No Results Found

The page you requested could not be found. Try refining your search, or use the navigation above to locate the post.

Its all about batteries this week as announcements about battery production took center stage in EV related news.

The expected demand for electric vehicles is spurning a rush to bring battery plants online to profit from the disruptive technology. CEO of market leader LG-Chem, Park Jin-soo, told reporters at a meeting at the company’s head office on the 11th of March that the Korean manufacturer sees a 40% rise in revenues over the next two years. Mr. Jin-soo sees that half of the $9.3 billion expected rise in revenue will be from batteries.

VW announced that it already agreed on partnerships to a value of €20 billion with European and Chinese battery manufacturers in support of it’s “Roadmap E” electrification program.

The Croatian high-performance EV company Rimac and Camel Group, the largest battery manufacturer in Asia, agreed to invest $158 million in the creation of a company that will produce 50,000 EV batteries and engines per year for electric cars and buses. Rimac will acquire 40% of the JV company, Zhongke Luo Rui Technology Co. through the investment of €5 million in cash, knowledge, and technology. The balance of the capital investment will come from Camel Group. The plant will be constructed in Xiangyang, a city in China’s central Hubei province. Camel Group became the second largest shareholder in Rimac Automobili after founder Mate Rimac by investing €30 million in 2017 to support the development of the Rimac C_Two hyper-car unveiled earlier the month at the Geneva International Motor Show.

GSR Capital, a Chinese private-equity company, will invest $500 million in National Electric Vehicle Sweden (NEVS) through a convertible loan. The funds will be used to build a battery assembly line at NEVS plant in Trollhattan, Sweden. The plant will have a capacity of between 400,000 and 500,000 battery packs per annum.

Mercedes Benz announced the creation of its 6th battery factory in Bangkok Thailand. Mercedes Benz and its local partner Thonburi Automotive Assembly Plant (TAAP) will jointly invest €100 million by 2020 in the existing assembly plant and e new battery assembly line.

Panasonic held a ceremony at its plant in Dalian, China, commemorating the first shipment of prismatic-type automotive lithium-ion batteries. The Dalian plant is Panasonic’s first in the country and batteries will initially be shipped to the Chinese and North American markets.

The Korean battery manufacturer SK Innovation broke ground on its $780 million 7.5GWh battery plant in Komarom, Hungary this week. The plant will be the size of 60 football pitches and will be completed by H2 2019 and production will only commence in 2022. Mercedes is said to be one of the first customers of the plant.

Volkswagen CEO, Matthias Müller, this week expanded on the German automaker’s e-mobility program “Roadmap E.” At the Group’s Annual Media Conference in Berlin Müller announced the Group would assemble electric cars at 16 locations around the globe by 2022 as it accelerated its e-mobility plans over the last couple of months. The Volkswagen Group targets 3 million EV sale per year by 2025 from 80 new electric models across its various brands. Volkswagen Group will add to its current portfolio of 8 EVs in 2018 by bringing three pure electric cars and six plug-in hybrids to market by the end of the year. The program will pick up speed in 2019 when there will be a new electric vehicle “virtually every month” according to Müller.

Volkswagen’s huge investment in its electrification plans by no means mean that the company is turning its back on diesel-powered vehicles as it will invest €90 billion over the next five years in its conventional vehicle portfolio. Müller said, “We are making massive investments in the mobility of tomorrow, but without neglecting current technologies and vehicles that will continue to play an important role for decades to come.” The continued commitment to diesel goes against convention as its rival Toyota announced this week that it would phase out diesel engines from passenger cars in Europe from 2018.

Volkswagen’s commitment to diesel is underpinned by the company’s view that the technology produces only 80% carbon dioxide compared to that of gasoline vehicles. Auto manufacturers in the EU must lower their total fleet emissions by around 20% from 2016 levels to 95 grams CO²/km which Müller believes cant be done without including diesel.

Fortunately, it was just not all news about batteries and strategy this week; some automakers are about to unveil EVs ready for production in the next year.

Sokon announced that it would increase its investment in SF Motors to $200 million. Sokon will add $30 million to its wholly-owned subsidiaries’ capital structure in anticipation of the launch of its EV on the 28 of March 2018. The vehicle is expected to be launched in 2019.

AIWAYS teased its EV made of rigid steel and carbon fiber before the Beijing Auto Show which runs from 29 April to 4 May 2018. The EV designed by Roland Gumpert who also designed the Audi Quattro has a range of 600km (375 miles) and accelerates to 100km/h in under 3 seconds.

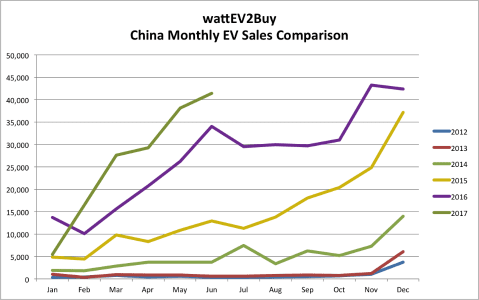

Historically sales for passenger vehicles take a hit during the Chinese annual new year’s holidays, 2017 was particularly bad for the Chinese EV market as the sales for electric cars dropped to around 7,000 units from over 40,000 in December 2016. This year was no different for passenger vehicles in general as sales declined 9.6% in February, but EV sales remained strong, reaching nearly 35,000 units which are 95% higher than February 2017. Electric car sales for the year to date now constitutes around 2% of all vehicle sales which is a 300% rise from year to date sales in February 2017. New models reaching the market this year so far is the two Yudo π1 models, the GAC Mitsubishi Qizhi, Chery Arrizio 3xe EV SUV, the Xpeng Identity showed at the CES 2018 and the Dongfeng S50 EV sedan and M5 EV MPV. With many more new models expected to be launched in the first half of 2018, we expect the Chinese EV market to explode even further this year.

The disruption caused by electric vehicles is in few companies so evident as in Ford. The American icon has been grappling with how it should respond to the changing landscape and after a false start and a change at the top resulting in the company having no new EVs to show for the foreseeable future. The company this week revealed its latest strategy which will see it replace 75% of its line-up by 2020 with a stronger focus on SUVs and trucks. The company’s new battery electric line-up of six EVs by 2022 will roll out in 2020 and start with a utility vehicle with a range of 300 miles. Ford is rethinking the current ownership model of gas-powered vehicles by making charging an effortless experience at home and on the road as well as offering full-vehicle over-the-air software updates to enhance capability and features. Ford vice president, Autonomous and Electric Vehicles, Sherif Marakby, said “Throwing a charger in the trunk of a vehicle and sending customers on their way isn’t enough to help promote the viability of electric vehicles, in addition to expanding our electric vehicle lineup, we are redesigning the ownership experience to ensure it addresses customer pain points that currently hold back broad adoption today.”

Ford plans to drive SUV growth with two all-new off-road models: the new Bronco and a yet-to-be-named off-road small utility – both designed to win a growing number of people who love getting away and spending time outdoors with their families and friends.

GM announced that it is moving into the production and commercialization phase of its autonomous version of the Chevrolet Bolt, the Cruise AV. GM’s autonomous vehicle subsidiary, Cruise, developed the world’s first production-ready vehicle built from the ground up to operate safely on its own with no driver, steering wheel, pedals or manual controls. I recently jokingly mentioned to friends that steering wheel manufacturers are going the way of the buggy whip, as evident from the picture of the GM Cruise AV on the cover of this weeks newsletter. GM will invest $100 million in its Orion and Brownstown facilities to bring the Cruise AV to market in 2019. The Orion Township assembly plant currently manufactures the Chevrolet Bolt EV while the Brownstown Battery assembly plant will be expanded to include the production of the Cruise AVs roof modules.

In brief:

The page you requested could not be found. Try refining your search, or use the navigation above to locate the post.

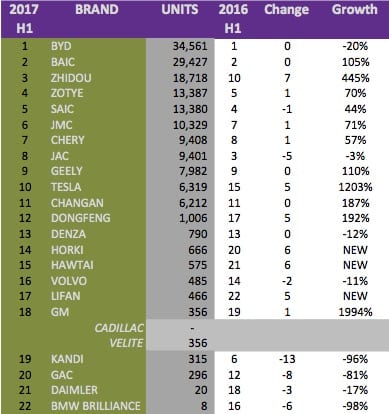

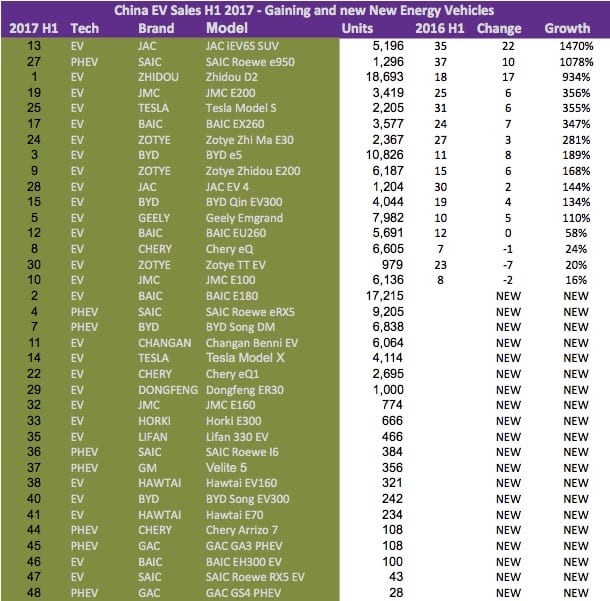

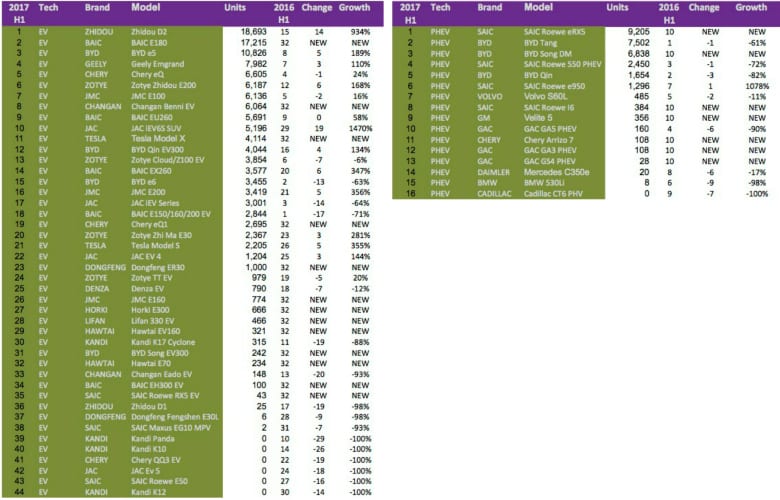

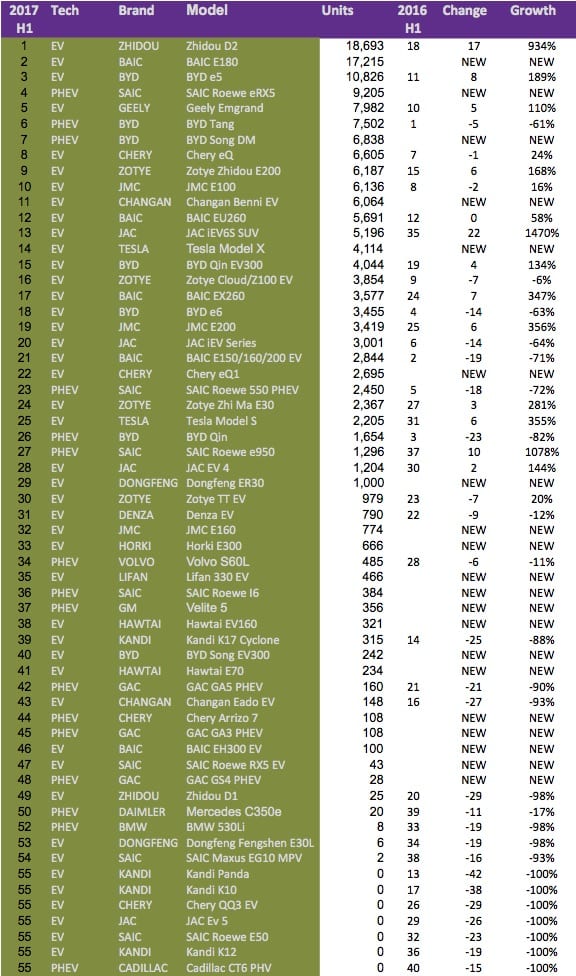

We look at the Top brands and models, the gainers and losers and how the battle between battery electric (BEV) and plug-in hybrid (PHEV) technologies play out in the summary of China EV Sales H1 2017.

The highlights for Chinese electric car sales in H1 2017 was:

The Top 3 EV brands in China for the first half of 2017 were BYD, BAIC, and Zhidou. Although BYD hung on to its first place, it sees its lead evaporate. BYD hardly registered any sales in the January 2017, and lost sales in its top performing Qin and Tang model ranges to competing new models from BAIC, Chery, and SAIC Roewe. BYD, one of the largest EV brands in the world, is seeing its position as China’s best performing EV brand challenged as it lost over 20% of its sales compared to 2016, while its competitor BAIC more doubled its sales. BAIC benefited from exciting new models entering the market in the last 12 months, with its small hatch, the BAIC EC180 being a top performer for three of the six months ending up the second best selling EV for the semester. Smaller EVs, or City cars, have also performed very well with the popular Zhidou Geely D2 selling nearly 20,000 units. Another brand with small EV models, Zotye, was placed fourth due to the popularity of its Cloud 100, E200 and E30 models. Other Top 10 Chinese EV brands selling city cars included Chery and JMC, both placed in the Top 10. Although JAC brought the exciting JAC iEV6S small SUV to market it was not enough to withstand the onslaught of its peers, crashing out of the Top 3 to the eight position. Tesla also entered the Top 10 list with the Model X performing very well (please note the June 2017 Tesla data did not make it in time for our analysis, which would have aided the brand’s performance). Western brands such as Volvo, BMW through its local partner BMW Brilliance, Daimler and GM mostly gave up market share to Chinese-produced vehicles.

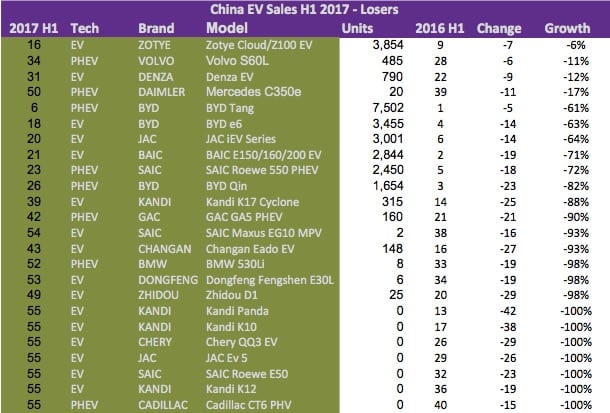

Twenty new EV models entered the Chinese EV market in the first half of 2017 but only three, the BAIC EC180, SAIC Roewe eRX5 and BYD Song DM, made it to the Top 10 list of electric vehicles in China. None of last years Top 5 could hang on to their positions with two of the new models, the BAIC EC180 and SAIC Roewe eRX5, entering the market with Top 5 positions within three months from being launched. Last year’s Top 3 EVs, the BYD Tang, BAIC E200, and BYD Qin all crashed out, with the BYD Tang the only model able to hold on to a Top 10 position. Plug-in Hybrid vehicles could only muster three positions in the Top 20 as small city EVs made up more than half of the units sold in 2017 to date. The popular SUV class accounted for 26% of the units sold in the Top 20 list of EVs in China while plug-in hybrids only accounted for 16% of all the EVs sold. New electric vehicle models made up 31% of all the EVs sold during the period under review.

BYD’s ailing fortunes are clear in the list of losers for the first half of 2017 but another popular EV brand from 2016, Kandi, saw diminishing sales as its Kandi K17 Cyclone could not compete with the host of new small city cars entering the Chinese EV market. Clear again is the composition of plug-in hybrids and foreign brands in the list of the worst performing electric cars.

Plug-in hybrid models are losing the battle in China, strange though that 35% of the new models launched in the last 12 months are PHEVs. In the comparable period in 2016 plug-in electric vehicles made up 33% of all the units sold while the vehicle type only contributed to 16% of all sales in 2017.

Be sure to check out our new presentation of all EVs since 2010 to gain great insights on all auto brands and their electric vehicle strategies. We have also created presentations per technology type BEV, PHEV, and FCEV.

The page you requested could not be found. Try refining your search, or use the navigation above to locate the post.

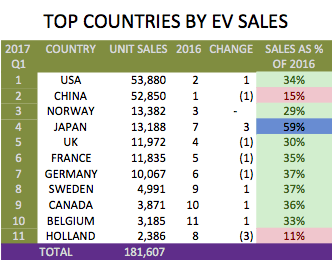

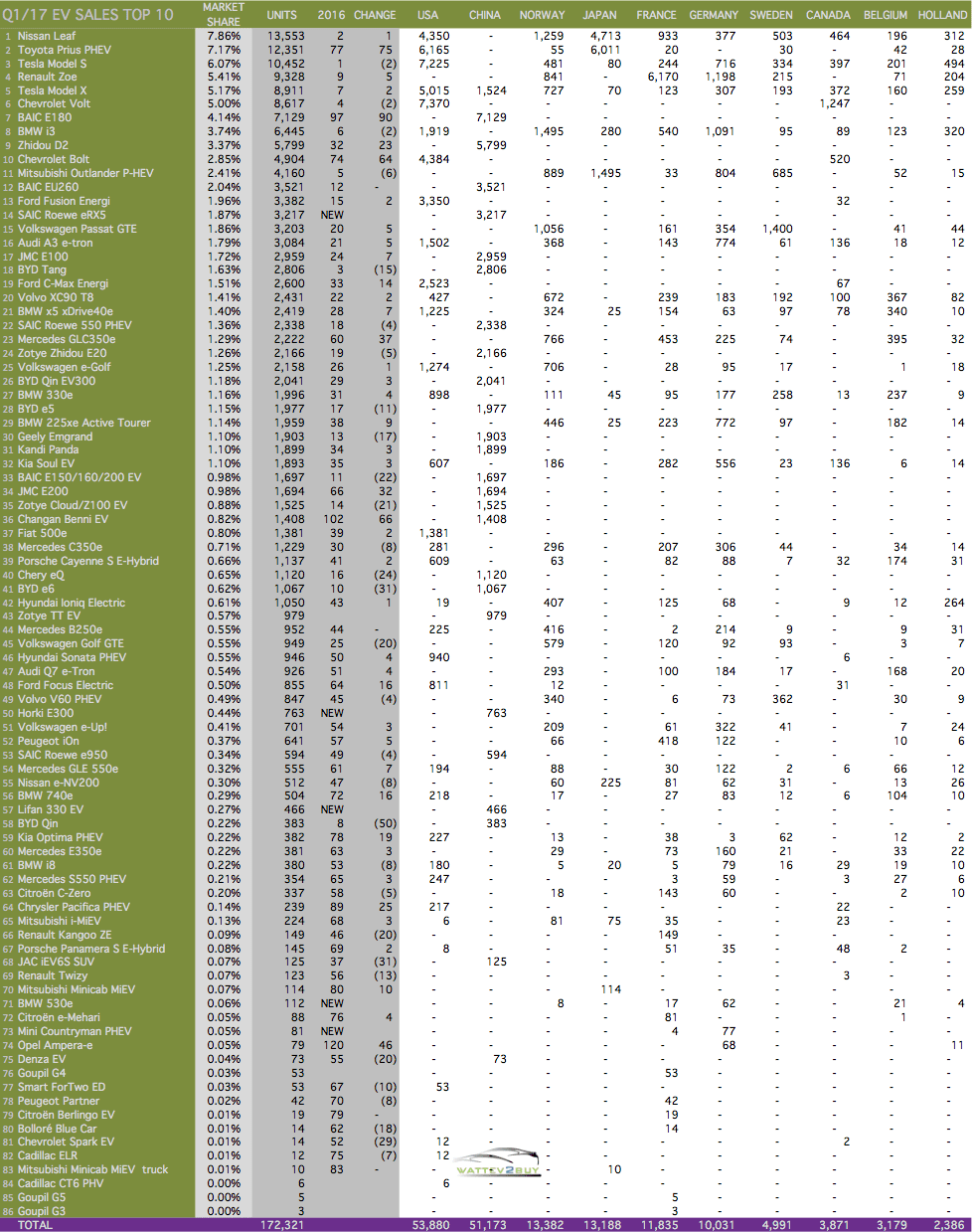

Now that all the Q1 data is in we can do a detailed dissection of the hottest quarter in EV history in which nearly 200,000 electric vehicles was sold. The headline data is that nearly 180,000 EVs were sold in the top 10 EV countries. Battery Electric Vehicles (BEV)  outperformed Plug-in Hybrid Vehicles (PHEV) by a long shot. A total of just over 106,000 BEVs were sold while only around 70,000 PHEVs moved off the dealership floor in the top 10 countries.

outperformed Plug-in Hybrid Vehicles (PHEV) by a long shot. A total of just over 106,000 BEVs were sold while only around 70,000 PHEVs moved off the dealership floor in the top 10 countries.

One of the standout data points is USA EV sales which overtook China as the best market for electric vehicles in Q1, making the USA the top EV country in Q1. The worst performer was The Netherlands, who fell out of the top 10. The Netherlands disappointing performance over the last couple of quarters does not bode well for the European country was seen, next to Norway, as one of the proponents of the technology. Only last year still did the Dutch Government contemplated a goal to be 100% electric by the middle of the next decade. It is unclear what caused the drop in EV sales in the Netherlands.

When comparing this quarter’s EV sales by country to their respective totals for 2016 one can see that the pace of EV sales picked up in most. If one should expect that by the end of Q1 EV sales should equate to roughly 25% of 2016, it is only China and The Netherlands that are underperforming. Chinese EV sales have lagged in January due to technical factors including a clampdown on EV subsidy fraud and the annual Chinese holiday, in which most industries shut down. Chinese EV sales have picked up the pace in the following months and the quarter still ended up 30% over the same period of the previous year. It can be concluded that EV sales for the first quarter in China are historically weak and Q1 2017’s performance is by now way an indication of a trend. Furthermore, the Chinese Government last week announced a plan to dominate the electric vehicle sector which should help the country to regain its stature. Japan, on the other hand, has picked up the strongest pace and has already achieved EV sales equal to 59% of its total 2016 sales. The Japanese EV market has the least variety of EV models available to consumers, and it is anticipated that the introduction of more models will stimulate the market further. Germany is the second best performer helped by a 77% improvement in EV sales on a year-to-year basis.

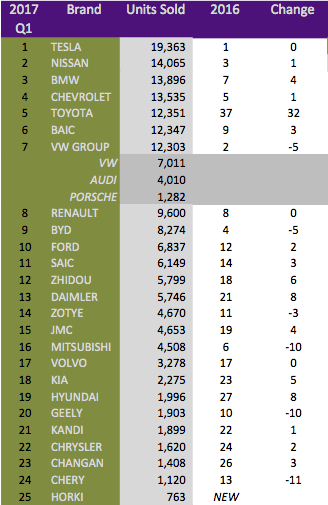

The top EV brand in the Top 10 EV Countries is Tesla for the second year running. Tesla announced in its April trading update that it sold just over 25,000 Models S and X globally. It is important to note that the figure repo rted includes vehicles being shipped, while country sales data shows vehicles registered. Toyota is back in the Top 10 list of EV brands on the back of a well-received new Toyota Prius. Chevrolet did not shoot the lights out with its new mass-market EV, the Chevrolet Bolt / Opel Ampera-e. Most of GM’s sales came from the Chevrolet Volt PHEV. The company is criticized for producing a limited amount of the Bolt and is being labeled as a compliance company for that, a term used for auto manufacturers that only sell EVs in Zero Emission states to gain credits. The big losers included VW, BYD, and Mitsubishi. BYD has been the Top EV manufacturer for 2015 and 2016 globally and was at the number three position for most EVs sold since the start of the decade. Competition from the likes of BAIC and SAIC is the main reason for the companies bad performance. Up til 2016, BYD had the advantage of being first to market, but some new models that can compete on performance and quality with BYD entered the market since 2016. (This sentence could very well be used for Tesla in a couple of years). Mitsubishi fell a staggering ten places as the company has not updated its popular Outlander PHEV or introduced new models as a replacement.

rted includes vehicles being shipped, while country sales data shows vehicles registered. Toyota is back in the Top 10 list of EV brands on the back of a well-received new Toyota Prius. Chevrolet did not shoot the lights out with its new mass-market EV, the Chevrolet Bolt / Opel Ampera-e. Most of GM’s sales came from the Chevrolet Volt PHEV. The company is criticized for producing a limited amount of the Bolt and is being labeled as a compliance company for that, a term used for auto manufacturers that only sell EVs in Zero Emission states to gain credits. The big losers included VW, BYD, and Mitsubishi. BYD has been the Top EV manufacturer for 2015 and 2016 globally and was at the number three position for most EVs sold since the start of the decade. Competition from the likes of BAIC and SAIC is the main reason for the companies bad performance. Up til 2016, BYD had the advantage of being first to market, but some new models that can compete on performance and quality with BYD entered the market since 2016. (This sentence could very well be used for Tesla in a couple of years). Mitsubishi fell a staggering ten places as the company has not updated its popular Outlander PHEV or introduced new models as a replacement.

The Top 10 EV models are still lead by the Nissan Leaf, a phenomenal performance by the 7-year-old EV. The Toyota Prius replaced the Tesla Model S in the top two while the Tesla Model X performed the best of the 2016 Top 10 cohort. Newcomers Chevrolet Bolt, BAIC E-180, and the Toyota Prius replaced the BYD e6, BYD Tang and Mitsubishi Outlander in the Top 10 EV models list for Q1.

Please use the comment section below to share your thoughts on the EV market.

Note on data: The detailed data above does not include the UK, who keeps their EV data more secret than Donald Trump does classified information.

The page you requested could not be found. Try refining your search, or use the navigation above to locate the post.

#1 – Fist full EV VTOL Jet take to the skies

A German startup, Lilium, founded in 2015 with the intent to develop the first fully electric vertical take-off and landing (VTOL) jet this week completed its first successful test flight. The vehicle, named Eagle, a two-seater prototype completed its first test flight in Bavaria, Germany. The test flight included a range of advanced maneuvers, including its signature mid-air transition from hover mode to wing-borne forward flight.

Lilium’s business plan provides a flying five-seater taxi on demand. The Lilium Jet has a cruising velocity of 300km/h (187mph) and range of 300km. The design consists of a 10-meter wingspan, 36 engines, and works on the canard concept with powered lift.

Lilium’s business plan provides a flying five-seater taxi on demand. The Lilium Jet has a cruising velocity of 300km/h (187mph) and range of 300km. The design consists of a 10-meter wingspan, 36 engines, and works on the canard concept with powered lift.

The company beats industry heavyweights Airbus at its own game. Airbus unveiled the Airbus Pop.up during the Geneva Auto Show in 2017.

#2 – LG-Chem Q1 Sales excels

LG Chem, the Korean battery vehicle manufacturer, this week announced it’s Q1 sales valued at $5.5Bln, showing growth of 33% year-on-year. More impressive though is that the company showed an increase in operating profits of 74% year-on-year. In our view, it provides a safety margin which could point to price decreases in the expected price war, similar the solar panel market as huge new plants is coming online over the next two years.

#3 – Tesla recall a buying opportunity

Tesla this week announced one of its largest voluntary recalls for 53,000 manufactured between February and October 2016. The recall is due to a fault in a third-party supplied component, potentially resulting in the handbrake not releasing. The recall is not viewed as negative and hardly had an impact on the share price as the company closed near its record price of $307.71 set earlier the week, still very well on the way to our first target of $320.

Tesla’s announcement that it would unveil its Semi-truck in September had analyst very excited, speculating that it would add billions to the companies bottom line and disrupt the sector. The company is expected to lease the batteries at $0.25 per mile saving trucking companies the $0.50 fuel charge.

#4 – Q1 EV sales for France, German, and China, two out three ain’t bad.

German (#9 on Top EV list), French (#7 on Top EV list), and Chinese (#1 on Top EV list) EV sales for Q1 was released this week. Both China and Germany saw huge year-on-year increases, while French EV sales flatlined. Read our blogs for a detailed breakdown of the sales.

#5 – More Concept’s and a few production-ready vehicles at Shanghai Auto Show

The New York and Shanghai Auto Show’s provided many newsworthy releases related to electric vehicle strategies, concept cars, and some productions cars. Although the New York auto show had all thirty plus electric vehicles available for sale in the State on view, the Shanghai Auto Show were the place to be for electric vehicle enthusiast. The VW Group teased its Audi eTron SUV and VW I.D. CROZZ concepts, which is only expected by 2019. Tired of all these old auto companies releasing concept after the other without having real competition for the Tesla available? Two production ready vehicles from newcomers Lucid Motors and NextEV‘s NIO brand were unveiled at the Chinese event. NIO’s ES8 seven seater SUV is expected to be available in China by the end of the year. The company also announced that it would add ten more units to its fleet of six EP9 supercars, priced at $1.48 million.