No Results Found

The page you requested could not be found. Try refining your search, or use the navigation above to locate the post.

Baojun operates under the “General Motors SAIC-Wuling” joint venture in China. In recent years the company has built up a portfolio of mostly small sedans, multi-purpose vehicles, hatchbacks, and a crossover utility vehicle. But, with the rapid growth of the electric vehicles market in China, the brand recently undertook its first electric car, the Boajun E100.

The Baojun E100, a small two-seater car that boasts a 29-kilowatt (39-horsepower) electric motor. It can reach a top speed of 62 mph with a range 155 kilometers (96 miles) on a single charge, and it takes about 7.5 hours to fully recharge the lithium-ion battery pack. As always, the electric car recaptures energy while driving via its regenerative braking system.

The car is designed as a two-seater avant-garde with a simple dashboard. The 7-inch LCD information system has 4G/LTE, and WIFI capabilities and the E100 is equipped with parking sensors. The steering wheel has a two-color design, which is consistent with the rest of the interior of the car. There is no transmission shift lever, but instead, there is a knob-type mechanism. The E100 is also equipped with an electronic handbrake and keyless start.

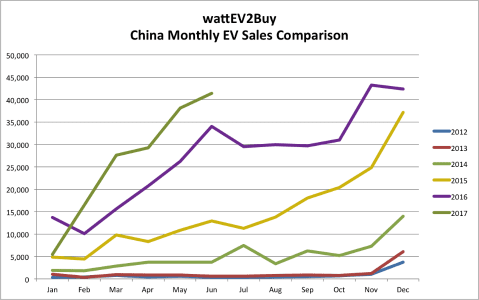

If you started searching for an electric car in June of 2017, Baojun would not have even made it onto your wish list, because it simply didn’t exist. But somehow the Baojun E100 was the 3rd highest selling EV in China for December of 2017. You may be wondering how Baojun managed to pull off this amazing feat. Well, the company started off by producing 200 initial units as “test versions” early in 2017, but they only sold their first batch of EVs in August 2017. Baojun sold 674 units in August followed by 1,562 in September, 1,715 in October, 1,915 in November and 5,545 in December for a total of 11,420 EVs in barely five months. The E100 finished 2017 as the 17th most sold EV in China, beating competitors such as the Haima EV160, Zotye Cloud, and Changan Benni Mini. To give you some perspective on how rapidly Baojun has entered the market: if they had started selling the E100 in January of 2017 at the rate which it is selling now, it would have beaten the Chery eQ to the second spot on the list. If one should make a forecast based on sales price the Baojun E100 could be in contention with the BAIC EC180 for the first spot to claim the Chinese “EV Crown.”

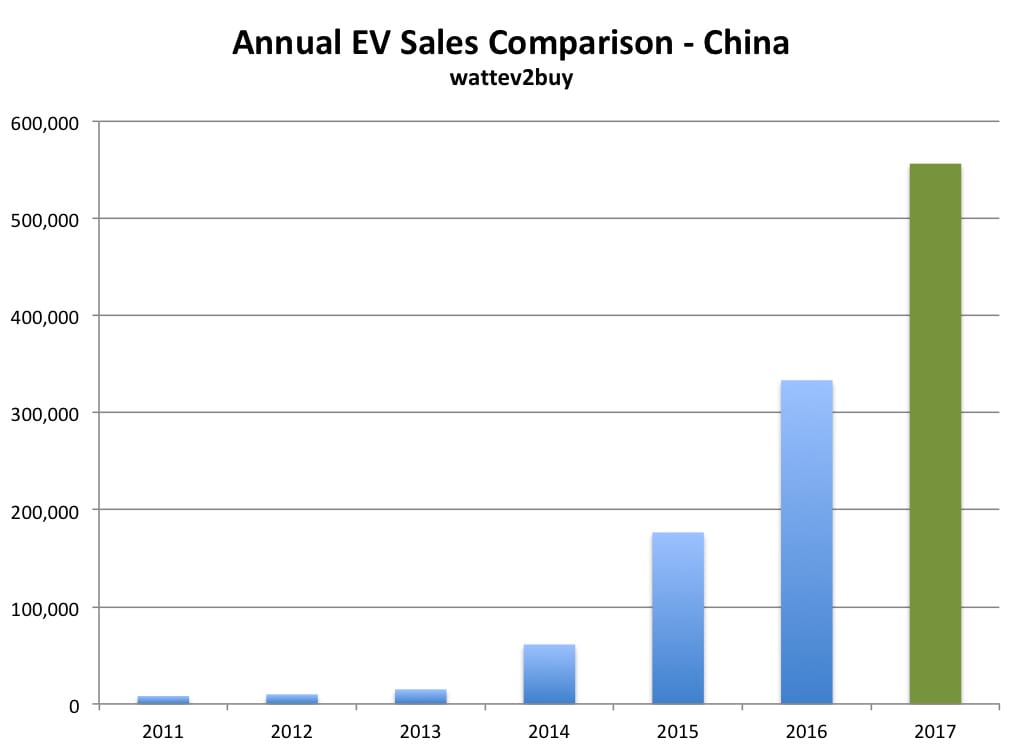

In the chart above there is a clear upward trend in the Chinese EV market, with the total number of EVs sold nearly tripling over the past three years. Although these increases can mainly be attributed to government incentives and an increased awareness of CO2 levels in China, one cannot deny the fact that Chinese citizens are moving away from traditional combustion engines and embracing the EV revolution. Baojun is perfectly positioned to become a market leader in the Chinese electric vehicle industry because it provides a reasonably cheap alternative for the rising Chinese middle class.

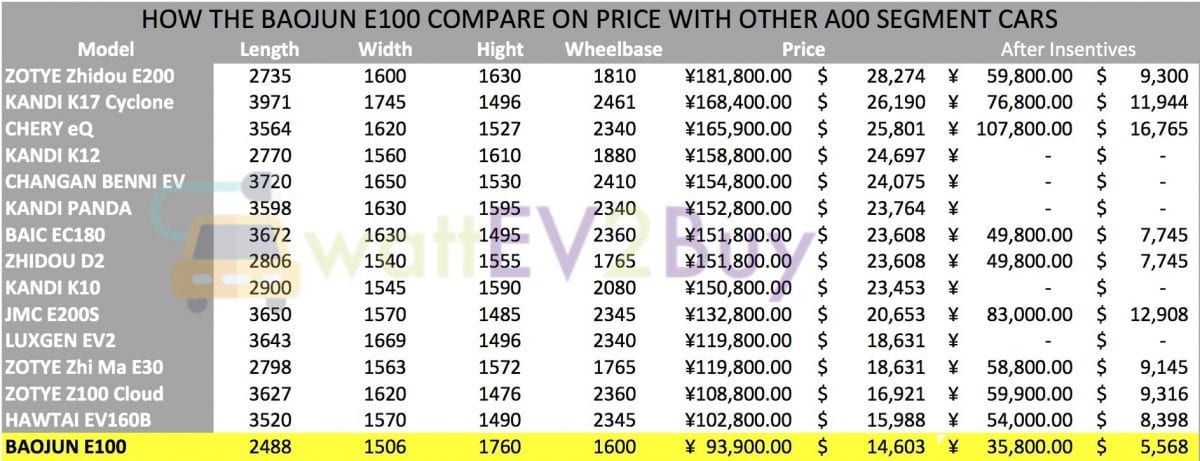

To sum it up in simple economic terms, China’s rapidly growing middle class is developing a massive demand for EVs, and there are a lot of companies looking to supply EVs to these consumers. The table above compares the price of small EVs in China, and unsurprisingly, the Baojun is cheapest EV on the market at the moment. This explains the EVs huge boost in popularity in December.

Taking all of this into consideration it seems that Baojun is positioned very well to build on their successes of 2017 and have the potential to reign supreme in 2018.

SAVE AND SHARE THE BAOJUN E100 SPEC SHEET

The page you requested could not be found. Try refining your search, or use the navigation above to locate the post.

Electric vehicles have developed tremendously in recent times, battery capacity and range have increased exponentially, and new investors are flooding into the market to get their share of the pie. The logical question is, where to next with this amazing technology?

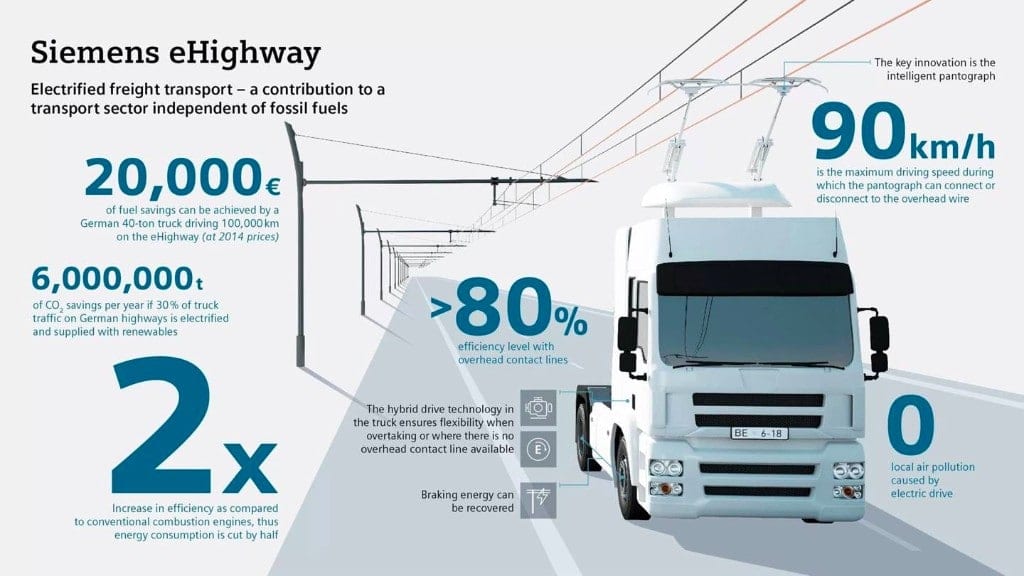

Siemens and Germany have announced their collaboration the eHighway which is being constructed on a 10 km strip of the Autobahn close to the Frankfurt Airport in Germany. Though 10km (6miles) doesn’t seem like much, this could be a groundbreaking step for electric trucks in the future. eHighways could cut input costs for companies dramatically and could make the price of goods independent from oil prices.

To learn more about eHighways check out this video.

eHighways have been dominating the news this week, Queensland Australia has announced that they are busy developing the continents biggest electric vehicle friendly highway. The strip of road will stretch over 2000km and will be supplied with 18 charging stations. This will make it possible for citizens to drive up the east coast from Brisbane to Cairns without worrying about recharging their EV’s.

This is a big push from the Australian government to increase the number of electric vehicles in the country. The charging stations will be free of charge for at least the first year and this could incentives consumers to go electric (there are only 700 EV owners in Queensland at the moment).

Baojun is a mass-market car brand from General Motors‘ SAIC-GM-Wuling joint venture in China. This week they have reviled their brand new fully electric commuter vehicle, the E100.

The E100, which is Baojun’s first electric car, is powered by a single 39-horsepower electric motor and has a top speed of 62 miles an hour. The E100 can drive about 96 miles on a fully charged battery. More than 5,000 people have already registered to buy the first 200 vehicles. Another 500 vehicles will be made available this week, and buyers will be chosen on a first-come-first-served basis. The Baojun E100 will sell for around $5,000 after incentives.

Exactly 70 years after the debut of its first electric vehicle, Nissan’s most advanced EV ever – the Nissan BladeGlider sports car – took center stage at this year’s Goodwood Festival of Speed in the UK.

Electric cars may only be booming now, but Nissan has been at it for the past 70 years and by the looks of it the blade runner could be another masterpiece in the making.

Check out this video if you don’t believe us:

Consumer Reports just published the results of its range test of the Chevrolet Bolt and came up with some surprising results.

While the Bolt is rated for 238 miles of driving by the EPA, the car exceeded that in the Consumer Reports test, squeezing out 12 more miles for a total of 250. That means the Bolt officially beats Tesla’s Model S, at least in this particular test. When CR tested the Model S 75D, it got 235 miles, compared to the EPA estimate of 259. This test may not be particularly telling but with the Tesla S costing double what the Chevy Bolt costs, some eyebrows could be raised at Tesla’s reliability when it comes to range.

Compiled by Ruan Goosen

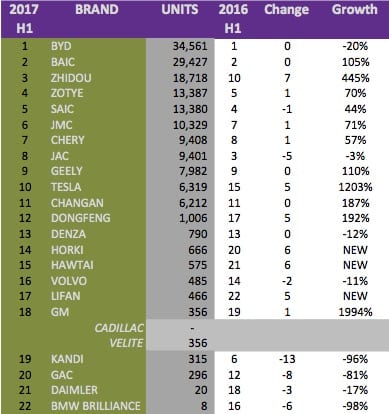

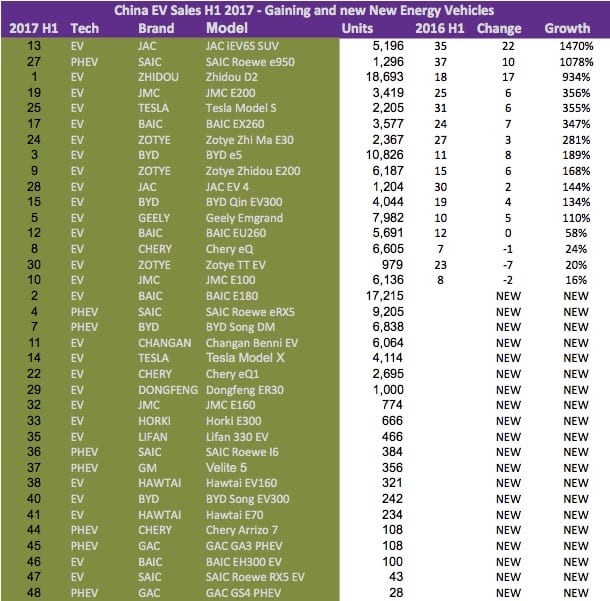

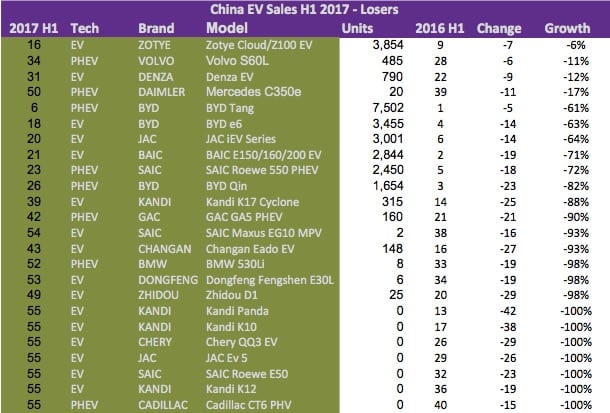

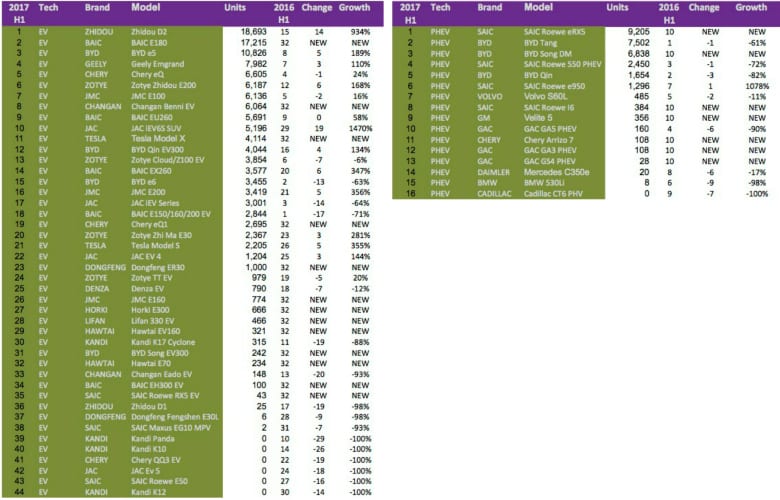

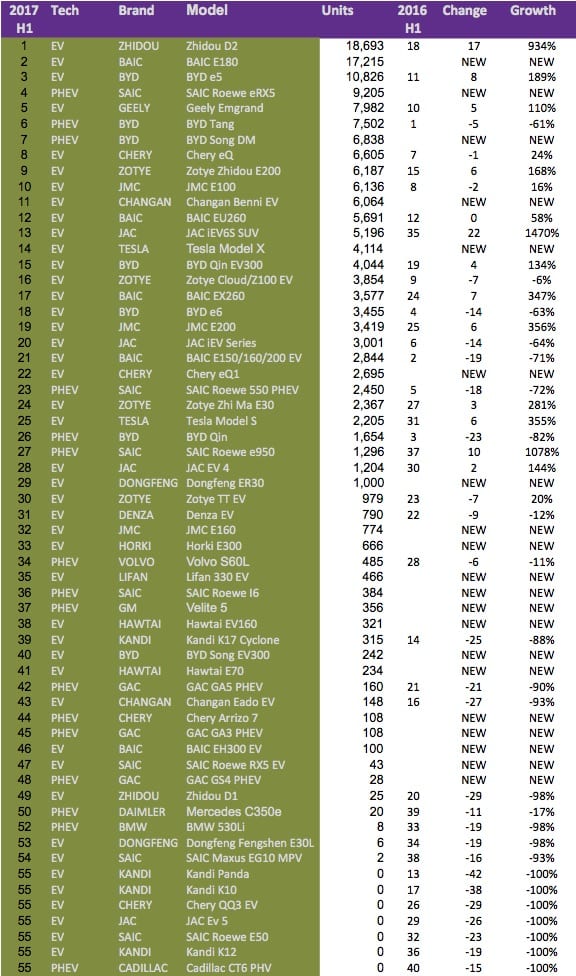

We look at the Top brands and models, the gainers and losers and how the battle between battery electric (BEV) and plug-in hybrid (PHEV) technologies play out in the summary of China EV Sales H1 2017.

The highlights for Chinese electric car sales in H1 2017 was:

The Top 3 EV brands in China for the first half of 2017 were BYD, BAIC, and Zhidou. Although BYD hung on to its first place, it sees its lead evaporate. BYD hardly registered any sales in the January 2017, and lost sales in its top performing Qin and Tang model ranges to competing new models from BAIC, Chery, and SAIC Roewe. BYD, one of the largest EV brands in the world, is seeing its position as China’s best performing EV brand challenged as it lost over 20% of its sales compared to 2016, while its competitor BAIC more doubled its sales. BAIC benefited from exciting new models entering the market in the last 12 months, with its small hatch, the BAIC EC180 being a top performer for three of the six months ending up the second best selling EV for the semester. Smaller EVs, or City cars, have also performed very well with the popular Zhidou Geely D2 selling nearly 20,000 units. Another brand with small EV models, Zotye, was placed fourth due to the popularity of its Cloud 100, E200 and E30 models. Other Top 10 Chinese EV brands selling city cars included Chery and JMC, both placed in the Top 10. Although JAC brought the exciting JAC iEV6S small SUV to market it was not enough to withstand the onslaught of its peers, crashing out of the Top 3 to the eight position. Tesla also entered the Top 10 list with the Model X performing very well (please note the June 2017 Tesla data did not make it in time for our analysis, which would have aided the brand’s performance). Western brands such as Volvo, BMW through its local partner BMW Brilliance, Daimler and GM mostly gave up market share to Chinese-produced vehicles.

Twenty new EV models entered the Chinese EV market in the first half of 2017 but only three, the BAIC EC180, SAIC Roewe eRX5 and BYD Song DM, made it to the Top 10 list of electric vehicles in China. None of last years Top 5 could hang on to their positions with two of the new models, the BAIC EC180 and SAIC Roewe eRX5, entering the market with Top 5 positions within three months from being launched. Last year’s Top 3 EVs, the BYD Tang, BAIC E200, and BYD Qin all crashed out, with the BYD Tang the only model able to hold on to a Top 10 position. Plug-in Hybrid vehicles could only muster three positions in the Top 20 as small city EVs made up more than half of the units sold in 2017 to date. The popular SUV class accounted for 26% of the units sold in the Top 20 list of EVs in China while plug-in hybrids only accounted for 16% of all the EVs sold. New electric vehicle models made up 31% of all the EVs sold during the period under review.

BYD’s ailing fortunes are clear in the list of losers for the first half of 2017 but another popular EV brand from 2016, Kandi, saw diminishing sales as its Kandi K17 Cyclone could not compete with the host of new small city cars entering the Chinese EV market. Clear again is the composition of plug-in hybrids and foreign brands in the list of the worst performing electric cars.

Plug-in hybrid models are losing the battle in China, strange though that 35% of the new models launched in the last 12 months are PHEVs. In the comparable period in 2016 plug-in electric vehicles made up 33% of all the units sold while the vehicle type only contributed to 16% of all sales in 2017.

Be sure to check out our new presentation of all EVs since 2010 to gain great insights on all auto brands and their electric vehicle strategies. We have also created presentations per technology type BEV, PHEV, and FCEV.

The page you requested could not be found. Try refining your search, or use the navigation above to locate the post.

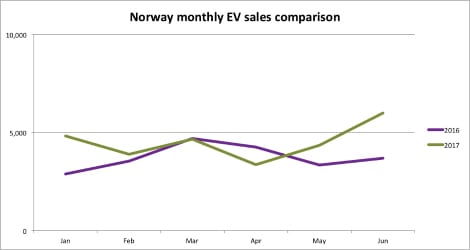

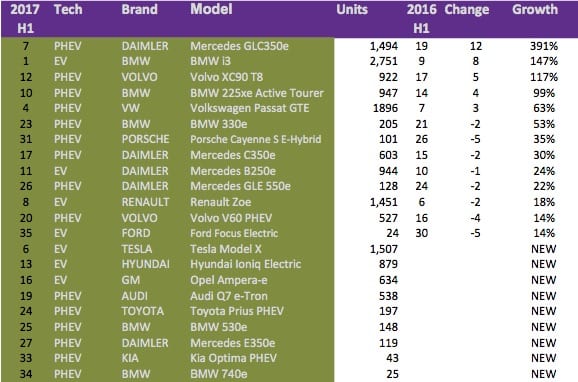

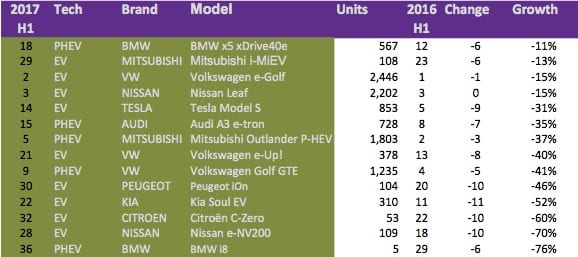

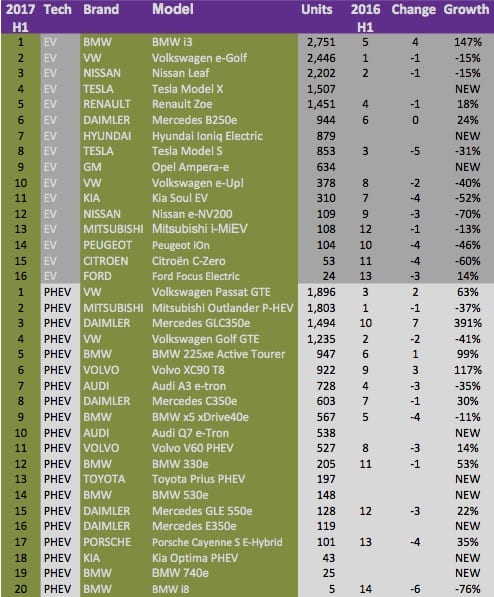

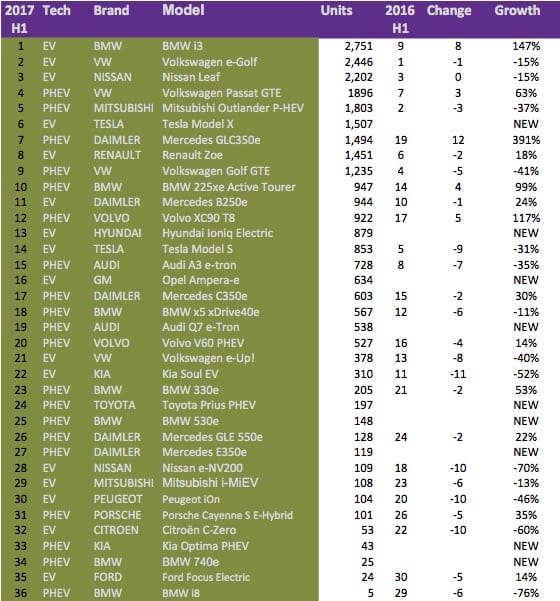

We look at the Top brands, Best and Worst Models and how the battle between battery electric (BEV) and plug-in hybrid (PHEV) technologies play out in the summary of EV Sales in Norway H1 2017.

The highlights for Norwegian electric car sales in H1 2017 was:

We saw very big changes in the Top 3 electric vehicle brands in Norway with only VW Group retaining its Top position, albeit with lower sales in its mass-market VW brand. Japanese automakers, Mitsubishi and Nissan were pushed from the Top 3 by German luxury automakers BMW and Daimler. Tesla sales also surpassed that of Mitsubishi and Nissan, with a strong performance by the Tesla Model X more than offsetting the slide in Tesla Model S sales. Tesla now commands over 11% of the total EV market in Norway.

We saw very big changes in the Top 3 electric vehicle brands in Norway with only VW Group retaining its Top position, albeit with lower sales in its mass-market VW brand. Japanese automakers, Mitsubishi and Nissan were pushed from the Top 3 by German luxury automakers BMW and Daimler. Tesla sales also surpassed that of Mitsubishi and Nissan, with a strong performance by the Tesla Model X more than offsetting the slide in Tesla Model S sales. Tesla now commands over 11% of the total EV market in Norway.

French automakers Renault, Peugeot and Citroën gave up positions to their peers as Hyundai and GM entered the market with the new Ioniq and Opel Ampera-e (Bolt EV) mass-market EVs. It is disappointing that first movers such as the PSA Group grew too comfortable supplying the same models for the past 5 years without preparing a response to longer range mass-market vehicles. Toyota has not achieved the same stellar sales in Norway with the new Toyota Prius as it did in some of its other markets.

The Top 10 gainers in sales growth over 2016 were mostly plug-in hybrid vehicles (PHEV) while the top selling vehicles by units were mostly battery electric vehicles (BEV). The BMW i3 rose a healthy eight positions and ate into the sales of the VW e-Golf, VW e-Up, VW Golf GTE, Audi A3 e-tron, and Nissan Leaf. Norway is now the second best market, after the USA, for the German manufactured BMW i3 accounting for 8% of all electric vehicles on the country’s roads. The Tesla Model X performed very well, helping Tesla to nearly double its sales in Norway. The rise of the Model X, now the best performing luxury EV in Norway, came at the expense of the BMW X5 xDrive and Mitsubishi Outlander. Luxury brands Daimler and BMW‘s large selection of PHEV models performed well in Norway with the Mercedes GLC350e helping Daimler to be the leader in the luxury class over BMW. It is only Daimler’s lack of an answer to the BMW i3 that kept the automaker in the third spot overall.

The VW brand sold 1,540 units less than last year across the VW Golf GTE, VW e-Golf, and VW e-Up models. The VW Group lost nearly 2,000 units in total if one should factor in the sales loss from the Audi A3 e-tron. The biggest overall loser was the Mitsubishi Outlander PHEV which sold 1,040 units less than the same period in 2016. The Tesla Model S is following the same trend as we see in many other countries, losing 31% or selling 388 units less than last year.

Pure electric vehicles (BEVs) extended their lead over plug-in hybrid vehicles (PHEV) to 20.6% from 17.3% in H1 2016 despite having fewer models to offer. A total of 14,753 BEVs sold in the first-half of 2017 in Norway compared to 12,231 PHEVs. For our calculation, we included the BMW i3 REx as a BEV since we don’t have an accurate breakdown of BMW i3 sales between the BEV and range extended version.

Be sure to check out our new presentation of all EVs since 2010 to gain great insights on all auto brands and their electric vehicle strategies. We have also created presentations per technology type BEV, PHEV, and FCEV.

The page you requested could not be found. Try refining your search, or use the navigation above to locate the post.

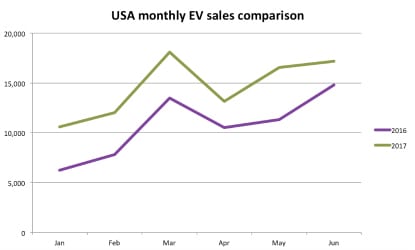

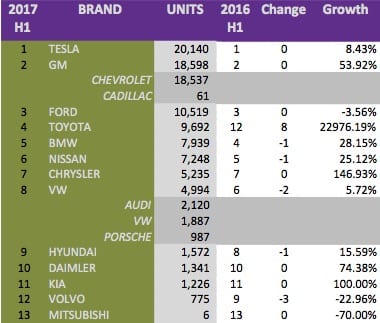

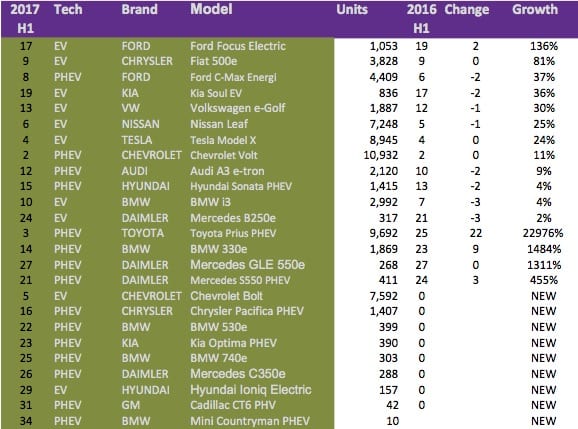

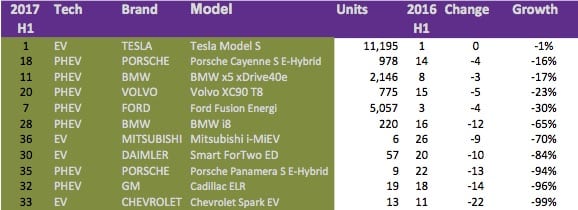

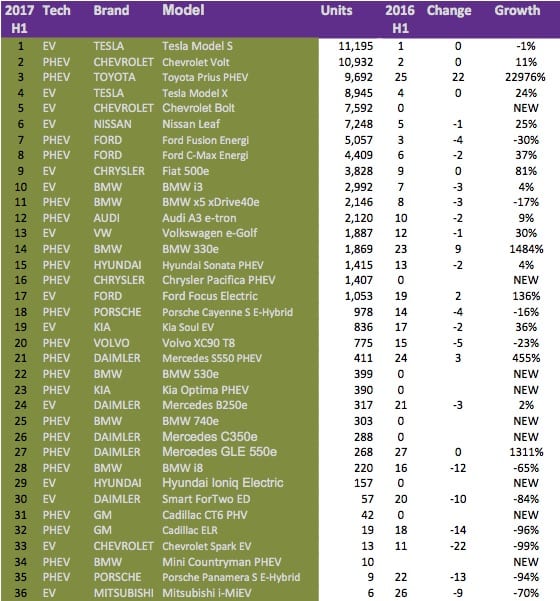

We look at the Top brands, Best and Worst Models and how the battle between battery electric (BEV) and plug-in hybrid (PHEV) technologies play out in the summary of USA EV Sales H1 2017.

The highlights for USA electric car sales in H1 2017 was:

There are no surprises in the Top 3 EV brands with Tesla holding on to its lead over GM due to a 24% rise in Tesla Model X sales. GM could not dethrone Tesla even with a new model, the mass-market Chevrolet Bolt EV up its sleeve. Improved sales in the 2nd Quarter from the Ford Fusion Energi and C-Max Energi helped the brand retain its third position fighting off the strong performance of Toyota with the new Toyota Prius which was placed third at the end of the first quarter.

Most brands showed improved sales growth over the first half of the year with only Ford, Volvo, and Mitsubishi showing declining sales. The Volkswagen Group showed a declining trend as the year progressed and mustered the lowest growth. The declining fortunes of the German automaker can be attributed to the Volkswagen e-Golf not being able to compete on range with the new mass-market Chevrolet Bolt being sold in the same price bracket. Chrysler showed the highest growth after Toyota buoyed by the new Chrysler Pacifica and great specials on its compliance car, the Fiat 500e. The results might have been better for the US automaker, but the Chrysler Pacifica launch was delayed and then impacted by recalls and plant closure due to battery problems.

Most of the existing models showed growth lower than the overall growth due to the big number of new models to the market. Surprisingly the Ford Focus and Fiat pure electric models outperformed the market showing that the public is becoming more comfortable with range issues and the continuously improving charging infrastructure is starting to have and effect on top of the financial incentives making EVs appealing.

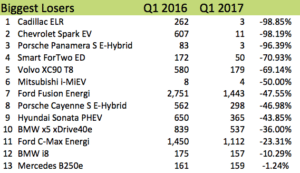

European plug-in vehicles were the biggest losers in this half of 2017 with a number of the luxury PHEV models losing big. Volvo and BMW saw some of their relatively new models losing steam. Both the BMW x5 xDrive and Volvo XC90 T8, released in 2016, lost market share in favor of the Tesla Model X. The Tesla Model S sales have flatlined although it remained the top selling BEV model. It will be interesting to see how the new Daimler Smart ForTwo ED fares in the second half of 2017. The German automaker is relaunching the brand as electric only in the USA and Canada from this summer and will offer a slightly improved model at a marginally reduced $23,800 starting price before incentives.

Battery electric vehicles are still maintaining its lead over plug-in hybrids albeit at a lower margin. BEVs took six positions in the Top 10 EV sales for the USA in the first half of 2017. The ever increasing number of plug-in models benefits the technology in the short term as it competes with only a handful of pure electric models. The Plug-in hybrid category benefited mostly from the release of the new Toyota Prius and to a lesser extend the Chrysler Pacifica. The Tesla Models X and S constitute nearly 44% of all BEV models showing the company’s dominance in the sector. The commanding position will improve even more with the release of the Model 3 in the second half of 2017 which might add about 40,000 units depending on the production ramp-up. The release of the Tesla Model 3 and new Nissan Leaf, expected by the end of the year, should help pure electric vehicles outperform the more dirty plug-in hybrids in the second half.

Be sure to check out our new presentation of all EVs since 2010 to gain great insights on all auto brands and their electric vehicle strategies. We have also created presentations per technology type BEV, PHEV, and FCEV.

The page you requested could not be found. Try refining your search, or use the navigation above to locate the post.

Being 100% modular allows companies to repair, replace and adapt different components resulting a tenfold longer product lifetime, lower total cost of ownership and recyclability. Companies can also upgrade the connected car & self-driving modules as technology improves over time without discarding still viable components. EDITs modular technology allows you to easily embed several autonomous driving technologies from level 0 to 5 or add your own self-driving code and custom hardware stack of lidars, sensors, CPUs, etc.

EDITs friendly shape, which easily transformable according to the needs of the customer that could help the transition towards a different layout of the autonomous driving cars of the future. Being modular makes the EDIT easy to repair and upgrade, disrupting many sectors as we transition faster to a zero emission and zero fatality mobility. The body is divided into five primary parts, four molds (front, rear, roof and double symmetrical door), optimizing production and decreasing costs. The interior can provide different settings depending on the level of autonomous driving. In a level 5 version, there is a “vis a vis” seating layout with a comfortable table in the central area without steering wheel where you can work while commuting.

Barriers to entry as a result of cost and time to develop exclude many great start-ups and ideas from the self-driving sector. EDIT is a ready-to-use technology that saves years of R&D and millions of dollars. There is no need to reinvent the wheel for startups that are struggling with reverse engineering and to cost-effectively integrate the newest technology into the closed design of cars already in the market. EDIT allows start-ups to employ a “lean and distributed” manufacturing principle thereby avoiding huge investments in factories resulting in a reduction of more than 80% in initial costs. OSVehicle claims its IKEA like approach saves up to 70% of logistic costs and hacks import taxes by shipping ‘EDIT’ in components as opposed to complete vehicles. OSVehicle uses the example of Nepal where import duty on assembled vehicles is 238% compared to 3% for ‘EDIT components. OSVehicle did not provide any other guidance on the cost of the EDIT.

The disruption caused by the first ever ready-to-use Self-Driving EV will be felt in various sectors, including:

EDIT is a white label platform for branding purposes whereby a brand can customize the exterior body and interior, still keeping the road legal certification. By being a Vehicle-as-a-Service solution companies can use EDIT to quickly deliver models tailored for each service and country. OSVehicle states that with the rise of food delivery, ride and car sharing, vehicles should focus on the service brand and its needs, not the car brand.

‘EDIT’ is designed in Italy by the OSVehicle team in collaboration with the design company Camal. EDITs design is compliant with European, US, and Asian safety regulations.

If you are only a hobbyist or ultra lean start-up wanting to build a self-driving car and find that the cost of EDIT is still too high, follow our advice in the earlier post. Just buy the OSVehicle TABBY EVO from as little as $12,000 and add to that George Hotz’s self-driving car kit which he plans to market through his company comma.ai at a price of $1,000.

The future is already here. Please feel free to share your thoughts on the EDIT DIY autonomous vehicle with the community in the comment section below or the OSVehicle forum on our app, that is if you have swiped right to “like” the EV.

Top 5 EV News Week 32 2020 | Cadillac Lyriq unveiled. Yet another Chinese EV startup IPO. Three new EV models launched this week.

Top 5 EV News Week 31 2020 | Successful IPO for CHJ Auto, Kandi finally enters the USA, Mitsubishi pays the cost for failing EV strategy.

Top 5 EV News Week 30 2020 | Chengdu Auto Show, Hozon Neta IPO, VW invest in China, eVito Tourer for sale

A slew of self-driving pilot programs has been announced recently, the latest being Delphi. The auto parts company previously owned by GM announced that it would roll out self-driving taxis in the USA this year. Delphi is already piloting a program in Singapore where it pilots an Audi SQ5, kitted with 26 sensors. The pilot would be extended to three vehicles in June and is done in conjunction with the Singapore government where the company hopes to have operating taxi service within three years. According to Automotive News it is anticipated that Delphi will host the US pilot in either Pittsburg or Boston and that services would commence in September 2017.

Delphi’s pilot program allows passengers to see what the cars “brain” sees on a tablet, which it calls its “comfort cam”, soothing first-time users of the service. Already speculation is rife that Intel, which just last month paid a staggering $15 billion for Isreali autonomous tech company, Mobileye, would acquire Delphi. The three companies are already integrating their technologies to provide autonomous systems for car manufacturers, as soon as 2019.

Delphi would extend the pilot to Europe in the 3rd quarter and will switch its test vehicles to an undefined electric vehicle by 2018. The regulatory environment for public testing eased last week as Germany passed a law allowing for the public testing of autonomous vehicles.

Competitors, Lyft and Waymo also signed a partnership agreement this week. Waymo, previously know as Google’s self-driving program is already piloting Chrysler Minivans and Lexuses in Phoenix. The company last month invited people living in South East Phoenix to apply for the program, allowing the participant to hail a ride via a mobile app for local trips. Already as much as 10,000 such rides have been completed by Google staff. Waymo announced in April that it would increase its autonomous fleet from 100 to 600 Chrysler Pacifica minivans. It is no surprise that Waymo did not partner with Uber since Waymo claims that Uber stole some of its technology in an ongoing court case between the two companies. Reuters reported that according to Lyft the transaction is not exclusive, leaving the door open for other partnerships such as Lyft’s shareholder GM.

GM paid $500 million last year for a stake in the USAs number two ride-sharing company; the automaker also acquired Cruise Automation to spearhead its autonomous vehicle strategy. GM is very aggressive in the autonomous space, trying to carve out a lead to make up for ground lost to newcomers such as Tesla. GM is spending vast amounts of money to this end, for instance paying $1.1 billion to acquire its second Y Incubator company, the Italian based OSVehicle, to develop a self-driving “Vehicle-as-a -Service” (VaaS) platform. GM’s efforts are seeming to pay off as the respected research firm, Navigant, recently ranked it and Ford at the top of the self-driving leaderboard.

Companies like Delphi, Intel, and Nvidia, are hoping to sell their driverless systems to automakers in what is expected to be a market of around $100 billion within the next couple of years. BMW last week unveiled 40 BMW 7-series equipped with Intel’s driverless technology. The test, using the specially converted autonomous 7-Series is part of the German company’s project that will see 155 million test miles driven. Nvidia, an early front-runner in the self-driving tech space lat week, announced that Toyota would use its autonomous microchip built on Nvidia’s artificial intelligence platform called Drive PX. Both Daimler and Audi have already partnered with Nvidia on its Drive PX system.

Precursors to larger ride sharing and hailing services would be regulation, computing infrastructure, and connectivity. Governments would have to enact regulation to allow driverless cars while processing power and data centers need to be increased many fold to accommodate driverless technology. So also is 5G connection a requirement, daily use of an average self-driving car would be four terabytes of data.

In February we provided a summary of the disengagement reports by companies doing public testing on Californias’ roads. Only 10 of the permitted 20 companies filed reports, this number would definitely increase in 2017 judging from all the pilots announced recently. The pilot programs currently in action are mostly for level three and four autonomy and are expected to be commercially available from 2020 onwards. Even though it is expected that the Tesla 2018 models would have level five compliant hardware installed full autonomy is only expected in the latter half of the next decade.

The video by BMW below provides a short overview of the different autonomous driving levels.

The Chinese Government released its long-term development plan for the automotive sector on the 25th of April 2017, setting out the China EV strategy. The plan, presented by the Ministries of Science and Technology and Ministry of Industry and Information Technology in conjunction with National Development and Reform Commission, sets out how the country will ramp up the local EV sector and dominate the world market.

If successful the Chinese auto sector can leapfrog the dominance of the big auto companies, such as Toyota, VW, BMW, Daimler, Ford, and GM. Big Auto has missed the boat on electric vehicles and therefore continue to downplay the technology as only a niche sector. Management boards of big auto companies are flip-flopping strategy as they try and come to grips with how to enter the market and to what extent they should invest in research in technology. BMW last week announced that EVs constituted 3% of its total sales for the first quarter of 2017 after a jump in EV sales of 50% (Top 5 EV News Week 18). With the release of the data, the company set out how it will introduce more models. The news from BMW is in stark contrast from news only six months earlier when the Board grappled with if it should pursue EVs at all (Top 5 EV News Week 49  2016). In the USA we have recently seen how newcomer Tesla is valued above Ford and GM by investors. The response by Big Auto and other detractors of EVs was that this is a temporary phenomenon, arguing that Tesla hardly produces one tenth of the vehicles any of the top brands does. If one look at total sales of Battery Electric Vehicles (BEVs), it seems investors on the other hand value companies on their future ability to produce electric vehicles. If the same apply for Chinese brands, we can very quickly expect a Chinese brand to ascend the list of top auto brands.

2016). In the USA we have recently seen how newcomer Tesla is valued above Ford and GM by investors. The response by Big Auto and other detractors of EVs was that this is a temporary phenomenon, arguing that Tesla hardly produces one tenth of the vehicles any of the top brands does. If one look at total sales of Battery Electric Vehicles (BEVs), it seems investors on the other hand value companies on their future ability to produce electric vehicles. If the same apply for Chinese brands, we can very quickly expect a Chinese brand to ascend the list of top auto brands.

According to the plan by the Chinese Government, it set a short-term target of EV sales of 2 million units locally by 2020 and at the same time elevate Chinese auto brands to be seen amongst the top ten electric vehicle brands globally. The medium term target is that EVs contribute 20% of the total annual fleet by 2025, which is a huge amount of cars. Measuring the movement in sales by brand in the table below we can already see the top Chinese EV brands, BAIC, SAIC, Geely Zhidou and JMC moving higher and two brands, BAIC and BYD in the top ten list for the first quarter 2017. Other evidence of Chinese companies investing heavily in the sector includes Chinese IT company, Tencent acquiring a significant stake in Tesla, sparking a rally in the stock.

Measures by the Chinese Government to achieve the targets above include:

China already has experience of setting itself to dominate a sector and achieving set goals. Less than a decade ago the Chinese Government plotted to dominate the PV panel market and in the process brought down the price of energy production from renewables, killing some western PV manufacturers in coal plants in the process. Already we are seeing a deluge of battery cell plants being planned by the end of the decade in China. We can, therefore, expect the same domino effect as in the energy markets, taking out auto manufacturers that were slow to embrace electric vehicles.

Interested in learning more about Chinese electric vehicles? Download our fun and easy app below, flick the China switch and swipe left the models you don’t like, right the ones you do, enter the chat rooms and share your thoughts with the community.

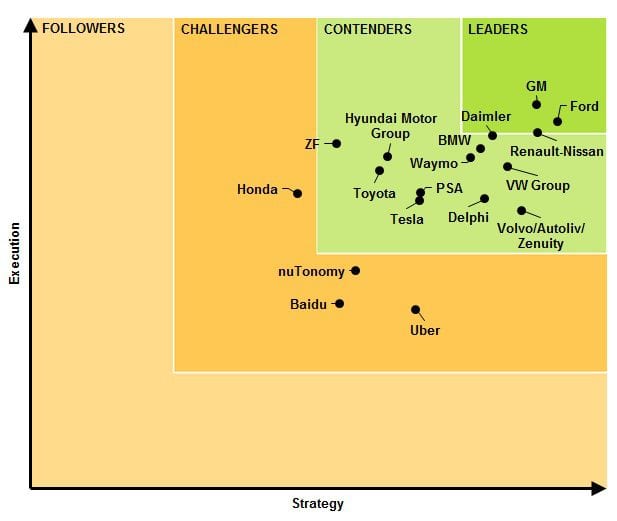

Navigant Research placed Ford and GM at the top of its autonomous driving leaderboard, surprisingly far above Waymo (7th), the pioneer of autonomous driving. Waymo was only listed as a contender, and Tesla who has already clocked over 300 million miles in Autopilot (Level 2 Autonomy) did not make the Top 10 list. Waymo, not aiming to develop a car, but rather focusing on autonomous technology has partnered with Chrysler and Ford on testing autonomous technology.Making Navigant’s findings even more surprising to us is that

Making Navigant’s findings even more surprising to us is that Waymo performed exceptionally well compared to other automakers on the list when comparing across all permit holders allowed to test autonomous tech on Californias public roads. According to CA DMV regulations, each permit holder must annually file a disengagement report, reflecting the number of events where a driver essentially has to take over from the vehicle’s autonomous mode to either prevent a traffic incident or where the system fails. Waymo posted a record 0.2 disengagements per 1,000 miles in its 2016. For a breakdown of each permit holders testing in California read our recent blog providing detailed analysis. The table below shows a summary of all the permit holders in the CA DMV program’s disengagements per 1,000 miles.

Despite Tesla aiming to have a market ready Level 5 autonomous product by the end of the year, it is only listed as a contender. Tesla is criticized by some, for being too aggressive, using its customers as guinea pigs for its AutoPilot software.

Not surprising though is that Uber features on the bottom end of the list, the controversial ride-hailing company has been in the news lately for losing its right to test in San Francisco, being sued by Waymo and a crash in Tempe, Arizona, temporarily halting its pilot program.

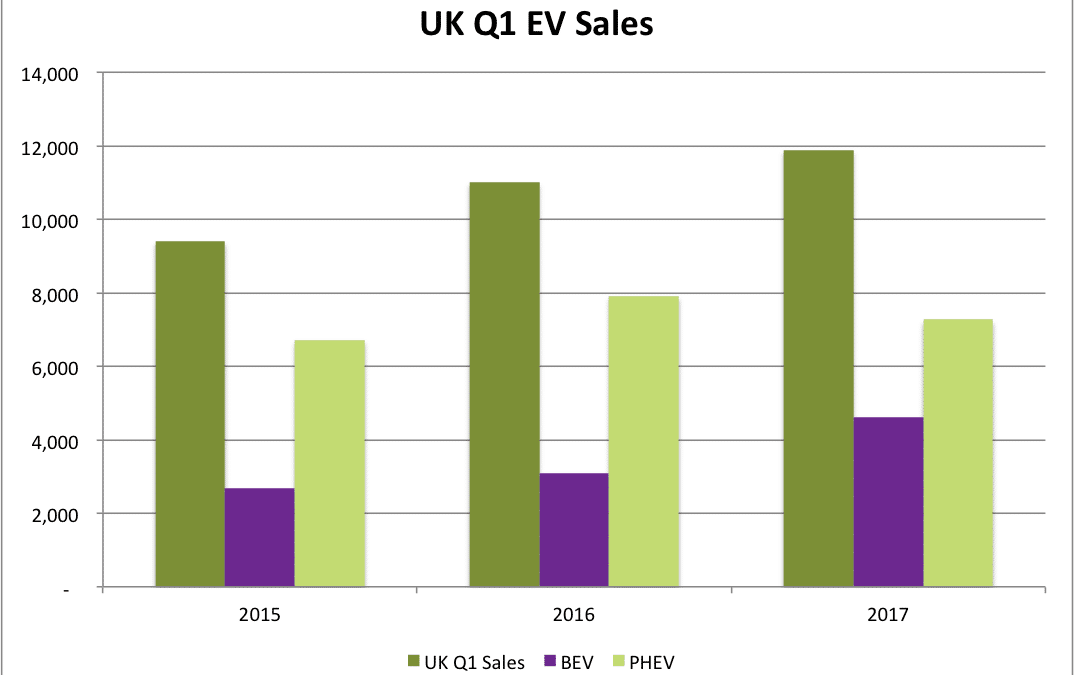

TOP 5 EV NEWS #1 – UK EV SALES Q1 2017 BREAKS RECORDS

UK EV sales for the first quarter 2017 set new records, mostly on the back of Tesla sales. The quarter’s sales bring EV’s contribution up to 1.4% of the total vehicle fleet. The UK sales for Q1, traditionally the best performing quarter for UK car sales, was closely watched as a new Vehicle Excise Duty (VED) comes into play from the first of April 2017. The new VED rules apply for all vehicles except zero emission vehicles (ZEV). According to the VED, Internal Combustion Engine vehicles (ICE) will be liable for a levy of £1,550 spread over five years on all vehicles priced over £40,000.

Electric vehicle sales for March, which contributed nearly 70% of the quarter’s sales, rose a below average 7% on a year-to-year basis, lower than the 8.4% for the total new car market. Total EV sales for the quarter was around 11,900 units, some 880 units more than Q1 2016. A deeper analysis of the UK electric vehicle sales showed a significant rise of the Battery Electric Vehicle (BEV) component, rising 34%, or around 800 units in March from the year before. Most of the 800 units can be attributed to Tesla’s massive sales drive, which led to a record 25,000 units being sold internationally, of which nearly 900, triple February’s sales, was sold in the UK during March 2017.

The improved performance of BEV vehicles compared to Plug-In Hybrid Electric vehicles (PHEV), showing a decrease of 5% to just under 5,000 units, corrects a trend since 2016 which saw 3-in-4 electric vehicles in the UK being PHEV’s.

All indications are that UK EV sales will breach the 100,000 unit mark, shared with only 7 other countries within the next couple of months. Recent surveys in the UK showed that most vehicle buyers are negative towards diesel vehicles due to diesel gate, a spectacular own goal by big auto and that 85% of vehicle owners now consider buying an EV, subject to them overcoming these EV related misconceptions.

TOP 5 EV NEWS #2 – AUDI & PORSCHE TO CO-OPERATE ON EV PLATFORM

VW sister companies, Audi and Porsche, to accelerate their respective electric vehicle strategies, this week announced that they would jointly develop a shared electric vehicle platform allowing the automakers a faster route to electric, connected and autonomous technology. The partnership will last til 2025. The German based VW Group‘s electric vehicle strategy is built on its MEB electric platform architecture, while Porsche targets the delivery of its first electric vehicle, the Mission E by 2020 and Audi, an electric SUV based on the e-Tron Quattro by 2018. Both vehicles will have various degrees of autonomy as part of its offering.

TOP 5 EV NEWS #3 – FORD’s CHINA STRATEGY

In the same week where Ford was dethroned by GM as the USA’s number two automaker, due to Tesla taking the top spot, the company released a new electric vehicle strategy for its Chinese operations. Ford, suffering from a shareholder revolt due to its lack of a convincing electric vehicle strategy and declining sales on Thursday announced that it targets 70% contribution from EV’s of its Chinese auto sales by 2025. The first phase of the strategy will be to produce a PHEV early 2018 together with its Chinese partner, Changan, also known as Chana. The company aims to have a small electric SUV within the next 5 years, capable of a battery electric range of 280 miles / 450km. The company still lacks a proper global electric vehicle strategy and the current attempt is too little and too late.

TOP 5 EV NEWS #4 – MAHINDRA & SSANGYONG ANNOUNCE EV

The Chairman of Indian automaker Mahindra and Mahindra, Anand Mahindra announced at the Seoul Motor Show this week that Mahindra and its Korean subsidiary SsangYong aims to develop a luxury electric vehicle by 2019, targeting entry into Chinese and US markets.

TOP 5 EV NEWS #5 – NAVIGANT RESEARCH DISCOUNTS WAYMO AND TESLA AUTONOMOUS EFFORTS

Navigant Research placed Ford and GM at the top of its autonomous driving leaderboard, surprisingly far above Waymo (7th), the pioneer of autonomous driving. Waymo was only listed as a contender, and Tesla who has already clocked over 300 million miles in Autopilot (Level 2 Autonomy) did not make the Top 10 list. Waymo, not aiming to develop a car, but rather focusing on autonomous technology has partnered with Chrysler and Ford on testing autonomous technology. Making Navigant’s findings even more surprising to us is that Waymo performed exceptionally well compared to other automakers on the list when comparing across all permit holders allowed to test autonomous tech on Californias public roads. According to CA DMV regulations, each permit holder must annually file a disengagement report, reflecting the number of events where a driver essentially has to take over from the vehicle’s autonomous mode to either prevent a traffic incident or where the system fails. Waymo posted a record 0.2 disengagements per 1,000 miles in its 2016. For a breakdown of each permit holders testing in California read our recent blog providing detailed analysis.

Navigant’s criteria are based on the following ten factors; vision, go-to-market strategy, partners, production strategy, technology, sales, marketing, and distribution, product capability, product quality and reliability, product portfolio and staying power. The Top Ten on Navigant’s list are Ford, GM, Renault–Nissan Alliance, Daimler, Volkswagen Group, BMW, Waymo, Volvo/Autoliv/Zenuity, Delphi and Hyundai Motor Group.

Despite Tesla aiming to have a market ready Level 5 autonomous product by the end of the year, it is only listed as a contender. Tesla is criticized by some, for being too aggressive, using its customers as guinea pigs for its AutoPilot software. Not surprising though is that Uber features on the bottom end of the list, the controversial ride-hailing company has been in the news lately for losing its right to test in San Francisco, being sued by Waymo and a crash in Tempe, Arizona, temporarily halting its pilot program.

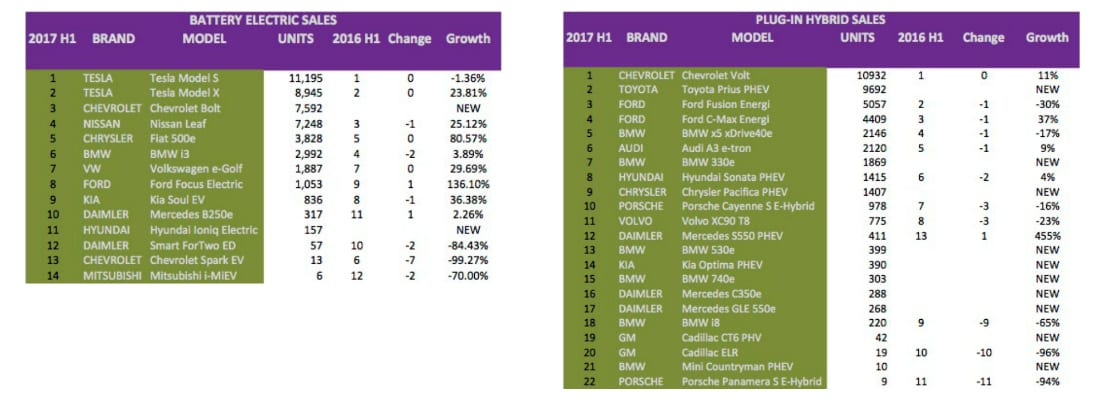

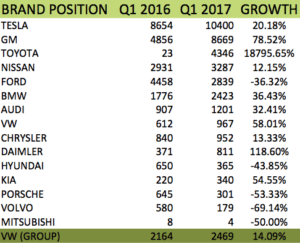

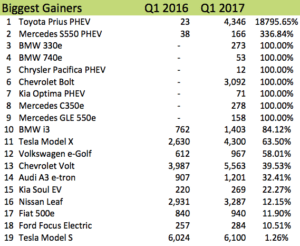

We look at the Top brands, Best and Worst Models and how the battle between battery electric (BEV) and plug-in hybrid (PHEV) technologies play out in the summary of USA EV Sales Q1 2017.

The highlights for USA electric car sales in Q1 2017 was:

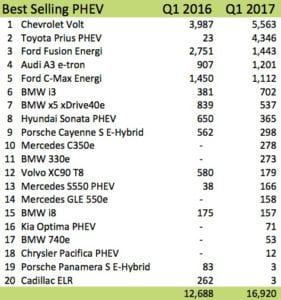

There are no surprises in the Top 3 Electric Vehicle Brands as Tesla remained on top, due to increase sales of the Tesla Model X, and GM and Toyota brought new models to book. Quarter 1 2017 was the first full quarter for the Chevrolet Bolt, the world’s first mass-market car. The Chevrolet Bolt‘s performance was rather disappointing, with sales dropping from a January high. The reason can be one of two, either GM‘s slow roll-out is to blame, or most buyers are waiting for the Tesla Model 3. Toyota’s only Plug-In Hybrid (PHEV) vehicle, the Toyota Prius Premium, performed remarkably well, taking in consideration that the battery capacity and range does not offer a real advantage to its competitors.

The bad boy on the block was Ford, barely hanging on to the Top 5 list of electric cars. Were it not for Porsche’s bad performance in the VW Group; the German automaker would have unseated Ford in the Top 5. BMW dropped out of the Top 5 list as Toyota entered the list in the third position. Daimler showed commendable improvement while Hyundai and Volvo joined Ford on the losing side. Nissan still shows consistent growth with its only electric vehicle, the Nissan Leaf.

Of the new electric vehicle models that came to market in this quarter, the Toyota Prius Premium, a PHEV outperformed GM‘s Chevrolet Bolt, a BEV by nearly 30%, a disappointing performance for the first mass-market electric vehicle. Both Mercedes-Benz and BMW had two more models in this quarter compared to 2016, with the Mercedes-Benz C350e and Mercedes-Benz GLE 550e outselling the BMW 330e and BMW 740e.

The Mercedes Benz S550 PHEV, BMW i3 2017 and Tesla Model X were the best performing existing models, although for the BMW i3, its the 50% improvement in battery capacity that attributed to its increase in sales.

The Tesla Model S sales remained flat on a year-to-year basis, despite continued improvements in its software and hardware.

Sales of the Cadillac ELR fizzled out completely in anticipation of the release of the Cadillac CT6 PHEV this month. Both the Porsche Cayenne and Panamera showed big losses in sales from a year ago, impacting on total growth for the VW Group. Judging from the Ford models sales slump, it is clear the century-old automaker needs to reassess it electric vehicle strategy. The big drop in the Volvo XC90 T8 can be attributed to the challenge faced by all automakers coming late to the electric vehicle party. To enter the electric vehicle market, lagging brands alter existing models to include batteries but in the process lose performance as drivers complain about smaller fuel tanks.

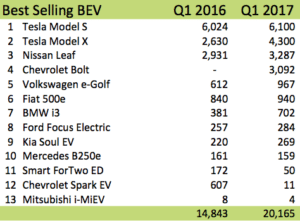

Battery Electric Vehicle’s (BEV), of which nearly half is constituted by the two Tesla models, outperformed plug-in hybrid electric vehicles. Over 20,000 BEV units were sold in the first quarter of 2017 compared to just under 15,000 a year ago. Q1 2017’s 19.2% increase in sales showed a slight improvement for the technology on Q1 2016 when BEV outsold PHEV with 17%. The USA is one of the few countries where BEV vehicles outsold PHEV’s since 2016, read our blog on the Top 10 EV Markets.

In total there is 13 BEV models and 20 PHEV models available in the USA market in 2017 so far. Consumers had a choice of seven new PHEV models in Q1 2017 and one BEV compared to the same period in 2016.

New model’s coming to market in the next quarter include three plug-in hybrids, the Cadillac CT6 PHEV, BMW 530e, and the Porsche Panamera 4 E-H, while only one BEV, the Hyundai IONIQ Electric will be released, should there be no surprises from Tesla on the Model 3.

Please leave us a comment on your thoughts regarding the electric vehicle models available to the US consumer.

Note on data used: For comparison purposes, the BMW i3 sales data was assumed to be divided in two, to accommodate for the BMW i3 BEV and REx PHEV

Tesla (NASDAQ: TSLA) shares broke through its $280 resistance level on record sales for the first quarter 2017, leading investors to re-evaluate their outlook for the company. The results showed that Tesla could deliver above market expectations. The sentiment is supported by a decrease of vehicles in shipment, of around 1,800 units. Investors are now reconsidering the poor market guidance for the company to deliver on its Tesla Model 3 promises. The Q1 sales of 25,418 units show a growth of 12% on the previous quarter, which is a massive 69% on year-on-year basis. The Tesla Model X was the star, showing around 22% growth at 11,550 units, while the Model S sales grew by nearly 6%.

Today’s intraday share movement makes Tesla’s market value more than Ford (NYSE: F) and sees it gaining on General Motors (NYSE: GM), officially making it the number two in the sector. The electric vehicle manufacturer, which some still sees as a start-up, intraday market capitalization stood at around $47.95 billion, while Ford’s value dropped to $44.91 billion, on the back of a share price that was down 5%, caused by a decrease in March sales of 7%. GM shares also suffered a sell-off of around 4% on a marginal growth of just over 1%, bringing the companies market cap well within reach of Tesla at $50.78 billion.

Both GM and Ford have missed the opportunity in electric vehicles. The automakers recently wrote to President Donald Trump, in an attack on EV’s, through the Alliance of Automobile Manufacturers, asking him to relax emission targets as they did not see consumer demand for electric vehicles justify such stringent EPA standards. Maybe investors are taking a cue from Hyundai’s shareholders, who revolted, resulting in the company changing its electric vehicle strategy in 2016.

The strong resistance of $280 which held since September 2014 saw the stock retreat after creating a double top formation at the level in July 2015. After testing the resistance for the second time, Tesla’s shares retreated to a low of $151 in Feb 2016. The first count on the breakout of the channel, which broke in January at $230, can see Tesla’s shares trade at around $320 in the near future. If all else remain equal, it will equate to a market cap of $52,2 billion, well above that of GM.

Share data, Google and Marketwatch

Are you looking for the perfect electric vehicle? Need to compare electric vehicles? Our easy to use tool, EV4U, helps you to find the perfect electric car!

ONE

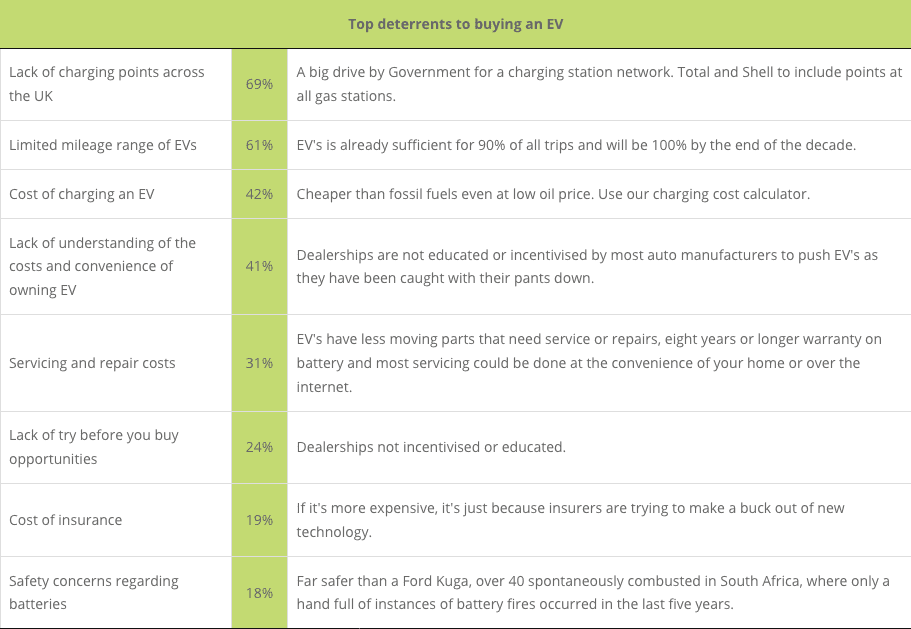

News from the past week shows the that the pendulum is swinging quicker than expected for electric vehicles. The results of two surveys in the UK this week was a clear indication that demand for electric vehicles is much more than most automakers anticipated. Google searches for the electric vehicles has also surged by 127%.

A survey by Venson Automotive Solutions shows that 85% of respondents from a survey in the UK are now seriously considering buying an EV. Reading between the lines, wattEV2Buy finds it significant that range is no longer the deterring factor when prospective buyers are considering buying an EV. For long, most respondents to such surveys cited range as overarching reason for not buying an EV. In the Venson Survey, a lack of charging stations was the biggest reason for prospective buyers to put off the buying decision. In a separate survey by Carbuyer, 61% of respondents said they would not buy diesel vehicles again because of “diesel gate,” the spectacular “own goal” by big auto. Diesel sales were down 9% in the UK for the month of February while plug-in vehicles rose by 49%.

Most automakers have caught on to the shift, but not aggressive enough, while others are being forced to produce plug-in electric vehicles. Labor organizations within Audi have asked management to build more electric vehicles, as some of the factory units fear missing out on the technology will lead to job losses. Hyundai was forced by shareholders to shift focus on Fuel Cell Hybrid Vehicles to plug-in electric vehicles, while Daimler has accelerated its massive $10 billion planned investment in EV’s. All these turnarounds in strategy pale in comparison to that of Sergio Marchionne, FIAT Chrysler‘s CEO, but more Hyundai, FIAT, and Daimler later in the post.

Below are the results of the Venson survey

TWO

Hyundai admits electric vehicles are an imperative. During the Los Angeles Auto Show in 2016, the company said that it planned to have 14 new alternative vehicles in the US by 2020. The planned product mix include’s four plug-in hybrids, four electric and one hydrogen fuel cell model. Thursday Mr. Lee shed some more light on the company’s plans, indicating that the first fully electric vehicle planned for next year would be a small SUV. According to Mr. Lee, the SUV would have a range of 185 miles (300km). Although the company is developing its own dedicated platform, it can’t say when it would be ready. The platform is modeled after that of Tesla, with the batteries in the floor, allowing for more battery capacity and cabin space. It is clear from the announcement that the company is aggressively trying to catch up on lost ground.

Hyundai now expects the EV market to be around 10% of the global fleet by 2025, at which point Fuel Cell EV’s will take off. Hyundai’s luxury brand, Genesis also announced today that it would introduce a PHEV by 2019 and BEV by 2021.

THREE

With the run-up to the Formula E to be held in Mexico City today, Ferrari came out in support of the event. FIA’s Auto magazine quoted the CEO of FIAT Chrysler, one of the auto industries biggest naysayers of EV’s, Sergio Marchionne as follows in an interview:

“The first is that we need to be involved in Formula E because electrification via hybridization is going to be part of our future.”

“We have already developed a hybrid supercar, La Ferrari,” he said, “and on future Ferrari models we will leverage new technologies as well as electrification.”

And this from a man that came out vehemently against the technology, saying it will never catch on.

FOUR

Daimler this week, after a board meeting in Berlin, announced that it would accelerate its $11 billion investment in electric vehicles by bringing it forward with three years from 2025, as announced last year to 2022. Reuters reported that the automaker’s aggressive stance are the result of it not being able to cut fleet emissions of 123gm CO2/km from 2015 to 2016 in Europe. Europe has set a very stringent target of 95gm CO2/km by 2020. Daimler’s own target for 2020 is 100gm CO2. The German automaker cites the popularity of SUV’s as the reason for it not cutting its emissions for the first time since 2007.

FIVE

GM acquired its second Y Incubator company, the Italian based OSVehicle, for $1.1 billion in a bid to develop a self-driving “Vehicle-as-a -Service” (VaaS).

OSVehicle provides an open-source platform to hobbyists and other start-ups. Customers can have a full EV platform, the Tabby EVO, shipped between $12,500 and $19,500. OSVehicle claim start-ups can save $2 million and 3-years in Research and Development by going the open-source route. The open-source platform enables for larger disruption in mobility options using electric vehicles. Imagine adding George Hotz’s self-driving car kit which he plans to market through his company comma.ai at a price of $1,000, and you can build your own “ai-chauffeur” driven zero emission vehicle.

GM aims to use OSVehicle to develop its EDIT modular self-driving car based on the Chevy Bolt M1 platform. The decision was influenced by the ability of modular platforms to extend the lifespan of heavy use vehicles, such as ride sharing and hailing applications. OSVehicle‘s Yuki and Tin Hang Liu claim that through the use of modular architecture, car fleets can last ten times longer by enabling seamless hardware upgrades of self-driving and connected car technologies.

Picture: Genesis Concept introduced at New York Auto Show

ONE

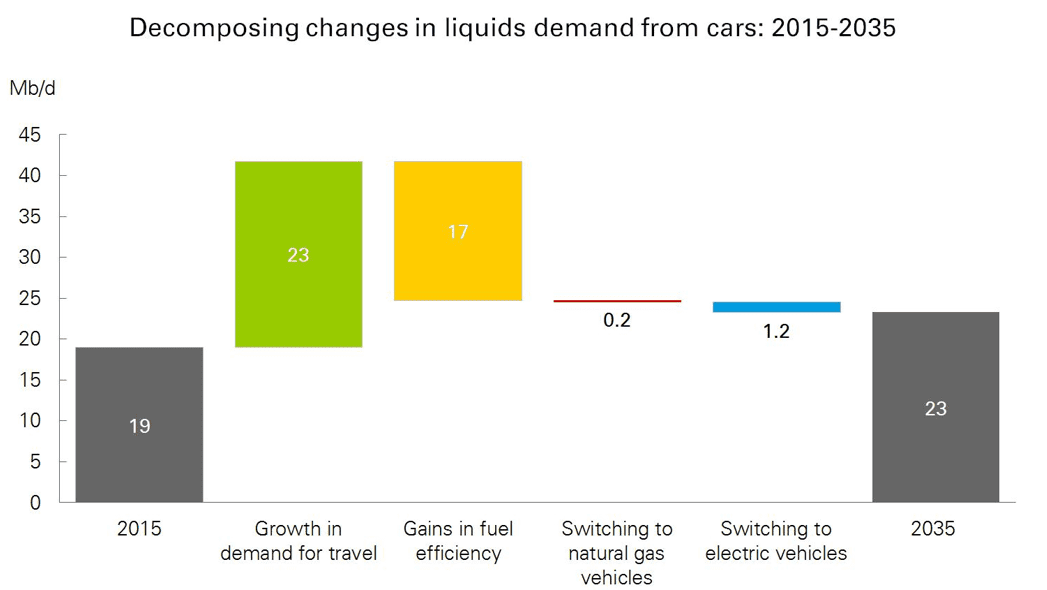

An article by OilPrice.com based on BP’s long-term energy outlook claims the electric vehicle car threat to the oil industry is overstated and a red herring for investors and other observers. The article cast doubt on if the achievability of a target of a 100 million electric vehicles by 2030, especially in a Trump era. Nonetheless, BP’s forecast still sees only a marginal effect of only 1.2 million barrels per day on oil demand if the target of around 7% EV’s by 2030 is reached. The article concludes that a bigger unknown to oil demand gains in fuel efficiencies, largely driven by more stringent emission targets.

TWO

Rumors about Apple’s secretive iCar named Project Titan has been circulating. MacWorld.co.uk speculated this week that Apple, the world’s most valuable company, has set itself a deadline of late 2017 to prove feasibility for a vehicle to rival Tesla.

THREE

Some policy gains were made this week in support for electric vehicles in the ongoing tussle targeting regulations for and against the technology. New York will from the 1st of April 2017 provide a $2,000 incentive to buyers of electric vehicles. In Wyoming, despite efforts by the Alliance of Automobile Manufacturers backed by Ford and GM to block Tesla from opening its direct sales business, the State Legislature this week approved a bill allowing Tesla to open its showrooms and sell vehicle’s without the use a middle man.

FOUR

Honda is setting itself up for failure with this week’s announcement that the much anticipated mid-sized 2018 Honda Clarity EV will only have an 80-mile range. Despite being a mid-size sedan, with the obvious space benefit it brings, the car will not even compete with smaller compact sedans and hatchbacks, such as the 2017 BMW i3 (114 miles), Nissan Leaf (107 miles) and the VW e-Golf (125 miles). The Honda Clarity EV’s direct competitors in the $30,000 to $35,000 price range, the Hyundai Ionic (124miles) and Tesla Model 3 (200 miles), will put it to shame.

FIVE

February Electric Vehicle sales data released for the USA this week reveals some interesting talking points. Overall, February sales gained a further 13.4% in January 2017 and over 55% on year on year basis. Contributors to the increase came from a nearly doubling in sales of the Tesla Model S and continued demand for the new Toyota Prius Plus. Unfortunately, the Prius in our books hardly counts as an electric vehicle due to its underwhelming continued reliance on its combustion engine. Disappointingly, sales for the Chevrolet Bolt declined over 18% from January, bringing total sales for the four months to 3,272 units, far short if one takes that at a claimed 30,000 units per annum the Bolt should have sold 10,000 units during the four months. In the car maker standings, GM retained its lead with 2,776 units over Tesla’s 2,550 units with Ford taking third place with 1,704 units.