TOP EV NEWS #1 – NEW EV MODELS

Hyundai unveiled the 2018 Hyundai Sonata PHEV at the Chicago Auto Show this week. The Hyundai Sonata PHEV is available in the USA in the ZEV states of California, Connecticut, Maine, Maryland, Massachusetts, New Jersey, New York, Oregon, Rhode Island and Vermont from Q2 2018. The 2018 Hyundai Sonata has undergone an extensive facelift and technology upgrade but remains with the same drivetrain as the 2016 version.

Mercedes Benz announced that the Geneva Auto Show would be the venue of the world premiere for the new C-Class Saloon and Estate PHEV model. The premiere of the C-Class will be on the 6th of March, at 12.30 p.m. in Hall 6. The new Mercedes Benz C-Class consists of a stylish makeover and technology upgrade equivalent to the S-Class. Mercedes further announced that it would expand on the look ahead for the EQ portfolio and showcase the EQC production vehicle. Also unveiled at the Geneva Auto Show will be the Smart Nightsky Edition which will be available with a 22kW onboard charger from March 2018, reducing charge time significantly to compensate for the short range of the Smart EV.

Opel is charting its own course on the electrification of its models after being acquired from GM by the French PSA Group. Opel CEO Michael Lohscheller announced this week that the company would produce an electric Opel/Vauxhall Corsa sub-compact car in 2020. The Corsa EV will be assembled exclusively at the company’s Spanish plant in Zaragoza.

The poster child of how not to run an EV company, Faraday Future, this week held a Global Suppliers Summit at its HQ in Los Angeles where it showed sketches of its second EV, a compact SUV. Faraday Future apparently secured $1.5 billion in funding from a backer in Hong Kong which will be made available on it reaching certain unknown milestones. The FF SUV is expected to cost in the region of $100,000 to $150,000 which is more “affordable” than its first production EV, the FF91. Faraday Future is yet to start construction on its assembly plant in Hanford, Nevada to bring its first EV to production.

TOP EV NEWS #2 – DYSON EV PLANS

We are used to tech companies invading the space of automakers brought on by the EV rush, but you don’t often hear of home appliance companies with EV ambitions. It might, however, be that appliance companies stand a better chance to mass produce electric cars with their understanding of manufacturing processes. Dyson, the British home appliance company last year announced that it is betting £2 billion on the development of an electric vehicle propelled by solid-state battery technology the company has been pursuing since 2014. The entrepreneur Sir James Dyson ramped up his company’s solid-state program in 2015 by acquiring Michigan based Sakti3 for $90 million.

The Financial Times this week took a closer look at Dyson’s EV program which targets three EVs from 2020 onwards and concluded that the first EV might be equipped with a lithium-ion battery rather than a solid-state battery as initially planned. Solid-state batteries which is much safer and more efficient is only expected to become mainstream in 2025 judging from pronouncements made by companies such as Toyota and Mercedes although EV start-up Fisker recently brought its solid-state battery roll-out forward to 2020.

Some industry insiders doubts if Dyson’s EV gamble will pay off with Aston Martin CEO Andy Palmer tweeting a spoof of a Dyson EV in 2017 (See image below). Dyson is yet to decide on a location for the production of its EVs which supports the detractors of Dyson’s plans as tooling for an assembly plant takes minimum 18 months no matter if you are a 100-year-old automaker or a start-up. The company is looking at locations in the UK, China, Malaysia and Singapore with the far east being favored since it is expected that China would be the largest market for the Dyson EV. Supporting Dyson’s plan is its ability to develop many components in-house making it less reliant on external suppliers. The Dyson EV is rumored to be made from plastic, which is closer to Dyson’s core and allows for the inventive design promised by Sir James Dyson in September 2017 when he announced that EV would look “quite different” to any currently on the market.

Other than Tesla Dyson does not want to over promise and under deliver and keeps its progress close to its chest. Also different than Tesla who had access to a lot of government funds the privately owned Dyson so far has only received £16 million from the UK Government. Developing electric cars is an expensive venture, this week in an interview with CNBC Renault-Nissan-Mitsubishi alliance chairman, Carlos Ghosn said that they are probably the only carmaker making money off selling EVs. To date, it seems Dyson is not considering an IPO but going it alone by supporting the £2 billion project from own funds.

TOP EV NEWS #3 – LOCAL EV INCENTIVES TO REMAIN IN CHINA

Recent reports claimed that the Chinese Government was set to scrap the local component of EV incentives which is aimed at supporting a robust EV sector and spur demand. Policymakers fears that by scrapping the local subsidies to curb state expenditure it will kill the infant EV sector. Local EV incentives is an extra subsidy set at a city level and are capped at 50% of that of the Federal incentives. Earlier the month Shanghai extended its local subsidy to 31 December 2020. In Shanghai, an EV buyer receives the full local portion of the purchase of a pure electric car and 60% on a plug-in hybrid. Bloomberg reported that unconfirmed sources indicated that the latest amendment to the national policy would retain the local incentives. The amended national policy has been changed to favor improved technology and longer range EVs by increasing the subsidy for EVs with a range of over 400km from RMB 44,000 to RMB 50,000 while upping the qualifying threshold from 100km to 150km and favoring more efficient batteries. Some sources indicated that FCEVs stand to gain the most by qualifying for 100% local subsidies. Shares of companies selling EVs rose on the report with BYD performing the best rising 5.2% on Monday followed by GAC with 4.3% and BAIC with 1.7%.

In related news, the Chinese Government gave its approval for the acquisition of a 4.79% shareholding by Daimler AG in Jinggangshan New Energy Investment Management Co, the top selling pure electric vehicle producer of 2017. Jinggangshan New Energy Investment Management Co, BJEV for short, is owned by Daimler’s local partner BAIC which holds 37.27% alongside the Beijing municipal investment fund and Xinshixinye Investment Management Co.

Further afield BYD is set to construct an electric bus assembly plant in India at the cost of Rs2 billion. The 100-acre plant which is situated in Bidar, Karnataka will have an initial capacity of 1,000 units per annum and also build batteries for the local market. BYD and its local partner Goldstone Infratech will bid on tenders by 10 Indian cities to supply 390 electric buses in the coming months.

TOP EV NEWS #4 – EV BUYERS FACE LONG WAITING TIMES

According to a survey by the German publication “Automobilwoche” the success of electric cars in Germany seems to be the technologies biggest risk as prospective buyers now face delivery times that can have them waiting as long as a year for their new EV. The problem is not isolated to buyers of imported vehicles only but also local brands such as Volkswagen where buyers have to wait until October 2018 for delivery of e new e-Golf purchased today. Smart CEO Annette Winkler said that the increase in demand is much stronger and faster than could have expected and planned for with the companies suppliers, resulting in buyers only receiving their new Smart by the end of 2018 or early 2019.

To compensate for the increased demand Volkswagen has introduced a second shift at its Dresden plant as e-up! buyers wait for five to six months. According to the survey, the waiting period for a Hyundai Ioniq EV is up to 12 months, the 2018 Nissan Leaf is around ten months, and six to seven months for the Peugeot ION and Kia Soul EV. Renault Zoe buyers only have to wait four months while the waiting list for a BMW i3 is the shortest at two to three months. The problem is not isolated to private buyers but fleet buyers are also affected. The software giant SAP wants to be carbon neutral in 2025 and is currently expanding its e-fleet. SAP manager Marcus Wagner told “Automobilwoche”: “If you want to buy a full electric in February 2018, you will get almost none.” It seems to me the problem is not isolated to buyers which place pre-orders for new EVs like the Tesla Model 3.

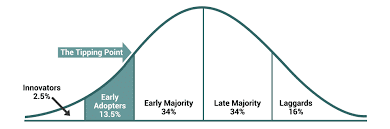

I hosted the friendly team of EV-Volumes last week in Cape Town and from the comments based on our combines research of the EV sector over a glass of beautiful Cape wine we concluded that the EV market has reached its tipping point.

TOP EV NEWS #5 – LITHIUM SUPPLY ON EVERYBODY’s LIPS

Following on our story above many news reports the past week referred to the supply of commodities for EV batteries such as lithium, nickel, manganese, graphite, and cobalt which seems to confirm the notion that EV sales are set to take off. Prices for the commodities have skyrocketed the last couple of years despite the fact that the amounts required of these commodities per cell are so small that price impact on the total cost of the battery is limited. Current cobalt prices have more than doubled in on a year to year basis from February 2017, trading above $80,000 per ton on the LME.

Renault-Nissan-Mitsubishi Alliance Chairman Carlos Ghosn in an interview this week on the announcement of the company’s record profits said that the rising cost of commodities for batteries does not worry him. Ghosn said:

“The increase in the cost of the raw material would be compensated by much better knowhow into how to make batteries more efficiently and how to substitute some of the raw materials going into the batteries,”

The German publication Frankfurter Allgemeine Zeitung reported that BMW is close to securing a 10-year supply of lithium and cobalt according to statements made by BMW’s head of procurement, Markus Duesmann. Duesmann said: “The aim is to secure the supply all the way down to the level of the mine, for 10 years. The contracts are ready to be signed.”

According to Reuters, BASF the German chemicals giant has entered talks over a supply partnership for high-grade Nickel used in long-range batteries with Russian miner Norilsk Nickel and BASF competitor, Belgium’s Umicore raised 892 million euros to expand its business. Umicore CEO CEO Marc Grynberg said that recycling would be crucial as mining won’t be enough to meet the world’s needs should EV demand continue at the current pace beyond 2025.

Bloomberg Quint reported that Samsung SDI is to purchase equity in an unnamed company which posses a recycling technology to extract cobalt from used cell phone batteries. Samsung can recycle 157 tons of cobalt and other minerals from the doomed Galaxy Note 7 smartphone while the commodity analysts CRU Group projects that 25,000 metric tons of minerals will be extracted from used batteries by 2025.

Companies are also pivoting towards developing batteries which require less cobalt such as nickel-cobalt-manganese batteries which consist of 88% nickel to be less reliant on cobalt of which more than 50% comes from the unstable Democratic Republic of Congo (DRC). The DRC recently passed a new mining code through the country’s National Assembly to grab more profits from the mining of cobalt and copper. The new code puts royalties of 5% on “strategic metals” which include cobalt, allow a larger shareholding by the State in mining companies and repatriates of at least 40% of the revenue of minerals that are sold for export.

Technology advances will also change the landscape in the coming years as manufacturers aim to bring down costs of EVs to compete with low cast manufacturers such as China. A research article in ScienceMag explained how desalination using metal organic framework (MOF) membranes separates lithium from salt water as a by-product.

EV DATABASES AVAILABLE IN OUR SHOP

No Results Found

The page you requested could not be found. Try refining your search, or use the navigation above to locate the post.