No Results Found

The page you requested could not be found. Try refining your search, or use the navigation above to locate the post.

Mercedes Benz and Chery Automotive reached an agreement in the trademark dispute lodged (EV News Week 12) by Chery in March 2017. According to a joint press release, the companies agreed to the following settlement with regards to using the EQ designation for electric vehicles in China:

Chery will focus on using the designations eQ and eQ1, as well as further numerical continuations thereof, while Daimler will focus on use in their electric Mercedes-Benz products with the designations EQC and any other alphabetical supplements. Daimler will use the EQ Power designation for Plug-In Hybrids and meanwhile Chery will also use eQ TEC to nominate their car electrification system.

Chery has already been using the eQ and eQ1 brand names in China since year 2014 and Daimler has now also granted them the possibility to use this name family in countries outside of China. Daimler established the EQ brand family for electrically driven Mercedes-Benz vehicles almost simultaneously in countries outside of China and Chery has granted the company the possibility to also use this in China now.

We reported in March that BMW was considering Mini as an EV only brand, with the Mini being its answer to Tesla and Chevrolet‘s mass market cars, the Model 3 and Bolt EV. At the time BMW CEO, Harald Krüger was quoted that the company is considering manufacturing facilities for the Mini in Germany, the Netherlands, and the UK. Reuters this week reported that unconfirmed sources indicated that the UK would be the winner in the race for producing a fully electric Mini. The BMW plant in Oxford is responsible for 60% of the Groups compact cars, but in the aftermath of BREXIT, the German automaker established the Netherlands as an alternative manufacturing base. The report indicates that the final desition will be announced at the Frankfurt Auto Show in September.

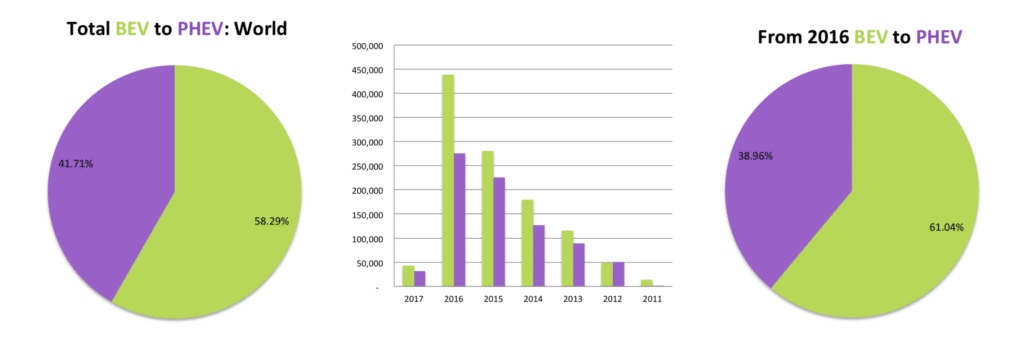

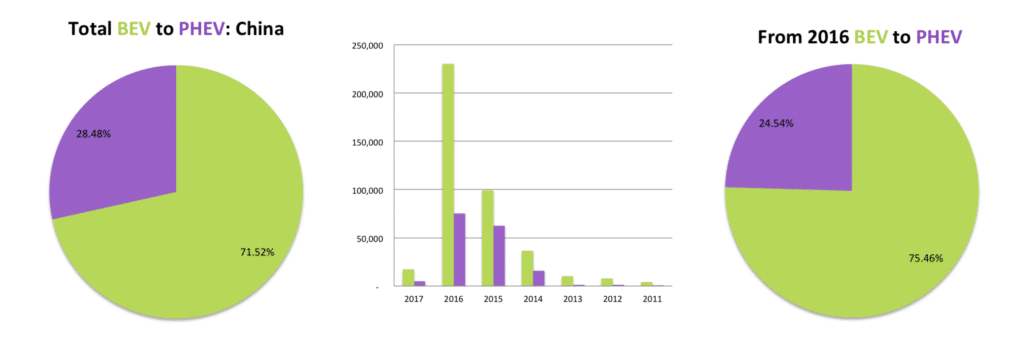

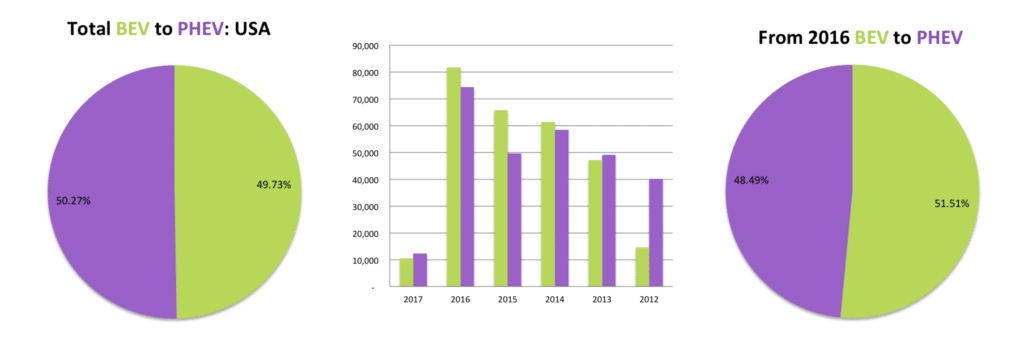

As the June EV sales data are being released, we have been able to create half year reports for the key markets. Most of the of the key markets are showing exceptional growth in the first half of 2017. The increased sales are helped with the release of a slew of new models. As many as 20 new models have entered the Chinese EV market since June 2016 while most European markets saw ten or more new models. Some of the highlights are:

Germany – Year on Year growth of 104% or 11,000 units

USA – Year on Year growth of 39% or 25,000 units – see report

China – Year on Year growth of 35.8% or 44,000 units – see report

Norway – Year on Year growth of 20.6% or 4,600 units – see report

Sweden – Year on Year growth of 35.2% or 2,100 units – see report

France – Year on Year growth of 1.4% or 260 units

Netherlands – Year on Year growth of -14.2% or shrinking with 656 units

Smaller markets such as Spain has also shown growth of 101% and Italy 53%. We will be releasing detailed reports on all the Top 10 countries in the following two weeks.

Nissan announced that the new Nissan Leaf would be released on the 6th of September. New EV model releases have become as anticipated and high profile as smart phone releases some years back. With the date nearing Nissan has been releasing teasers about the long awaited new Nissan Leaf. The latest teaser revealed that the Leaf would have an e-Pedal, or for the novice, just one pedal to accelerate and break. Breaking is done by taking your foot off the pedal, activating regenerative breaking. The technology was first used in the Tesla Model S and then in the BMW i3 in 2014. Previous teasers indicated that the Leaf would have some autopilot functionality.

The Swedish carmaker, Volvo, and the Chinese company, Geely is fostering deeper relationships in the worlds largest market for electric vehicles. In a press release by Volvo this week it was revealed that the companies would establish a new joint venture technology company to share existing and future technologies. We have seen this cooperative trend in China for the last couple of months, which is a departure from previous JVs between international and Chinese companies. In the past international automakers were forced by law to enter into JVs with Chinee companies to be able to sell their vehicles, which lead to mostly older generation models being dished up to the Chinese consumer as the international partners tried to protect their IP.

The JV company will be owned 50/50 by Geely and Volvo with its HQ in China and a subsidiary in Gothenburg, Sweden. The Memorandum of Understanding agreed to on the 20th of July between Volvo, Geely and newly formed LYNK & CO determined that the companies will share vehicle architecture and engine technologies via cross licensing arrangements of technologies managed by the new joint venture. The IP for the technology will remain with the company that developed it, but the technology itself will be available for use by Volvo, Geely Auto, and LYNK & CO, via license agreements. Volvo Cars and Geely already share technology, most notably the Compact Modular Architecture (CMA) which is being used by Volvo Cars for its soon-to-be-announced smaller range of 40 series cars and by LYNK & CO.

Separately, it is also announced that Volvo will acquire a minority shareholding in LYNK & CO.

Meet Zacua, the first Mexican produced electric vehicle. The Mexican company Motores Limpios, S.A.P.I. de C.V. produced the Zacua electric vehicle in partnership with Spanish, French and Chinese companies. The French company Automobiles Chatenet designed the two models, the M2 and M3. Spanish company Dynamik Technological Alliance developed the drivetrain while the battery is from China. The Zacua brand is named after the name of a bird species found from Mexico to Panama.

Production of the 2-seater full electric vehicle will be limited to 100 and is expected in November 2017, followed by 200 in 2018 and 300 in 2019. Assembly of the Zacua M2 and M3 will be in Mexico State and move to Puebla in 2019. The production of the Zacua generated 30 early stage jobs while no indication of the initial or total required investment was divulged.

Specifications for the Zacua are as follows:

Pricing for the base model starts at $24,500 / 440,000 pesos and buyers will not be required to pay car tax or purchase an environmental verification certificate as required by Mexican law. Owners will also not be restricted by the “Hoy No Circula” or No Circulation Today, an environmental program required to improve the air quality in Mexico through six monthly emission testing and restrictions on driving between 5.AM and 10 PM.

The Renault owned Romanian producer of low-cost vehicles, Dacia; this week indicated that it would also enter the market for alternatively fuelled vehicles according to a Romanian publication quoting Renault Group’s Commercial Director Hakim Bouthera. According to Mr. Bouthera Dacia needs to reposition itself as the market changes away from combustion engines but should maintain its DNA as producer of affordable cars. The Romanian EV market has seen a steady rise in the adoption of electric vehicles, with April 2017 data showing a near three fold increase in EV sales compared to the same period in 2016. The April data shows that 548 EVs were sold at the end of the month to only 195 in the same period of the previous year. EVs now constitute 1% of registered vehicles in Romania with around 2,000 alternatively fuelled cars sold in the last three years. The Romanian government supports the EV sector with a €10,000 (45,000 lei) subsidy.

London Taxi Co, the Geely owned company since 2013, this week unveiled its production ready electric taxi, the TX, which is based on the FX4 black cab that went out of production in 1984. The 60-year-old British company changed its strategy to produce electric vehicles exclusively and opened its EV production facility at the end of March in Ansty, Coventry. The company will be as the London Electric Vehicle Company (LEVC). The new model will be a range extended car with a 70-mile (112km) electric range and 400-mile (640km) total range. The first 150 black cabs will be seen on London’s roads from November 2017 to comply with Transport of London’s (TfL) new rules requiring all new cabs to be zero emission capable from 1 January 2018 with the intent to phase out diesel cabs by 2023. TfL will support the initiative with co-developing 80 charging points by 2018 which will increase to 200 by 2020. The average London Cabbie covers around 120 miles (192km) per day and costs around £43,000 ($56,000) which is financed by the London Taxi Co through a private hire vehicle finance scheme. Although no formal pricing have been announced word on the street is that the TX will sell for around £50,000 ($65,000). LEVC also announced that it already received an order for 225 TX’s from the Dutch taxi operator, RMC, for use in Amsterdam. The TX competes with the Uber financed Toyota Prius and Mercedes Benz Euro 6 Vito Taxi (not EV), priced at £47,000 ($75,200).

The Nikkei Asian Review reported this week that Nissan Motor of Japan is developing a low-cost EV for Chinese cities which is expected within fiscal 2018, citing the automakers CEO, Mr. Hiroto Saikawa. The car is expected to be a pure electric A-class able to travel short distances priced at half the cost of a Nissan Leaf or around 1.5 million yuan ($13,200). The new city car will share its platform with other Nissan Alliance members Renault and Mitsubishi and produced at local partner Dongfeng to keep cost in check. Renault is developing its own EV on the same platform for the Chinese market, the Kwid crossover expected in the Chinese market by 2019.

The Chinese Governments aggressive electric car quotas are forcing international automakers to fast track electric vehicle plans for the country, fearing penalties such as losing their production licenses. The Chinese Government is expected to implement requirements from 2018 which will force auto companies to sell electric cars to generate ZEV credits. Automakers are complaining that the targets are impossible to meet and will disrupt their businesses. Reuters this week reported on a letter seen by it where auto companies wrote to the China’s Ministry of Industry and Information Technology in June 2018 asking for concessions on the planned initiative. The companies requests include asking for a delay of the program by a year, softening of the penalties and an equaling the requirements for local and international players.

Japanese EV start-up, GLM (right below), sold 85.5% shares to Hong Kong watchmaker O Luxe for an estimated $114 million according to the Nikkei Asian Review. GLM, labeled Japan’s Tesla, unveiled its electric supercar, the GLM G4, at the Paris Motor Show in October 2016. The GLM with a range of 400km (234-mile NEDC) has a total system output of 400kW and torque of 1,000N.m accelerating to 100km/h in 3,9 seconds reaching a top speed of 250km/h. The start-up evolved from a Kyoto University venture in 2010 and made ripples with its Tommykaira ZZ prototype (left below) earlier the year which features the worlds first resin windshield. O Luxe shares rose 21% on the news while GLM dropped 19.6%.

Up to now, news about VWs plans with its I.D. electric series have been sparse. The latest news on the VW I.D. strategy was about VW’s Chairman, Dr. Herbert Diess confirming the production of the I.D. Buzz. Dutch publication, Groen 7, this week provided a further glimpse of the VW strategy with the I.D EV model range which included two more models to join the three models already announced. VW will develop the I.D Lounge, an SUV and I.D AEROe, a sporty sedan exclusively for the US and Chinese markets. The I.D Lounge and I.D. AEROe will follow the I.D., I.D. Cross and I.D.Buzz models to hit the roads from 2019 to 2022. VW will produce the I.D. for the European market and the I.D. Cross for Europe and China. The market for the I.D.Buzz is yet to be defined.

All the I.D. models will be developed on VWs M.E.B platform. Golf replacement, the I.D. is expected in 2019 and promises a range of up to 600km from a 125kW electric motor. The last model in the range, the I.D. Buzz will have two electric motors with a combined output of 291kW and an acceleration of 0-100km/h in 5 seconds.

In related news the CEO of VW Group company Porsche, Mr. Oliver Blume said that half of all Porsche models would be electric by 2023. The Porsche Mission-E is expected in 2019/2020, followed by a BEV SUV Coupé. Porsche is preparing for the production of 60,000 electric vehicles per annum at its Zuffenhausen assembly plant.

SEAT, the Spanish-based VW Group brand, announced that it would develop an electric version of the high-performance Cupra model range.

Audi and German auto parts company, Schaeffler, partnered to develop a new powertrain for the ABT Schaeffler Audi Sport Formula E Race Team. The partnership will be around the development for the next three generations of the race car’s powertrain. The team has finished on the podium for the past two seasons and is again lying second in the third iteration of the ever popular event.

The VW JAC electric vehicles joint venture signed in Berlin at the start of June 2017 officially kicked off in Hefei, Anhui Province on the 29th of June 2017. The Chinese JV company, JAC Volkswagen Automobile Co., Ltd. with an initial investment of 5.6 billion Yuan ($740 million) will deliver its first electric car in January 2018. According to reports the first EV from the JV will be a fully electric SUV.

We have followed the Chinese “Netflix,” LeTVs, misadventures in the electric vehicle sector for the past year. LeTVs auto companies, Faraday Future in the USA and the LeEco in China, is well known for overpromising and underdelivering on its goals. The reason for the failure of the enterprises to make good on the hype created around it stems mostly from a cash crunch at the parent company, LeTV, due to it overextending itself in a wide range of projects. The founder of LeTV, Jia Yueting, had to personally jump in and save the two electric vehicles from faltering as groundbreaking of the Faraday Future ground to a halt while the launch of the FF91 at the CES 2017 flopped and the JV with Aston Martin was suspended. At the start of June, the Shenzhen Stock Exchange suspended the launch of the company’s RMB 2 billion bond which was supposed to provide cash flow to LeTV and its subsidiaries. This week Jia Yueting announced that LeTV would complete A-round financing by the end of the year to fund its vehicle projects housed under LeAuto. The funding will be used for mass production of electric vehicles. Jia Yeating stepped down recently as General Manager at LeTV and took a board position at LeAuto and FF Global. Faraday Future also clawed back some reputation this week as the FF91 prototype set a new production vehicle record at Pikes Peak.The FF91s time of 11 minutes 25.083 seconds record was 20 seconds faster than the previous record set by a modified Tesla Model S. Should the funding fails it will most probably be the end of the projects as LeTV has racked up large debts already resulting in large-scale layoffs and halting of projects.

The Korean auto manufacturer, Ssangyong, 72.85% owned by Indian conglomerate Mahindra and Mahindra announced that it will produce of an electric SUV by 2020. The SUV is to be assembled at the 250,000 unit plant in Pyeongtaek South Korea. and promises a range of 300km with a top speed of 150km/h. Ssangyong earmarked 1 trillion won ($1 billion) for the development of SUVs and EVs over the next four years. The parent Mahindra & Mahindra will support the development with funds and technical assistance.

The international promotion of electric vehicles got another leg up this week with the Governments of Thailand and New Zealand announcing incentives to promote the adoption of electric vehicles.

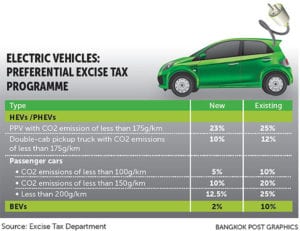

The Thai government set preferential excise duties for electric vehicles as depicted in the slide by the Tax Authority below. Electric Vehicles is one of 10 target industries in Thailand, which is an international auto manufacturing hub. The preferential rates will apply through 2025 and will extend to include EVs and ten EV parts. The ten EV components to benefit from the incentive are batteries, traction motors, battery management services, DC/DC converters, inverters, portable electric vehicle chargers, electrical circuit breakers and EV smart charging systems according to the Bangkok Post.

The New Zealand legislature passed the Energy Innovation Amendment Bill to implement sections of the New Zealand Governments Electric Vehicles Program amongst other changes. The amendment comes at a time when New Zealand EV sales for May 2017 smashed records. The amendments make provision for the exemption of EVs from road charges and enabling bylaws allowing special lanes for EVs.

In related news, the US state of Nevada passed Assembly Bill 69 which authorizes the testing of autonomous vehicles on its public roads. Nevada joins an ever increasing list of States allowing for the testing of self-driving cars on public roads. States that already allows for the testing on public roads include Texas, California, Michigan and New York.

Be sure to check out our new presentation of all EVs since 2010 to gain great insights on all auto brands and their electric vehicle strategies. We have also created presentations per technology type BEV, PHEV, Autonomous, and FCEV.

Beijing Automotive Industry Holding Co. Ltd (BAIC) is 60% owned by the Chinese Government. BAIC spun its electric vehicle business into a separate unit, Beijing Electric Vehicle Company (BJEV). The company raised $460mln in and IPO for its Electric Vehicle unit, drawing investors such as LE Holdings, the Chinese company with ties to Faraday Future and LeAuto. The BJEV factory is situated in Caiyu, Daxing, Beijing. The vehicle bodies are welded in Zhuzhou Hunan province. BJEV has launched its new range of EV’s, called Arcfox. BJEV unveiled its first concept vehicles for the Arcfox sub-brand in 2016 which comprised of the tiny open top SUV, the Arcfox-1 and the performance model the Arcfox-7 which is based on the Formula E platform of the NextEV Racing team.

BAIC was founded in September 2010 and tried to acquire the intellectual property rights of GM unit, SAAB Automobile’s in 2009 for $200m but failed. The German company, Daimler AG, acquired a 12% shareholding in BAIC during November 2013. BAIC produces some of the best-selling electric vehicles in the country, the E150/160/200 series, the EU260, and EC180 which is the top seller for 2017. The Daimler influence is clear in the design of the new BAIC EU260 model, which looks similar to the Mercedes C series.

BAIC BJEV was one of the first automakers to qualify for an electric vehicle production certificate from the Chinese Government in 2016 as part of the Chinese New Energy Vehicle Program to regulate the EV sector.

BAIC BJEV is now in its third generation of EV technology and is the best-selling electric vehicle auto company in China. The company announced an aggressive five-year plan in 2016 whereby it aims to sell 500,000 per annum by 2020. At the end of 2015, the company was the fourth largest EV manufacturer in the world and has since improved its performance with a 156% jump in sales in 2016, putting it ahead of BYD. The company is planning the launch of the Arcfox 1 in 2017 followed by other pure electric models the BAIC Senova EX260 SUV and BAIC EH300. 2018 will see the release of BAIC EH300L SUV EV and EX400L SUV.

Click through to the BAIC’s page on wattEV2Buy to explore the past, present and future EV models by the Chinese automaker.

Be sure to check out our new presentation of all EVs since 2010 to gain great insights on all auto brands and their electric vehicle strategies. We have also created presentations per technology type BEV, PHEV, Autonomous, and FCEV.

Stay tuned to wattEV2buy and follow the rest of our weekly series on Chinese EV brands.

The page you requested could not be found. Try refining your search, or use the navigation above to locate the post.

GoTo Traum EV Models to see the latest models, news, and sales.

The latest auto brand coming from China, Traum Auto from the Zotye stable, was officially launched on the 27th of June 2017. The company is registered as Traum New Energy Automobile and will be headquartered in Hebei Province. The new Chinese auto brand will use Zotye’s Chongqing plant for its vehicle production. Traum is the German word for “Dream” and judging from the pace of growth in the Chinese auto sector the Chinese Dream is to have a vehicle, more particularly an SUV.

The new Zotye brand is focussed on the aspirational youth segment in the fast-growing Chinese economy. Most automakers globally struggle to attract the younger generation to show interest in owning vehicles as mobility trends change. In the USA only around 20% of the youth in a 2012 survey showed any interest at all in getting a drivers license. In the Japan Toyota discontinuing its youth brand Scion at the end of 2016.

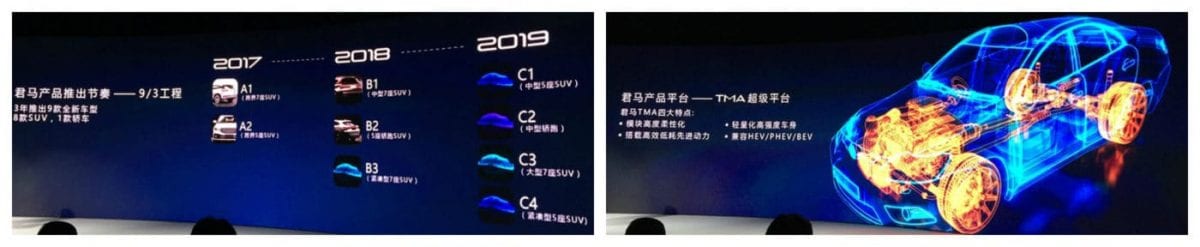

Traum Auto, very much like another newcomer Yudo Auto, is zooming in on the SUV segment as it plans to release eight SUVs in the next three years and only one sedan or hatch vehicle. Other than Yudo which will only produce electric vehicles, Traum will produce vehicles with an original design and advanced power plants over the whole spectrum of HYBRID, PHEV and BEV technologies leveraging on Zotye’s knowhow. The company targets efficiencies for its hybrid vehicles of 4liter/100km and plug-in hybrids of 2l/100km and BEV with a range of 550km (340 miles).

Traum Auto aims to develop connected car’s packed with the latest technologies and will kick off with a five and seven seater SUV as early as November this year.

Being in step with its target market Traum Auto will use new sales channels to distribute its vehicles. China has embraced e-commerce and other Chinese automakers such as Geely has already switched to online delivery channels away from the physical dealership model. China’s most popular city EV, the Geely Zhi Dou D2 EV is sold exclusively through experience centers, Geely’s Tmall.com store and new energy vehicle online platform Diandong.com. Traum Auto will, however, must have some physical presence close to its clients as it is still tied to regular servicing of combustion engines.

Traum Auto has named Song Jia as its CEO and gained the skills of Benedek Toth as its designer. Benedek Toth worked as Senior Designer at Mercedes-Benz’s RDNA Advanced Design in California. Do you see the Mercedes connection in the Traum models rendered below? We would love to hear your thoughts in the comment section.

Pictures: autoreview.ru

Be sure to check out our new presentation of all EVs since 2010 to gain great insights on all auto brands and their electric vehicle strategies. We have also created presentations per technology type BEV, PHEV, and FCEV.

Interested in learning more about Chinese electric vehicles? Download our fun and easy app below, flick the China switch and swipe left the models you don’t like, right the ones you do, enter the chat rooms and share your thoughts with the community.

Tesla is aggressively targeting Asia for expansion. Last week we reported on Elon Musk’s tweet about the US company’s efforts to enter the Indian market. Musk in his TED interview in May eluded to Tesla pursuing the signing of up to five Giga factories by year-end. Rumors that Tesla will establish a factory with the Shanghai Municipality was quashed byAutomation Instrumentation company, Shanghai Lingang Holdings Ltd. The company denied any contact with Tesla related to a China-based factory as the news created a spike in the Chinese company’s share price. Tesla in the meantime responded with the following press statement:

“in order to better serve the China market, Tesla is exploring the possibility of establishing a Chinese manufacturing plant with the Shanghai municipal government. Based on the previous communication, by the end of this year, the localization plan will be more clear. Tesla has been committed to cultivating China market. At the same time, in order to better serve the market all over the world, we are constantly assessing the potential factory location in the global area. Although we expect that most of the production will be completed in the United States, we need to set up factories overseas to ensure more local consumers can afford our products.”

Tesla is looking to establish local production in world’s largest market for electric vehicles to escape the 25% import duty on its models. Tesla also this week began delivering the Model S 90D in South Korea announced the launch of the Model X in Indonesia.

Other Tesla headlines this week saw the announcement of the start of the production of the Model 3 battery cells and the resignation of its Autopilot Head, Chris Lattner. Chris Lattner joined the company barely six months ago. Both Chris and the Tesla cited that he did not fit the company’s culture.

SAIC, the state-owned top four Chinese auto manufacturer and CATL, top lithium battery manufacturer, this week established two joint venture companies in a bid to challenge Tesla’s dominance in the EV and Battery sectors. CATL and SAIC will play to their strengths in the separate JVs with CATL focusing on battery technology and SAIC on drive train development.

In a similar vein, BYD, the top selling EV manufacturer in China for two years running has spun its battery division into a separate entity allowing it sell batteries to other Chinese and international auto manufacturers.

Ford this week publicly presented its autonomous Ford Fusion Hybrid we reported on at the end of last year. The self-driving Fusion was put through its paces at the University of Michigan where it successfully navigated daily traffic conditions at a top speed of 25mph.

The French PSA Group announced that it plans to have a Level 3 self-driving vehicle by 2020 and introduce semi-autonomous DS 7 Crossback next year. The PSA systems are called ‘Traffic Jam Chauffeur’ and ‘Highway Chauffeur’.

Audi started testing Level 3 autonomous vehicles in New York. Audi calls the technology ‘Audi Highway Pilot’.

Texas signed a bill authorizing testing of self-driving cars on public roads.

French self-driving manufacturer Navya announced the establishment of a US-based plant in Michigan and aims for the start of production by the end of the year.

Two VW Group companies this week confirmed the production of exciting concept vehicles introduced recently.

Audi announced that it will start producing the Audi e-tron Sportback EV at its Brussels plant from 2019 while VW’s Chairman, Dr. Herbert Diess confirmed that it will produce a version of the of the I.D. Buzz unveiled last year. The I.D. Buzz will join the I.D. Crozz in production and compete with Tesla‘s expected Type II people carrier.

This week was another bumper week for the EV sector as two new EV-specific brands were created alongside the usual flood of new ZEV models we are now getting used to.

Volvo created a high-performance electric vehicle company by rebranding its Polestar High-Performance Division. Volvo teased the new logo and announced the new management, under the leadership of its Design VP, Thomas Ingenlath, now Polestars CEO. Polestar will continue its engineering work under its old logo but will turn the sub-brand into an electrified global high-performance car company with the new branding.

Chongqing Sokon, one of the 15 Chinese companies with EV production certificates and owner of US based AC Propulsion this week acquired US AM General’s auto assets for $110 million. The acquisition includes the Hummer plant in Indiana and will be housed within its USA unit, SF Motors. Sokon has made a number of aggressive moves the last 12 months, including the signing of Tesla co-founder Martin Eberhard but so far has not made any clear indication of how all these actions will translate into a strategy.

CHJ Automotive announced during a Round A capital raising that it will create a new vehicle category for city application by bringing an ultra- compact two-seat EV to market in 2018 from its plant in Changzhou, Jiangsu province.

Zotye announced that its sixth and latest production facility, completed recently in Chongqing, will produce an electric SUV, the M12 or Zotye T300E as well as a PHEV MPV the seven seat B40.

Hyundai announced this week that it will produce 3,600 units of its Future Eco (FE) FCEV model.

Renault launched the upgrade to its MPV, the Kangoo Z.E EV. The new Kangoo has a 50% improvement in range from its 33kWh battery, allowing it to achieve a NEDS range of 270km (170miles).

Thunder Power Holdings is a Hong Kong-based start-up hailing from Taiwan. The brand was officially launched on two occasions. The Asia Pacific brand launch was at the end of March 2017 in Hong Kong and included the signing of an agreement with the Catalan Government for the company’s European expansion. The second launch, this time for Mainland China, was held on the 23rd and 31st of May 2017 in Beijing and Shanghai.

Thunder Power have been developing EVs from 2011 and introduced its first concept vehicles, the Thunder Power Racer and Sedan in 2015 at the Frankfurt Auto Show. Production of Thunder Power electric cars is anticipated for 2018 at its assembly plant in Guangzhou, Guangdong Province China. A 10,000 sq.m prototype manufacturing facility has already been completed in the first half of 2017 on the company’s 165-acre site. When completed the plant will have a capacity of 100,000 units per annum. The plant is a joint venture with the Guangzhou municipal investment fund, the GanNan Fund. The investment from the fund is around 2.5 billion yuan and is expected to drive a total investment of 7.5 billion yuan.

The Thunder Power EV strategy is to be a global player and includes a second plant in Catalonia, Spain, where it has already opened an R&D Center for an investment of €80 million. The plant is expected to be constructed to be ready for production by 2019.

Thunder Power won two awards for design at the 2016 Mondial de l’Automobile in Paris, albeit only for its logo and stand design.

Thunder Power’s first production EV is based on its Sedan Concept. The top-end sedan, designed by Dallara in Italy, will have a range of 650km from a 125kWh battery. The entry level sedan will start with an 85kWh battery and 200kW electric motor. The 320kWh Racer has a top speed of 240km/h. Thunder Power uses NMC (Nickel Manganese Cobalt) chemistry for its battery packs.

Thunder Power has opened orders for the sedan on its website. The Sedan is priced at around $72,000 (490,000 yuan).

Click through to the Thunder Power’s page on wattEV2Buy to explore the past, present and future EV models by the Chinese automaker.

Stay tuned to wattEV2buy and follow the rest of our weekly series on Chinese EV brands.

Bloomberg released an unconfirmed report on Tuesday that the Chinese Government would place a moratorium on the release of EV production certificates as the country tries to manage the sustainability of the sector. Although the report remained unconfirmed at the time of going to press shares of automakers with issued permits rallied on the news.

In 2016 the Chinese Government announced that it would limit the number of EVs produced by regulating the sector through the issue of production certificates. The National Development and Reform Commission (NDRC), a body that oversees investments in the centrally managed economy, announced that only ten permits would be issued to produce EVs. At the time a much as 200 companies, including 30 IT companies, had business plans to profit from the government’s program to promote electric vehicles. It was estimated that the anticipated production would far exceed 50 million units per year. The Government further feared that the rush of newcomers to the industry would lead to inferior products harming the sustainability of its strategy to dominate the EV sector.

In May 2017 I published an article on the permitting process and the products and strategies of companies with issued production certificates. At the time Shenzhen GreenWheel received the 14th permit, allowing the company to produce 50,000 per annum. Since then a 15th permit, possibly the last for the foreseeable future, was issued to the newly formed JAC/VW joint venture, granting a production certificate of 100,000 per annum.

The Chinese Government targets to add 2 million new energy vehicles to the national fleet per annum by 2020. In 2016 the country sold more than 500,000 taking the total of EVs on the country’s roads to over 800,000 units. Should the report hold true, it leaves the question what would happen to the business plans of companies such as LeEco and NextEV with much-publicised intentions to develop electric vehicles. As recent as February this year LeEco was forging ahead with breaking ground on its 200,000 plant in Deqing, Zhejiang Province, a $1.8 billion project. NextEV made big strides in electric and autonomous vehicle technology through its NIO brand, breaking production records and setting the first autonomous lap record in the process with its NIO EP9 sports car. The moratorium could very well be for a short while until the Chinese EV sectors show signs of recovering from its recent slump. The Chinese EV sector which showed double digit growth until 2016 grew only 7% for the year to date in 2017. If the moratorium is expected to last longer, the incumbents might look at approaching other countries to assist them in developing EV plants.

Click for a list of the Chinese automakers with EV production certificates and their models.

Honda released its mid-term strategy, Vision 2030, this week as the company plays catch-up to the rest of the market as most of the Japanese automaker’s competitors have already formulated strategies for autonomous and electric vehicles through 2025. Like most of its peers in Japan and Korea, Honda placed its bets on hydrogen fuel cell vehicles, losing valuable runway on the electric vehicle trajectory that most of the sector now find themselves on.

Reuters quoted CEO, Takahiro Hachigo “We’re going to place utmost priority on electrification and advanced safety technologies going forward,” as Honda acknowledged it must look beyond conventional cars to survive. The company targets to have new energy vehicles contribute two-thirds of its model range by 2030, up from 5% currently. Honda has employed nearly $7 billion in R&D spend by March 2018 to support its strategy.

The company further announced that it would unveil a model based on its new independently designed EV platform in the 3rd quarter of 2017. The company will also start selling the Honda Clarity EV in the USA for around $35,000 in the second half of 2017. Unfortunately, the expectations for the Honda Clarity to fail is high as it only has a range of 80 miles per charge, competing with the 2010 Nissan Leaf in 2018.

Henry Fisker, the EV pioneer behind “Tesla killed” (as opposed to Tesla killer) Fisker Karma this week, unveiled the design specification for its 2019 production vehicle the Fisker EMotion. The Fisker EMotion is expected to have a range of 400miles and a top speed of 161mph. The vehicle employs proprietary charging technology, the UltraCharger, that charges 100miles in 9 minutes. The vehicle is equipped with LIDAR autonomous hardware. Fisker will employ the same direct sales strategy as Tesla and service through “The Hybrid Shop,” an initiative with THS. THS is a specialty EV servicing company with 36 service centers in North America, targeting 400 globally by 2019. The company will release more information during the month of June and pre-ordering will open from June the 30th.

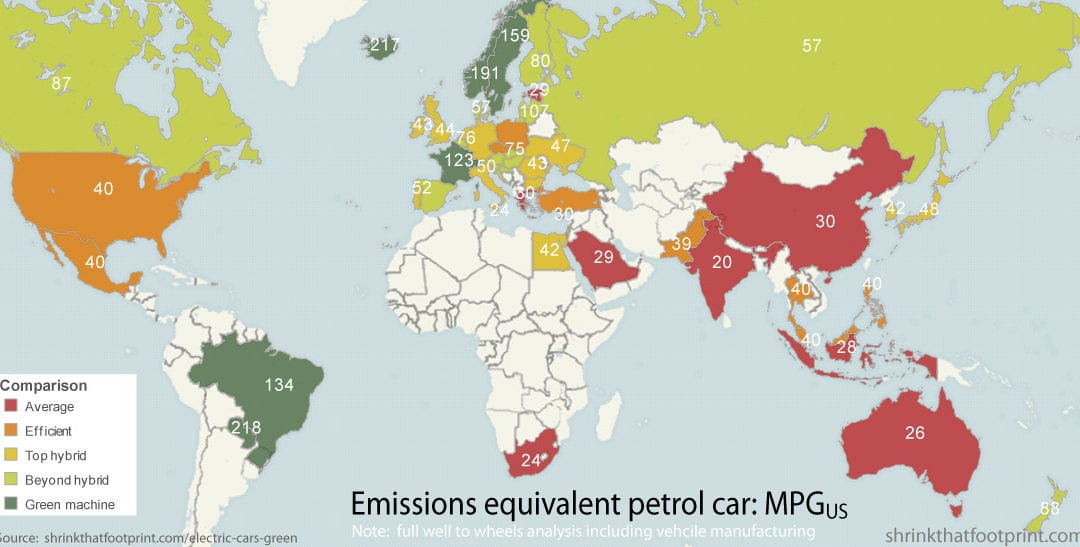

Longtime Nissan Chairman, Carlos Ghosn, this week commented that he does not see electric vehicle adoption equal to that of other nations soon. The Australian Governments lack of support for the sector has received widespread criticism from the auto sector recently. Mr. Ghosn was quoted by Australian publication, Drive, saying “The subsidies are important to jump-start the technology and help the technology reach a new level. I understand that your government is going to issue a new policy. I will be waiting [to see] what are the components of this policy.” Earlier this year Nissan Australia CEO Richard Emery lashed out at the Australian government over a lack of support for the EV sector, describing his dealings with the industry as ‘amateur hour.’

Other automakers have shared the same sentiment, this week BMW country chief, Mark Werner, according to Car Advice said at the launch of the plug-in hybrid 530e iPerformance that the government has “stuck their collective heads in the sand.” “Our government is so far behind in their view of climate change,” he said. “Australia has shocking emissions levels. Worse than what we would call non-industrialised or third-world countries.”

EV sales in Australia totaled less than a 1,000 vehicles in 2016, while the smaller neighbor, New Zealand sold close to 1,500 in the same period.

Mahindra Racing took two podium positions in the 7th race of the third season of the Formula E series held in Berlin on Saturday the 10th of June. The Mahindra team stands a very good chance to end 2nd in the series with five races remaining as it lies only 17 points behind the second place Audi team. Multi-season winner, Renault had an unfortunate race, with its ace Sebastian Buemi being disqualified due to a tire pressure infringement. Mahindra has been very consistent over the season with some podium finishes but has never been able to clinch the top position. The 8th race will be held today and bodes to be an exciting spectacle.

The relatively young GAC Motors is one of China’s best-respected vehicle brands. The company has a defined EV strategy and will add three models to its EV fleet in 2017.

Guangzhou Automobile Group Co, Ltd. founded in 2005 has various Joint Ventures with large international auto manufacturers such as Toyota, Hino, and Honda. Wanxiang Group, a large auto-parts manufacturer, and owner of Karma Automotive, previously known as Fisker Automotive, is one of the founding shareholders.

GAC MOTOR established its New Energy division at the end of 2015. The division focused on developing its R&D and production to penetrate the growing Chinese market for EV’s. The New Energy strategy is supported by GAC Group’s “1513” new-energy development strategy which makes the development of an R & D platform, R & D of core technologies a key development direction for its products.

GAC has international ambitions and aims to establish sales and service networks in 14 countries, including North America, Africa, South and Eastern Europe and South East Asia. GAC has reaped the rewards of creating a world-class vehicle brand and sold more than 380,000 vehicles in 2016, compared to around 194,000 the previous year, and has achieved 80 percent compound annual growth rate from 2011 to 2016. The company expects to sell 500,000 cars in 2017 and plans to produce 1 million cars in 2020. The Group targets 200,000 new energy vehicles in 2020 and meeting fuel consumption targets of 5.0L/100Km over its model range. In 2016 GAC Trumpchi delivered a total of 3,378 units of its GA5 PHEV model, an increase of 167% on 2015.

To support its strategy, Guangzhou Automobile Group passed two resolutions impacting EV development at its Board of Directors meeting on June 5th, 2017.

GAC Motors are also pursuing other electric mobility solutions. In February 2016, Guangzhou Lixin Taxi Company owned by GAC Access launched more than 200 Levin twin-engine HEVs into Guangzhou taxi market. Also, GAC Group fully mobilizes the creativity of various business sectors and is actively devoted to new energy and energy conservation and environmental protection. GAC Motors and BYD established a JV in 2015 to co-operate in EV development. As a result, the company launched 400 pure electric buses produced by GAC BYD New Energy Bus Co., Ltd. into Guangzhou public transport system to provide services for citizens. The JV company is 51% owned by GAC and has a registered capital of 300m RMB.

Click through to the GAC Motors page on wattEV2Buy to explore the past, present and future EV models by the Chinese automaker.

Stay tuned to wattEV2buy and follow the rest of our weekly series on Chinese EV brands.

The page you requested could not be found. Try refining your search, or use the navigation above to locate the post.

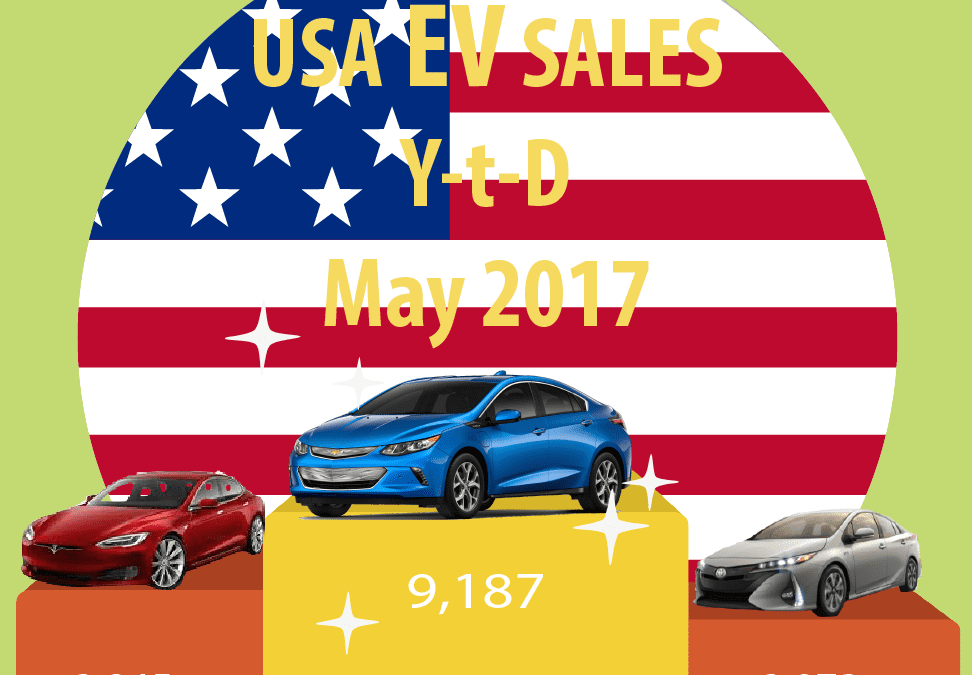

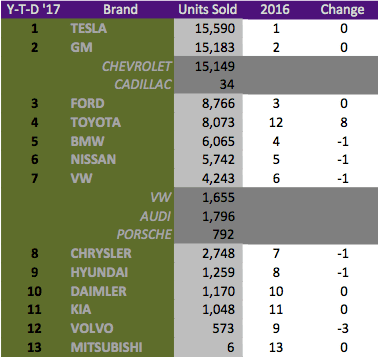

EV sales in the USA are up 43% Year-to-Date after sales in May resulted in it being the second best month for electric cars for the year  so far. May 2017 sales outperformed May 2016 with a 46% increase. The tussle between BEVs and PHEVs is to close to call as pure electric vehicles continue giving ground on the lead at had over PHEVs, with PHEVs outselling BEVs in May with 8,325 units vs. 8,243 pure electric vehicles which include the BMW i3 REx.

so far. May 2017 sales outperformed May 2016 with a 46% increase. The tussle between BEVs and PHEVs is to close to call as pure electric vehicles continue giving ground on the lead at had over PHEVs, with PHEVs outselling BEVs in May with 8,325 units vs. 8,243 pure electric vehicles which include the BMW i3 REx.

The best performing electric vehicle for the month was the Toyota Prius, dethroning the Chevrolet Bolt for the first time this year. The Tesla Model S also dropped out of the top 3, a rare occurrence, making way for its sibling, the Tesla Model X. The Hyundai Ionic and Chrysler Pacifica both climbed five or more positions for the year, with the Chevrolet Bolt increased its units sold with 21% on April but remaining in the 5th place overall for the year. The big losers for May 2017 were the Mercedes C350e, Audi A3 e-tron, and Ford Focus Electric.

The Top 3 brands remained the same as this time last year with Tesla, Chevrolet and Ford taking the top three positions. The rest of the brands had to make way for the rise of Toyota, taking the 4th place. Volvo gave up the most ground, falling from 9th to 12th spot.

Toyota confirmed this weekend that it divested from Tesla as it exited the co-operating agreement the companies had on electric vehicle technology. Toyota acquired 3.15% in Tesla in 2010 for $40.5 million, a stake which would have been worth $1.75 billion at Friday’s close. According to the Japan Times Toyota announced that the sale of the stake, which happened in trances between October 2014 and the end of 2016, is “a part of a regular review of business alliances.” The partnership resulted in the development of an electric Toyota RAV 4, which was abandoned as the company changed course away from EVs to hydrogen fuel cell technologies.

The Indian Government’s Department of Energy posted a blog in which it reiterates its ambition to only sell EVs by 2030 through its National Electric Mobility Mission Plan on which we reported on in Week 17. The Government’s plan set a target of between 6 and 7 million units by 2020 already, which seems overly ambitious as EV sales have yet to pick-up in the country. One if its largest automakers Mahindra and Mahindra last week announced that it only now plans to increase its battery production capacity from 500 units to 5,000 a month, a far cry from what should be needed if it wants to produce its fair share of 6 million units. The blog sees that EVs will reach parity with ICE vehicles by 2022. Bloomberg New Energy Finance in a report last week saw this only happening in 2025. Automakers such as Mahindra is reluctant to overly invest in EV manufacturing infrastructure while the prices of ICE cars remain cheaper than EVs in a country where the consumer is very price sensitive. The Indian Government is yet to definitively announce what financial contribution it will make towards achieving the goals, other than saying it acknowledges that it will need to carry the industry for the first three years.

Chinese Premier, Li Keqiang, and German Chancellor, Angela Merkel met on Thursday to discuss various trade issues between the two countries, amongst others the impact of the China’s ZEV-like quota on German automaker’s expansion plans in the Asian country. The Chinese Government proposed that car manufacturer had to achieve a level of 8% EV sales by 2018. Although not confirmed Reuters on Friday reported that the Chinese Government agreed to delay the quota to 2019 for German companies but that they should ramp up EV deliveries at a later date.

As the electric vehicle sales in neighboring Norway climbed 30% year-on-year for the month of May the CEO of Russia’s largest oil company, Rosneft PJSC, Igor Sechin denounced EVs as overrated. Mr. Sechin was quoted by Bloomberg during a speech at the St.Petersburg International Economic Forum saying Tesla is overvalued and EVs are “not as popular as had been expected” in Europe’s biggest economies. Mr. Sechin went further saying “The market’s assessment of the prospects of electric car producers, in our view, is significantly overestimated,” and that “Until the electric transport industry becomes as user-friendly and attractive for consumers as the cars with internal combustion engines, the prospects for electric vehicles remain largely uncertain.” Rosneft that had 2015 revenues of nearly $100 billion market value was clipped by that of Tesla at the end of May 2017. Tesla shares were up nearly 60% for the year while Rosneft was down 20%.

We acknowledge Donald Trump leaving the Paris Climate Pact but took a decision to rather report on other EV related stories of the week.

Interested in learning more about Chinese electric vehicles? Download our fun and easy app below, flick the China switch and swipe left the models you don’t like, right the ones you do, enter the chat rooms and share your thoughts with the community.

On the 1st of June 2017, VW and JAC signed a joint venture agreement to develop mass market electric vehicles in China. The agreement received the political support of both the German and Chinese Governments as it was signed in the presence of Chancellor Angela Merkel and Chinese Premier Li Keqiang. Although the agreement was negotiated over a period of time it is significant that it was signed on the same day that Donald Trump took the USA out of the climate accord agreed in Paris 2015 in a move alienating the USA from the rest of the world.

VW and JAC will each hold 50% in the JV enterprise to develop, produce and market electric vehicles and mobility services with a key focus on mass market EVs over a 25 year period. The JV has already received a production certificate for 100,000 units last week as required by new Chinese regulations created in 2016 to regulate the EV sector. The value of the prospective 100,000 unit plant is set at $740million. VW has been operating in China since 1984 through partnerships with FAW, SAIC, and JAC and plans to deliver 400,000 electric vehicles to the Chinese market in 2020 and 1.5 million electric vehicles in 2025 as part of its electric vehicle strategy, named “TOGETHER – Strategy 2025”. It is planned that the new joint venture with JAC should produce its first jointly developed electric vehicle in 2018. The terms of the partnership according to a VW press release is as follows:

The agreement provides for the construction of a further factory as well as a research and development center. The joint venture also includes the development and production of components for new energy vehicles (NEV), the development of vehicle connectivity and automotive data services. In addition, it is intended that the joint venture should establish new used vehicle platforms and engage in all related business activities.

JAC Motors, China’s 10th largest auto manufacturer is a state-owned enterprise officially know as Anhui Jianghuai Automobile Co. Ltd and situated in Hefei, Anhui Province, close the larger Chery Auto. JAC Motors crafted its strategy for the electric vehicle segment, named “The Pure Electric Vehicle Development Plan” in 2002, making JAC an early mover in China and one of the most popular brands. In 2012 the company held the Top 1 position in China and thereby gaining the Top 3 place globally. At 2016 the company sold 22,000 new energy vehicles, bolstering it to showcase the largest range of electric vehicles at the Beijing Auto Show in 2015. JAC has also recently partnered with Carlos Sim to build vehicles in Mexico, taking advantage from Donald Trumps isolating policies there.

Interested in learning more about Chinese electric vehicles? Download our fun and easy app below, flick the China switch and swipe left the models you don’t like, right the ones you do, enter the chat rooms and share your thoughts with the community.

In June 2016 the Chinese authorities embarked on a program to regulate the industry that saw over 200 companies planning to produce over 50 million cars a year. Initially, the Chinese Government announced that it would only provide ten manufacturers with permits to produce electric vehicles in a bid to ensure quality and reliability to the consumer. A year later, at the end of May 2017, 14 new energy vehicle manufacturers were awarded production certificates to develop electric vehicles, with no indication what the new limit on participants is. China leads the world in terms of the size of the electric vehicle market; one would expect that it would lead to the creation of great looking automobiles, the opposite has been the norm.

China’s electric car sector is known for its ugly models, most are either bad clones of other brands, such as the Tesla Model S clone the Youxia Ranger X, or old body types of Japanese or European models with a battery thrown in, such as the 2012 Suzuki SX4 rebadged as the 2017 SD EV Yinse. Currently, most Chinese vehicle manufacturers are bringing mid-to-low end models to production, competing with Western models such as the Tesla Model 3, Chevrolet Bolt, Renault Zoe and the Nissan Leaf. A couple of Chinese manufacturers are following the Tesla model of starting with a luxury sedan or sports car and will, therefore, compete with the likes of the Rimac Concept One, Tesla Modle S or Porsche Mission-E.

Many Chinese automakers have addressed design challenges by opening design centers in Europe, mostly in Italy, world-renowned for design, especially automotive design. Some Chinese automakers own established Western brands such as Geely owning Volvo, SAIC Roewe buying MG, NEVS buying SAAB and Wanxiang buying Karma Automotive. One might, therefore, be forgiven to expect that world-class design principles would find its way into Chinese electric vehicle production. Unfortunately, the fusion between Western and Chinese design has yet to deliver eye-catching electric vehicles.

With the greater oversight, one would have hoped to be wowed with only the best electric vehicles rising to the top and receiving the coveted production permits. Let’s look at the current Chinese automakers that have been granted production certificates and see what the Chinese consumer and the rest of the world can expect.

The Chinese Government owned BAIC is one of the top-selling EV brands in China and is now into its second generation EV design with the BAIC E200, BAIC EC180, and BAIC EU260. BAIC has also created a stand-alone company for electric vehicles, BJEV and is expected to bring a new brand to light, called Arcfox. Unfortunately, BAIC’s design still looks very much like copies of other brands, take for instance the BAIC EU260 which looks very much like an older Mercedes C-Series.

Changjiang EV produces the eCool EV, also know as the FDG Yangtze EV. The company classifies the eCool as a mini-SIV, but in all honesty, it looks more like a hatchback. The eCool comes with 10-inch multi-touch HD screen providing an onboard interconnected experience and a mobile terminal. The vehicle achieved a 4-star C-NCAP measured at 50km/h impact. The hatchback comes in various funky colors, and customers can personalize their dash and seat covers, not that is does anything for the general look of the EV.

CH-Auto Technology founded in 2010, the Chinese electric vehicle manufacturer branded as Qiantu Qiche (前途汽车), meaning Future Auto in 2015. Qiantu aims to compete head-on with Tesla and unveiled the Qiantu K50 Event! as the first model in its arsenal to do so ( for all the language buffs, the ! is not a typo but part of the name). The K50 Event! is one of the more appealing Chinese EVs.

Chery Auto was honored with “Best Globalization Strategy for the year 2015” among Chinese Vehicle manufacturers. Chery is a leader in the EV sector with one of the first production cars as far back as 2008.The Chery QQ, first produced in 2015, remains one of the top 10 models in China. The QQ might be popular, but it is certainly not for its looks.

The company was founded in 2011 and opened the Jiangsu MIN’AN Automotive Research Institute in October 2015 where it develops its new energy vehicles. Min’an Auto is set to unveil its first EV in 2018. Min’an has the intent to develop three models in 2018, an SUV, rendered below, a sports car and a neighborhood electric (NEV) delivery van. Min’an suffers from the same classification issues as Changjiang EV, trying to sell a hatchback as an SUV.

Owned by Chinese auto parts company Wanxiang Group, who bought the remnants of Fisker Automotive in 2013. The company aims to manufacturer 900 Karma Revero’s in 2017. Waxiang Group was one of the first automakers to receive a production certificate allowing it to produce electric vehicles in 2016. The Karma Revero teaser below was released late 2016 and does not look a lot different than the Fisker Karma of 2012.

JMC created a new company to house its electric vehicle unit under in early 2015. The plant situated in Nanchang City has a planned production capacity of 70,000 units per year by 2020. JMC EV is planning to follow up on its first electric vehicle the E100 EV with four new models, the E200, E160, S330 SUV PHEV and E170. Th JMC E100 is one of the top 20 sellers in China. Both the E100 and E200 looks quite similar and follows the same boring lines as most of the small electric vehicles such as the Chery QQ and BAIC EC180.

The Sokon owned company received its production certificate early 2017 which allows the company to produce 50,000 EVs annually. The company has not unveiled any vehicles but have secured Tesla Co-founder, Martin Eberhard, as a consultant and acquired US-based AC Propulsion at the end of 2016. Sokon developed small commercial vehicles in partnership with Dongfeng.

National Electric Vehicles Sweden (NEVS), a Chinese-owned company, acquired the SAAB brand from bankruptcy in 2012. The company received a production permit for 200,000 units annually. The company has already signed an agreement to supply 20,000 SAAB 9-3 to Chinese Aerospace entity, Volinco. Disappointingly it seems that consumers will have to be content with getting another relic from the past as an option when it comes to buying a new EV in China.

Yudo Auto electric vehicles strategy is to produce affordable pure electric SUVs and aims to be a first-class brand in 5 years and international presence in 10 years. Yudo chose the words “creating for change” as its tagline and opened a Design Center in Milan, Italy. The company unveiled two small SUVs at the Shanghai Auto Show in April 2017 as part of its Gemini strategy. The Yudo Pi1 base model looks like a bad knockoff of the VW Tiguan, and the flagship Yudo Pi3 reminds of a Landrover Freelander of the 90’s. Let’s hope there is more “creating for change” down the line.

Know Beans (Zhi Dou), a Geely company, and yes that’s the brand’s name, develops the popular ZD D2 mini-car which is also sold under the Zotye label as the Zotye E20. The D2, produced since 205, is also a top 20 electric vehicle in China. You just know, when you look at the D2, that it hails from China. I don’t know what is worse, the brand name or the vehicle, enough said.

Henan Suda EV, also know as SD EV received permission to develop a 100,000 EV plant. SD EV offers one of this ‘Back to the Future’ opportunities, where you can buy a vehicle from 2012 as a brand new model in 2017. SD EV has two EV models ready for production. The vehicles are based on Suzuki SX4 sedan and hatch. The word Suda means to ‘Speed Up’ in Chinese while the Henan refers to the company’s home province.

Hozon received an electric vehicle production certificate allowing it to produce 50,000 units per annum. Hozon unveiled its first concept vehicle, a compact crossover named @, at the 3rd World Internet Conference in November 2016. The Hozon logo looks surprisingly similar than that of Mercedes, and the rendering of the marketing material looks like that of an old generation Buick Lacrosse, while the @ like a Tesla Model X.

GreenWheel received approval to develop a 50,000 unit plant. The company is better known for developing Neighborhood Electric Vehicles (NEV). Now that GreenWheel has qualified for EV production it aims to start production of the small crossover, named the V5, which is an electric version of the Weichai Enranger G3.

JAC and VW entered into a JV to produce 100,000 EVs per annum in May 2017 and became the 15th and last company to receive a permit in this round of permitting.

For too long the stereotype Chinese manufacturer has been known for copying rather than innovating. It is therefore disappointing to see that most of the authorized EV producers are still developing cars based on old combustion vehicles. The failure of the permitting process to identify and authorize truly innovative companies to ensure a sustainable and dominant Chinese EV sector will be negative for the whole EV sector, we need companies such as Tesla, testing the boundaries set by traditional auto manufacturers.

At the end of the day, beauty is in the eye of the beholder so I would love to hear your comments on the state of China’s electric vehicle design in the comment section below.

Interested in learning more about Chinese electric vehicles? Download our fun and easy app below, flick the China switch and swipe left the models you don’t like, right the ones you do, enter the chat rooms and share your thoughts with the community.

The page you requested could not be found. Try refining your search, or use the navigation above to locate the post.

Reports this week hinted that cost issues are driving BMW to depart from its dedicated EV brand strategy. BMW CEO, Harald Krueger last year set the German automaker’s strategy as follows:

“Our Strategy Number One Next is centred on consequent lightweight construction, alternative drivetrain technology, connectivity, autonomous driving functions and the interior of the future. The iNext will set the standard from 2021″

Only three weeks ago wattEV2Buy reported that the BMW AGM determined that it would start producing it iNext autonomous brand at its Dingolfing plant form 2021.

Unconfirmed online reports this week claimed that BMW would not pursue the development of the BMW i5 as its mass market answer to the Tesla Model 3, but rather follow other carmakers such as Hyundai and Citroën, by offering electric options across existing ranges so that customers can choose a gasoline model or an electric model.

The reason for the change of heart is that the cost associated with the specialized chassis systems of the i8 and i3 makes it unsuitable for high volume production. In March BMW’s reported its lowest profitability since 2010 on the back of spending on technologies to compete with its rivals in the electrification and autonomous sectors.

It seems BMW is struggling to communicate or find a definitive answer to present as its mass market EV solution. In March of 2017, the BMW CEO hinted that the Mini could be automakers mass market EV.

The following statement by Harald Kreuger this week, “The all-electric MINI and the all-electric BMW X3 will mark the beginning of the second wave of electrification for the BMW Group, benefiting from the ongoing technological progress we are making in this area.” is seen to support the reports that the company is having a rethink on its EV Next strategy.

BMW’s change of direction will set it on a different course than its competitor in the luxury car market, Daimler, which has set an aggressive strategy to develop a separate brand to establish a market lead in the e-mobility sector.

The BMW strategy now seems to focus on finding the least cost route of adding batteries to existing models to produce vehicles for consumer’s increasing appetite for electric cars. Adding batteries to combustion vehicles is seen as a cop-out as consumers will be better served by buying electric vehicles built from the ground up around the technology.

Indian based Mahindra and Mahindra this week shed some more clarity on how it aims to compete in the electric vehicle sector. The company announced that it would construct a battery plant in Chakan, Pune City in Maharashtra State which will increase the company’s battery output ten fold. Currently, the company produces only around 500 battery packs a month for its e2O, and eVerito models from imported cells at its Bengaluru plant, the Chakan plant has a target of 5,000 units a month. The Indian company is also developing a high powered electric vehicle platform available by 2019 that is capable of speeds up to 200km/h / 125mph and a range of 350 – 400km (250 miles). The Indian government has set a lofty goal of 100% electrification of the countries vehicle fleet by 2030, but to date, the technology has failed to get any traction that can compare with its peer, China.

US-based research firm Research and Markets this week released a report indicating that they see the EV charging infrastructure market should be valued at around $45 billion by 2025. A rush by governments to encourage the adoption of electric vehicles is seen as the main driver for the uptake of the technology. The research firm also reported on the adoption trends within the charging technology sector, stating that the CHAdeMO connectors would be replaced by Combined Charging System (CCS) as the preferred connector type. The fast charger segment is said to lead over slow or home-based chargers, showing an estimated CAGR of 47.9% from 2017 to 2025.

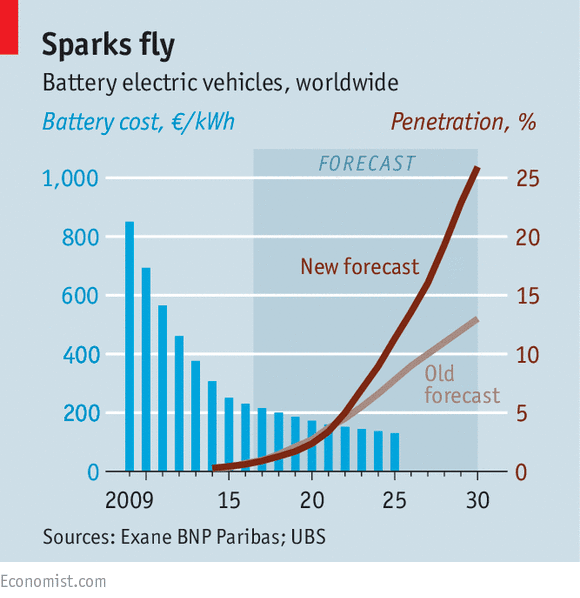

Research firm Bloomberg New Energy Finance (BNEF) this week reported that it expects EVs to reach price parity with internal combustion vehicles (ICE) in the USA and Europe by 2025. Falling battery prices driving down cost is seen as the main reason behind the conclusion. Currently, battery prices constitute around 50% of an EVs cost, by 2020 BNEF forecast batteries to only constitute between 23% and 16% of an electric car’s total cost by 2030. The report did not compare the total cost of ownership, which is expected to favor EVs this decade already. It is unclear if the study did take into consideration regional factors such as the EU adding as much as $340 per engine on diesel engines from 2020, which should increase the cost of combustion engines.

In March the UK based Detroit Electric signed a joint venture agreement with Shanghai-listed Far East Smarter Energy Group (Smarter Energy). The JV called for the Chinese partner to invest $370 million over a four-year period. Already the JV is experiencing stress as Smarter Energy this week announced that it would transfer 40% in Detroit Electric to Far East Holding Group (Holding) to secure financing. The transaction was done at no value. Smarter Energy revealed that the financing round is taking longer than anticipated and that it is struggling to secure the required production certificates from the Chinese Government to be allowed to produce electric vehicles. Up till May 2017, only fourteen such permits have been granted by the Chinese authorities. The remaining shareholding structure of the joint venture now has Detroit Electric owning 50% while Yixing Environmental Protection Science and Technology Industrial Park 10%. It is unclear how the restructuring will impact on the company’s timeline to bring the SP:01 to production by 2018.

Recently the Chinese Government embarked on a program to clean up the electric vehicle sector which has been negatively impacted a confluence of companies rushing to produce electric vehicles lead to subsidy fraud and sub-standard products. At some point in 2016 over 200 companies had business plans to profit from the Chinese Government’s aggressive program to establish a dominant electric vehicle sector. A large number of the business operating in the sector had no previous experience in producing cars, among them were IT and Social Media companies such as Tencent (Future Mobility and Tesla), Baidu / BitAuto (NextEV) and LeEco (Faraday Future). The Chinese authorities became concerned that the unregulated development of the sector could lead to an oversupply of vehicles as the total planned capacity from the 200 companies reached over 50 million units annually, ultimately negatively impacting the sustainability of its program. At the end of 2016, the government closed or fined various manufacturers who were caught taking advantage of the subsidies to promote the adoption of electric vehicles. Further measures to regulate the industry included:

Other adjustments were made to entry applications in the auto sector by requiring joint ventures with foreign automakers, such as Denza, to be approved by the investment department of the State Council, local manufacturers need approval from the relative provincial government. The State Council indicated that in principal new capacity to combustion plants should be capped effectively halting development of new combustion plants.

At the time of publication, only fourteen companies have so far received production certificates for new energy vehicles, the last being Guangdong GreenWheel Electric Vehicle Co. Ltd which received approval to develop a 50,000 unit plant in Mingcheng Industrial Park. Greenwheel indicated that the plant would be developed at a cost of $267 million ( RMB 1.783b ). To successfully apply for a production certificate, the applicant needs to convince the authorities that it can research and develop key technologies such as powertrains. The other companies with development certificates are BAIC BJEV, Changjiang EV, Qiantu Motor, Chery New Energy, Jiangsu Minan, Wanxiang Group (Karma Automotive), JMC EV, Chongqing Jinkang, NEVS, Yudo Auto, Know Beans, SD EV, and Hozon Auto.

Up to now Chinese auto manufacturers provided very sketchy specifications on the electric range of their models, mostly indicating how far the vehicle can travel at a constant speed of 60km/h. To protect and assist the consumer the Chinese Automotive Technology and Research Center for the first time introduced an EV Test through the issue of the Chinese First Electric Vehicle Management and Evaluation Rules. The first classification process should be completed in the second half of 2017. The classification would be done by a five-star rating focusing on the following key performance areas:

The Chinese Government aggressive EV strategy targets the sale of 800,000 electric vehicles in 2017, increasing sales to two million units per annum by 2020. The top ten automakers, including FAW, Dongfeng Fengshen, Chana, SAIC, GAC Trumpchi, and Great Wall finalized production plans to produce over 4 million units by 2020 at a planned investment of $12 billion (RMB 80 billion ).

Interested in learning more about Chinese electric vehicles? Download our fun and easy app below, flick the China switch and swipe left the models you don’t like, right the ones you do, enter the chat rooms and share your thoughts with the community.

The Chinese Government released its long-term development plan for the automotive sector on the 25th of April 2017, setting out the China EV strategy. The plan, presented by the Ministries of Science and Technology and Ministry of Industry and Information Technology in conjunction with National Development and Reform Commission, sets out how the country will ramp up the local EV sector and dominate the world market.

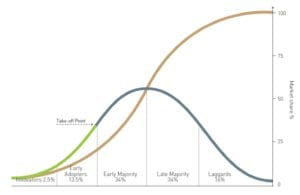

If successful the Chinese auto sector can leapfrog the dominance of the big auto companies, such as Toyota, VW, BMW, Daimler, Ford, and GM. Big Auto has missed the boat on electric vehicles and therefore continue to downplay the technology as only a niche sector. Management boards of big auto companies are flip-flopping strategy as they try and come to grips with how to enter the market and to what extent they should invest in research in technology. BMW last week announced that EVs constituted 3% of its total sales for the first quarter of 2017 after a jump in EV sales of 50% (Top 5 EV News Week 18). With the release of the data, the company set out how it will introduce more models. The news from BMW is in stark contrast from news only six months earlier when the Board grappled with if it should pursue EVs at all (Top 5 EV News Week 49  2016). In the USA we have recently seen how newcomer Tesla is valued above Ford and GM by investors. The response by Big Auto and other detractors of EVs was that this is a temporary phenomenon, arguing that Tesla hardly produces one tenth of the vehicles any of the top brands does. If one look at total sales of Battery Electric Vehicles (BEVs), it seems investors on the other hand value companies on their future ability to produce electric vehicles. If the same apply for Chinese brands, we can very quickly expect a Chinese brand to ascend the list of top auto brands.

2016). In the USA we have recently seen how newcomer Tesla is valued above Ford and GM by investors. The response by Big Auto and other detractors of EVs was that this is a temporary phenomenon, arguing that Tesla hardly produces one tenth of the vehicles any of the top brands does. If one look at total sales of Battery Electric Vehicles (BEVs), it seems investors on the other hand value companies on their future ability to produce electric vehicles. If the same apply for Chinese brands, we can very quickly expect a Chinese brand to ascend the list of top auto brands.

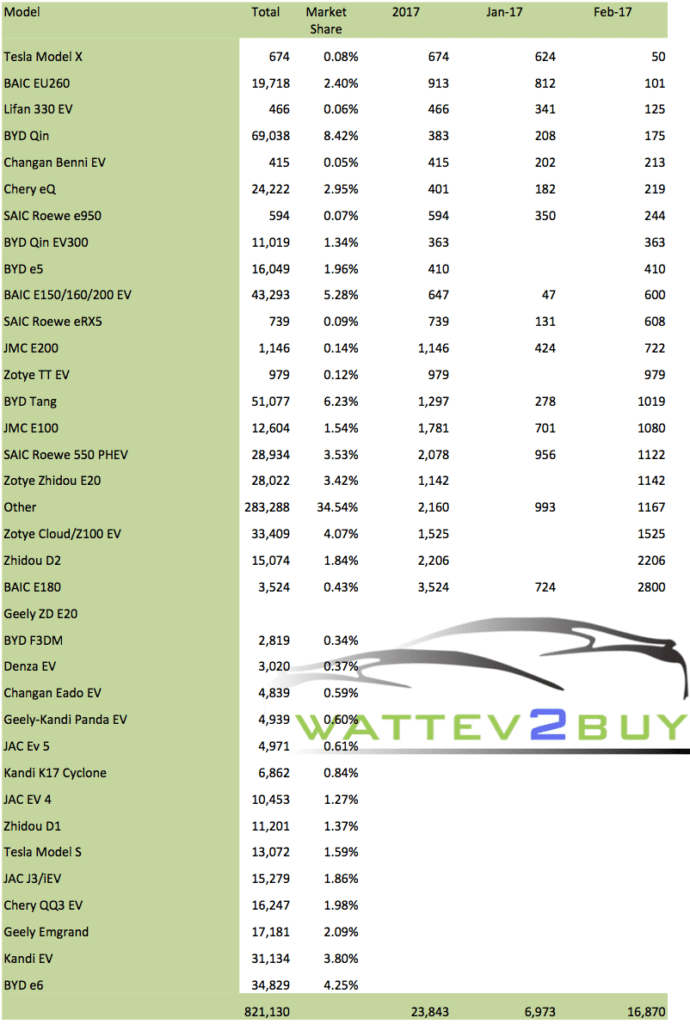

According to the plan by the Chinese Government, it set a short-term target of EV sales of 2 million units locally by 2020 and at the same time elevate Chinese auto brands to be seen amongst the top ten electric vehicle brands globally. The medium term target is that EVs contribute 20% of the total annual fleet by 2025, which is a huge amount of cars. Measuring the movement in sales by brand in the table below we can already see the top Chinese EV brands, BAIC, SAIC, Geely Zhidou and JMC moving higher and two brands, BAIC and BYD in the top ten list for the first quarter 2017. Other evidence of Chinese companies investing heavily in the sector includes Chinese IT company, Tencent acquiring a significant stake in Tesla, sparking a rally in the stock.

Measures by the Chinese Government to achieve the targets above include:

China already has experience of setting itself to dominate a sector and achieving set goals. Less than a decade ago the Chinese Government plotted to dominate the PV panel market and in the process brought down the price of energy production from renewables, killing some western PV manufacturers in coal plants in the process. Already we are seeing a deluge of battery cell plants being planned by the end of the decade in China. We can, therefore, expect the same domino effect as in the energy markets, taking out auto manufacturers that were slow to embrace electric vehicles.

Interested in learning more about Chinese electric vehicles? Download our fun and easy app below, flick the China switch and swipe left the models you don’t like, right the ones you do, enter the chat rooms and share your thoughts with the community.

It was just a matter of time for the newly formed partnership, barely five months old, between LeEco and Aston Martin hit the rocks, creating a roadblock for the Aston Martin EV strategy. Although none of the two companies officially announced the breakup of the Joint Venture to develop electric vehicle technology, China Money Network recently reported the suspension of the partnership by the British luxury carmaker.

The terms of the JV was for LeEco to help with the development of low emission vehicle technologies and deliver a concept car within two years. The partnership was funded by China Equity and the Chinese President oversaw the signing of the agreement. It was expected that the concept car will produce more than 1,000hp. The partnership also extended to the Rapid E 2018 model which is expected late 2017 and would have incorporated the latest LeTv Internet of the Vehicle (IOV) system. It is uncertain how the breakdown in the partnership will impact on the release of the performance saloon.

The terms of the JV was for LeEco to help with the development of low emission vehicle technologies and deliver a concept car within two years. The partnership was funded by China Equity and the Chinese President oversaw the signing of the agreement. It was expected that the concept car will produce more than 1,000hp. The partnership also extended to the Rapid E 2018 model which is expected late 2017 and would have incorporated the latest LeTv Internet of the Vehicle (IOV) system. It is uncertain how the breakdown in the partnership will impact on the release of the performance saloon.

Recently we reported that LeEco, the Chinese equivalent of Netflix and parent company of two EV start-ups, Faraday Future in the USA and LeSee in China, was forced to sell its Silicon Valley property, earmarked for its US headquarters. The sale, reported by Reuters, to Chinese property developer, Genzon Group, will provide the company with $260 million much-needed cash.

Both EV start-ups are known for making bold statements and big ticket announcements just to be followed by press reports of cash flow and funding problems. The announcement comes at a time when Faraday Future is battling to break ground on its plant in Northern Los Angeles. The company could not even pay the $21 million deposit to Aecon despite being offered $300 million by the local authorities for building the assembly plant there.

The 13-year-old LeEco is financially pressed on all fronts and founder, Jia Yeutling, was quoted by insiders referring to the cash flow problem as a “big company disease.” Rumors have also been flying that it was exciting its India operations and shares in its flagship unit, Leshi Internet Information and Technology Corp Beijing lost 25% of its value in five months. LeEco, which products include consumer electronics and cellphones, such as the LePro phone were able to raise $2.2 billion from Sunac China Holdings, a property developer. The funds are however not earmarked for LeEco‘s electric car division. Faraday Future is said to hold the patents to the technology, but recent reports state that the technology is in fact held by a separate company in the Cayman Islands, creating insecurity for investors and borrowers.

One might assume that an icon such as Aston Martin also took the reputational risk in consideration when entering into a partnership with an unproven start-up, but it seems Chinese cash was the deciding factor. The partnership was concluded at a time when a number of partnerships and equity transactions between British car makers and Chinese companies were entered into. Other transactions included investments by Geely in the London Taxi Company’s EV plant at Ansy, and Shanghai-listed Far East Smarter Energy Group investing in UK-based Detroit Electric for the manufacturing of the SP:01 EV. The transactions strengthen both the UK and Chinese positions in the electric vehicle market and created over 1,400 UK jobs.

We look forward to the official announcement by Aston Martin on the state of the partnership and how it will impact the release of the long-awaited RapidE. Aston Martin as recent as December stated that LeEco’s financial woes would not impact the JV or the release of the RapidE.

China, the world’s largest market for electric vehicles showed a rise in sales for the first quarter of 2017, improving on 2016 figures by 12,500 units. While March was a particularly good month, selling over 30,000 units, we wonder if the total sales of nearly 56,000 units in the first quarter will be enough for 2017 to beat the record of 350,000 set in 2016?

EV sales for 2017 kicked off rather poorly in January with a disappointingly low 7,000 units. The Chinese holiday season and the regulatory clampdown on the abuse of EV subsidies were blamed for the lackluster sales. Fortunately, sales improved as the following months saw a doubling each month on the previous, setting a very promising trend. Battery Electric Vehicles outsold Plug-In Hybrids by nearly five to one as over 44,000 BEV units were sold compared to only 9,000 PHEV models during the period.

New models were the top sellers, taking three of the top five positions in a country starved for cool looking EVs. Chinese consumers are used to being dished up a mix of inferior cars due to major international brands being forced to partner with local manufacturers. To protect their IP, the global brands produced older variants of their vehicles for the Chinese market. The situation has improved for the Chinese consumer as local producers such as BAIC, SAIC and BYD have started producing improved second generation EV models. The BAIC E180 and BAIC E260, taking the first and third positions for the quarter is a case in point of how the second generation electric vehicles are drawing more buyers to the sector.

2016’s darling, BYD is slipping in the rankings, the company, part-owned by Warren Buffet, which has been the best-selling electric vehicle brand in the world for 2015 and 2016 could only muster two-thirds of BAICs sales. More worrying for BYD is that it had five models in the market compared to BAICs three BEVs. Tesla had a respectable performance with the Model X selling 1,500 units, which is 13% of all Tesla Model X units sold internationally during Q1, accounting for 6% of the company’s total sales for the period.

In total Q1 2017 sales improved 30% on that of the same period in 2016, indicating that 2017 could even be a better year for electric vehicles, despite stricter regulation, proving that electric vehicles are entering the mainstream.