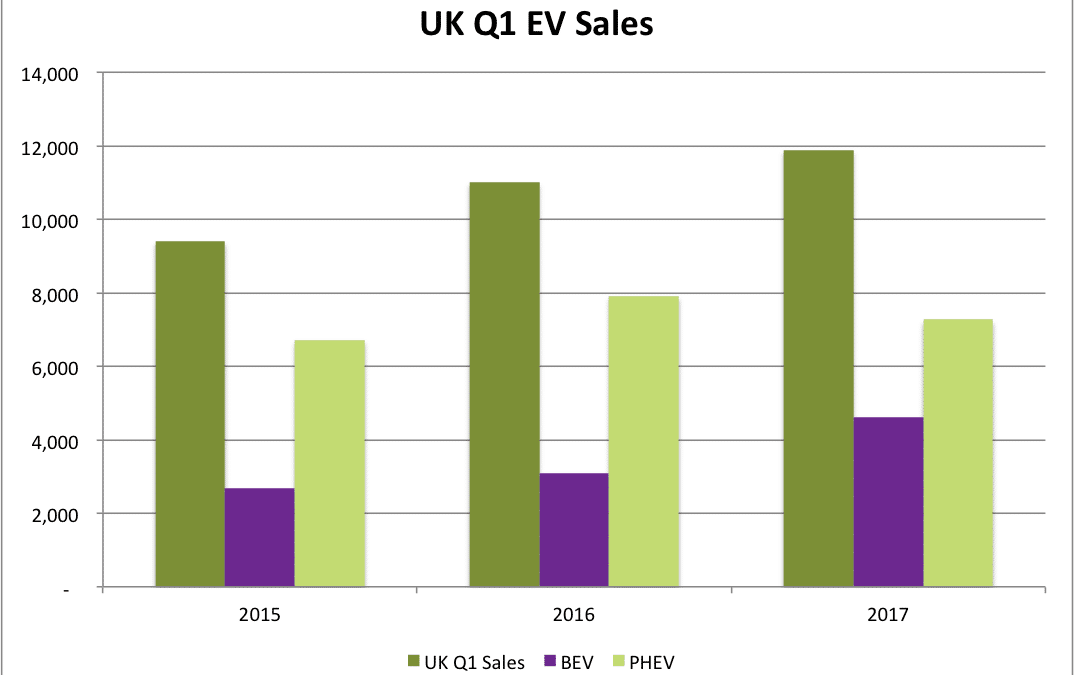

Electric vehicle sales for March, which contributed nearly 70% of the quarter’s sales, rose a below average 7% on a year-to-year basis, lower than the 8.4% for the total new car market. Total EV sales for the quarter was around 11,900 units, some 880 units more than Q1 2016. A deeper analysis of the UK electric vehicle sales showed a significant rise of the Battery Electric Vehicle (BEV) component, rising 34%, or around 800 units in March from the year before. Most of the 800 units can be attributed to Tesla’s massive sales drive, which led to a record 25,000 units being sold internationally, of which nearly 900, triple February’s sales, was sold in the UK during March 2017.

The improved performance of BEV vehicles compared to Plug-In Hybrid Electric vehicles (PHEV), showing a decrease of 5% to just under 5,000 units, corrects a trend since 2016 which saw 3-in-4 electric vehicles in the UK being PHEV’s.

All indications are that UK EV sales will breach the 100,000 unit mark, shared with only 7 other countries within the next couple of months. Recent surveys in the UK showed that most vehicle buyers are negative towards diesel vehicles due to diesel gate, a spectacular own goal by big auto and that 85% of vehicle owners now consider buying an EV, subject to them overcoming these EV related misconceptions.

TOP 5 EV NEWS #2 – AUDI & PORSCHE TO CO-OPERATE ON EV PLATFORM

VW sister companies, Audi and Porsche, to accelerate their respective electric vehicle strategies, this week announced that they would jointly develop a shared electric vehicle platform allowing the automakers a faster route to electric, connected and autonomous technology. The partnership will last til 2025. The German based VW Group‘s electric vehicle strategy is built on its MEB electric platform architecture, while Porsche targets the delivery of its first electric vehicle, the Mission E by 2020 and Audi, an electric SUV based on the e-Tron Quattro by 2018. Both vehicles will have various degrees of autonomy as part of its offering.

TOP 5 EV NEWS #3 – FORD’s CHINA STRATEGY

In the same week where Ford was dethroned by GM as the USA’s number two automaker, due to Tesla taking the top spot, the company released a new electric vehicle strategy for its Chinese operations. Ford, suffering from a shareholder revolt due to its lack of a convincing electric vehicle strategy and declining sales on Thursday announced that it targets 70% contribution from EV’s of its Chinese auto sales by 2025. The first phase of the strategy will be to produce a PHEV early 2018 together with its Chinese partner, Changan, also known as Chana. The company aims to have a small electric SUV within the next 5 years, capable of a battery electric range of 280 miles / 450km. The company still lacks a proper global electric vehicle strategy and the current attempt is too little and too late.

TOP 5 EV NEWS #4 – MAHINDRA & SSANGYONG ANNOUNCE EV

The Chairman of Indian automaker Mahindra and Mahindra, Anand Mahindra announced at the Seoul Motor Show this week that Mahindra and its Korean subsidiary SsangYong aims to develop a luxury electric vehicle by 2019, targeting entry into Chinese and US markets.

TOP 5 EV NEWS #5 – NAVIGANT RESEARCH DISCOUNTS WAYMO AND TESLA AUTONOMOUS EFFORTS

Navigant Research placed Ford and GM at the top of its autonomous driving leaderboard, surprisingly far above Waymo (7th), the pioneer of autonomous driving. Waymo was only listed as a contender, and Tesla who has already clocked over 300 million miles in Autopilot (Level 2 Autonomy) did not make the Top 10 list. Waymo, not aiming to develop a car, but rather focusing on autonomous technology has partnered with Chrysler and Ford on testing autonomous technology. Making Navigant’s findings even more surprising to us is that Waymo performed exceptionally well compared to other automakers on the list when comparing across all permit holders allowed to test autonomous tech on Californias public roads. According to CA DMV regulations, each permit holder must annually file a disengagement report, reflecting the number of events where a driver essentially has to take over from the vehicle’s autonomous mode to either prevent a traffic incident or where the system fails. Waymo posted a record 0.2 disengagements per 1,000 miles in its 2016. For a breakdown of each permit holders testing in California read our recent blog providing detailed analysis.

Navigant’s criteria are based on the following ten factors; vision, go-to-market strategy, partners, production strategy, technology, sales, marketing, and distribution, product capability, product quality and reliability, product portfolio and staying power. The Top Ten on Navigant’s list are Ford, GM, Renault–Nissan Alliance, Daimler, Volkswagen Group, BMW, Waymo, Volvo/Autoliv/Zenuity, Delphi and Hyundai Motor Group.

Despite Tesla aiming to have a market ready Level 5 autonomous product by the end of the year, it is only listed as a contender. Tesla is criticized by some, for being too aggressive, using its customers as guinea pigs for its AutoPilot software. Not surprising though is that Uber features on the bottom end of the list, the controversial ride-hailing company has been in the news lately for losing its right to test in San Francisco, being sued by Waymo and a crash in Tempe, Arizona, temporarily halting its pilot program.