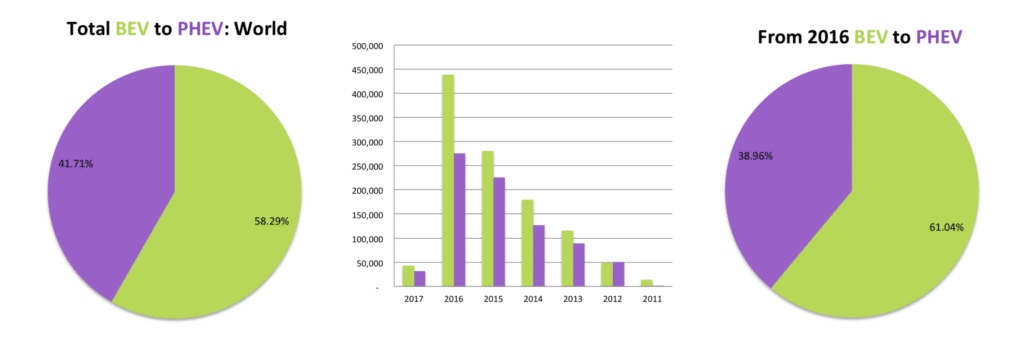

Battery Electric Vehicles (BEV), also known as pure electric vehicles, has outsold plug-in hybrid electric vehicles since the start of the decade. Intuitively one would have thought that because of the high cost of battery cells at the onset of electric vehicles that Plug-in Hybrid Electric Vehicles (PHEV’s), such as the Toyota Prius, would have been the best first step to enter the market, which the company initially did until it abandoned the technology. Traditional auto manufacturers (Big Auto) in general did not take electric vehicles seriously, leaving the task to start-ups such as Tesla to develop solutions for the consumer. In the auto industry, it is easier for new entrants to enter with new technology than compete with Big Auto, churning out engines from plants which cost has already been recovered. Thus leaving Big Auto at a disadvantage as they have to invest in research and infrastructure, playing catch up with the disruption.

The big driver’s behind the performance of BEV’s has been:

- Small vehicles such as the Nissan Leaf, which have accounted for over 10% of all electric vehicle sold and around 19% of all BEV’s sold;

- China has been the best market for BEV’s. In 2016 the Top 10 BEV’s sold were more than all EV’s, BEV and PHEV combined, for the same period in the USA. Micro BEV’s or neighborhood electric vehicles (NEV’s) are the best sellers in the China, supported by a Government that wants to be the world leader in the new technology and combat pollution in its cities. Twenty percent of all EV’s sold in China comes from just five mini BEV’s, the BAIC 200EV, Kandi Panda, Zotye Cloud, Zotye E20 and Chery eQ.

- Incentives and legislation such as the Zero Emission Vehicle Program in the USA to support the adoption of electric vehicles.

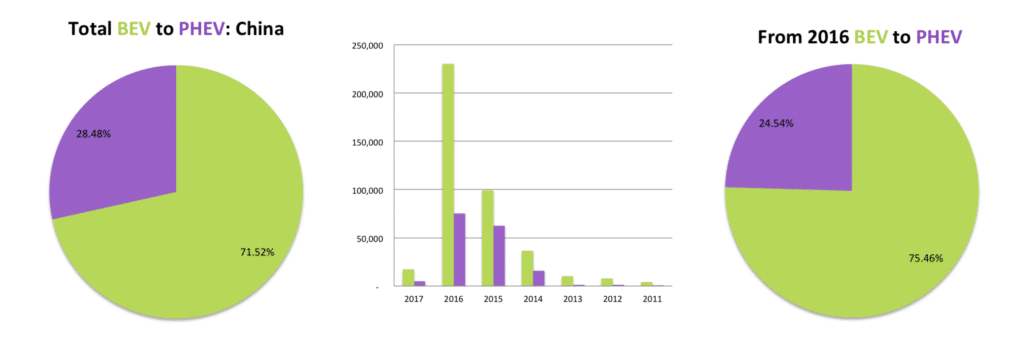

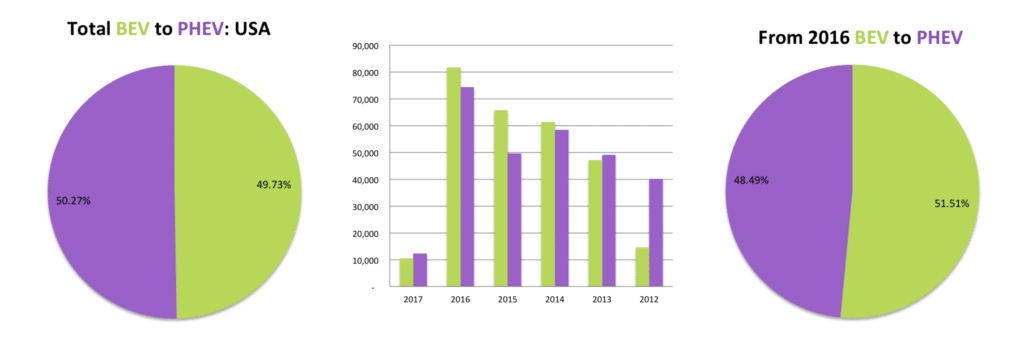

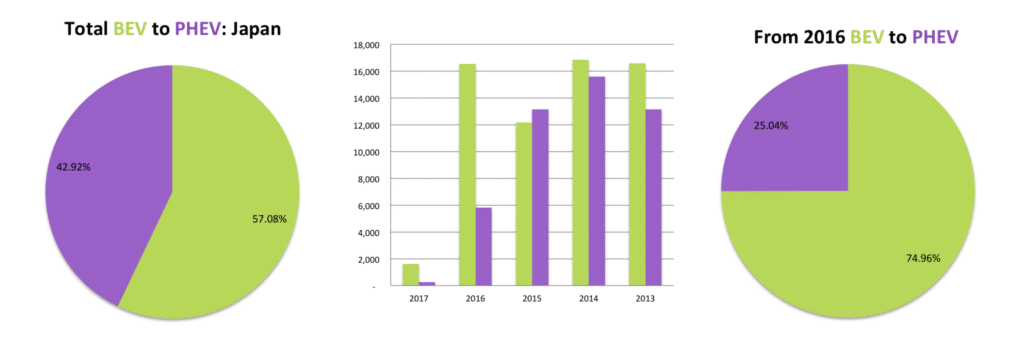

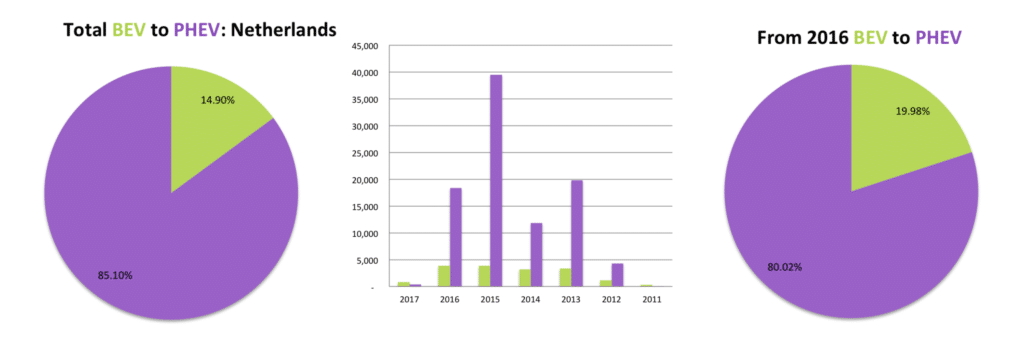

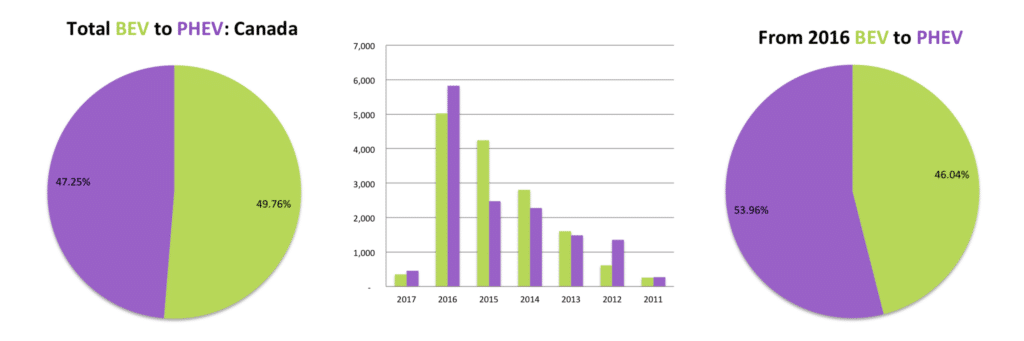

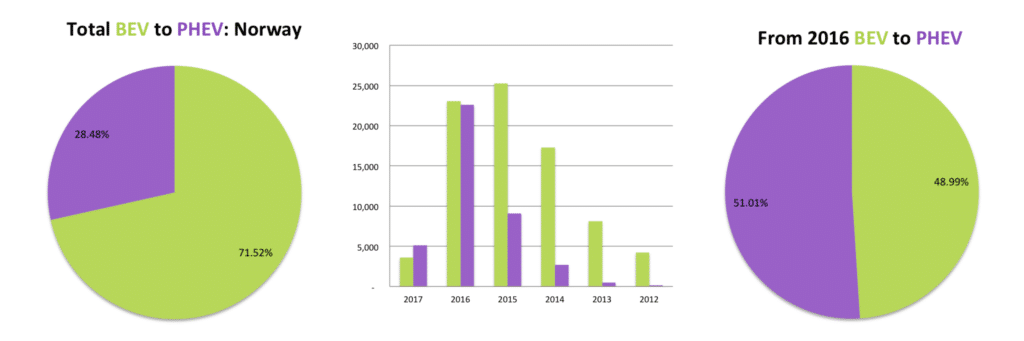

It is expected that the trend for BEV’s should remain favorable as technology and cost improvements and more automakers plan to bring BEVs to market by the end of the decade. Analyzing the Top 10 EV markets, which represent over 90% of all EVs sold, however, show the opposite. Surprisingly, at closer inspection, PHEV’s are gaining on BEV’s in the majority of the Top 10 EV markets. In our study below we compare the proportion of BEV’s to PHEV’s in the Top 10 EV markets by plotting all EV’s sold from the start of the decade to EV’s sold since 2016, when most automakers changed their electric vehicle strategies. (For more detail follow the links to the different countries for a complete breakdown of sales per model and year in that country).

Chinese BEV’s, not always the most beautiful looking cars, have performed very well since the start of the decade and even more so over our test period from 2016. There are only three PHEV’s of any value worth mentioning in China, namely the BYD Qin, BYD Tang and SAIC Roewe 550, which combined sales accounted for around 18% of all EV’s sold since the turn of the decade. 2016 for the first time saw larger sedans taking over from the micro BEV’s, with the BYD e6, BAIC EU260, and Geely Emgrand entering the Top 4 list in the country. It is clear that with aggressive government support sales for BEV’s are ever increasing in the world’s Top market for EVs.

The home of Tesla and compliance vehicles, the USA, is the second largest market for electric vehicles. Stripping out Tesla, which accounts for nearly 40% of all BEV’s sold in the country will provide a completely different picture than above, where the BEV and PHEV ratio mirrors a presidential race. Most Big Auto brands are represented in the country, and when we say country, we can be forgiven to say California, where it’s Air Resource Board developed the Zero Emission Vehicle Program, targeting 15% of all vehicles to be ZEV’s by 2025. The ZEV Program supports the adoption of BEV’s by forcing automakers to sell a certain percentage of Zero Emission Vehicles. The ZEV program has been adopted by nine other states, which in total account for around 30% of all new vehicle registrations in the USA. The result is that even automakers with no EV strategy, including Fiat Chrysler, are selling what is called “compliance vehicles,” being converted plug-in variants of existing models, such as the Fiat 500e and Chrysler Pacifica. GM has also been labeled a compliance company by some, even though it introduced the first mass-market EV, the Chevrolet Bolt. The argument against GM is that it only released the Bolt it the ZEV States while it produces an uninspiring amount of 30,000 vehicles. On the other hand, GM is supporting the fight against clean air regulations and Tesla‘s direct sales model, effectively trying to halt the progress in the EV sector.

Japan, the fourth largest of the Top 10 EV markets, with China, is one of the few countries in the Top 10 list where BEV’s are outselling PHEV’s. In the case of Japan BEV’s contributed to around 75% of all EV’s sold. The country is however not the best example of expanding BEV sales. Only three brands contribute to over 90% of the sales through four models, namely the Nissan Leaf (EV), Mitsubishi Outlander (PHEV), Mitsubishi i-Miev (EV), and Toyota Prius (PHEV), which production was halted in 2015 for re-release in 2017. No great analytical deduction can be made other than a 40% increase in Nissan Leaf sales and 50% drop in Mitsubishi Outlander sales in 2016 resulted in the shift in favor of BEV’s.

The Netherlands is a big hope for the EV sector. The country targets an 100% electric fleet by 2025. However, the data don’t really show encouragement for zero emission vehicles in a country one would have guessed would be ideal for BEV’s due to the relatively short distances within its borders ( sorry if this does not sound very Euro-centric). BEV sales have stagnated since 2013 with the Nissan Leaf and Tesla making up most of the market. The EV’s sector is dominated by PHEV’s from Volkswagen, Audi (also VW), Volvo, BMW, and Mitsubishi. The Mitsubishi Outlander PHEV is a big hit, cornering nearly 25% of the EV market in the Netherlands. The country also has the highest international sales of the Mercedes C350e, Volkswagen Passat GTE, Volvo XC90 T8 and V60 PHEV.

The Netherlands is a big hope for the EV sector. The country targets an 100% electric fleet by 2025. However, the data don’t really show encouragement for zero emission vehicles in a country one would have guessed would be ideal for BEV’s due to the relatively short distances within its borders ( sorry if this does not sound very Euro-centric). BEV sales have stagnated since 2013 with the Nissan Leaf and Tesla making up most of the market. The EV’s sector is dominated by PHEV’s from Volkswagen, Audi (also VW), Volvo, BMW, and Mitsubishi. The Mitsubishi Outlander PHEV is a big hit, cornering nearly 25% of the EV market in the Netherlands. The country also has the highest international sales of the Mercedes C350e, Volkswagen Passat GTE, Volvo XC90 T8 and V60 PHEV.

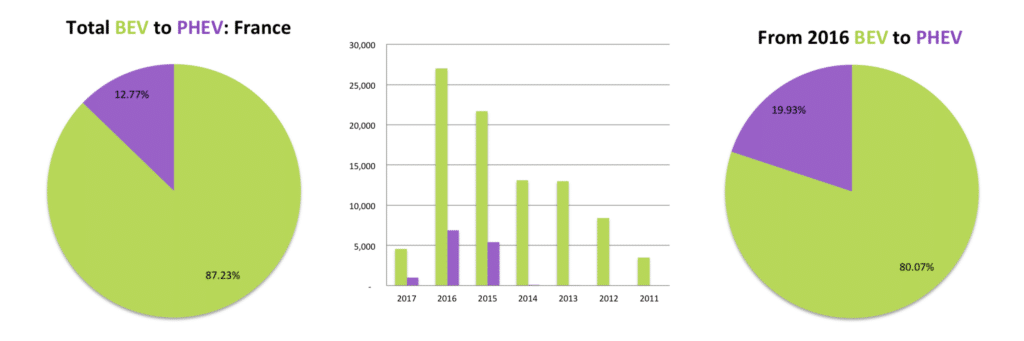

In France, the home of Renault, Citroën, Bolloré, and Peugeot is number six on the list of the Top 10 EV Markets. Here, PHEV’s have gained slightly on BEV’s but are still only 20% of all EV’s sold, while EV’s represent 1.4% of all vehicles registered in 2016. The high percentage of BEV’s is a clear indication that French automakers were more progressive in accepting electric vehicles at the turn of the decade. France also has the highest number of commercial electric vehicles, just over 15% of all EV’s, with the Renault Kangoo being the delivery vehicle of choice. France also has one of the biggest range of EV models available to the consumer, with over 50 models recorded in its official sales data.

In France, the home of Renault, Citroën, Bolloré, and Peugeot is number six on the list of the Top 10 EV Markets. Here, PHEV’s have gained slightly on BEV’s but are still only 20% of all EV’s sold, while EV’s represent 1.4% of all vehicles registered in 2016. The high percentage of BEV’s is a clear indication that French automakers were more progressive in accepting electric vehicles at the turn of the decade. France also has the highest number of commercial electric vehicles, just over 15% of all EV’s, with the Renault Kangoo being the delivery vehicle of choice. France also has one of the biggest range of EV models available to the consumer, with over 50 models recorded in its official sales data.

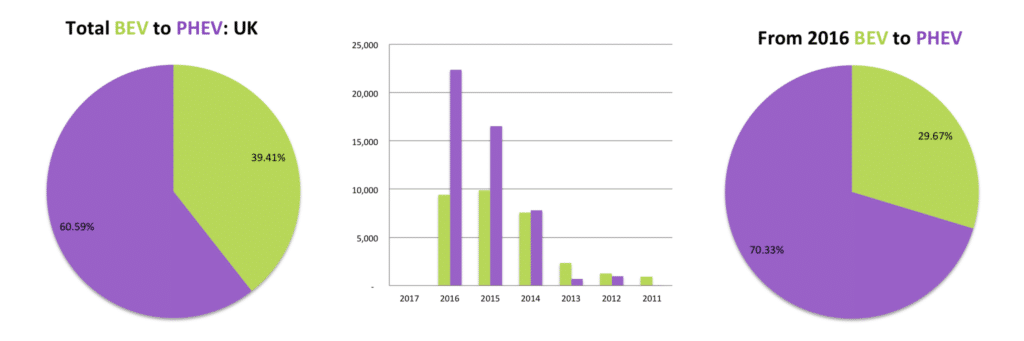

The UK market is much more excepting of PHEV’s with the trend increasing in the last year as more models are becoming available. The UK is another strong market for the Mitsubishi Outlander, where the Japanese vehicle represents nearly 30% of all EV’s sold. The world’s seventh biggest market for EV’s is also a great offset point for Germany. UK Sales for the BMW 330e is the highest in the world and sales for the Mercedes C350e is a couple of units short of the that of the Netherlands, which has the world’s most at 5,754 units. Publicly and reliable sales data for the UK is difficult to get hold of, with only the Top 5 models available up to December 2016, making a proper analysis difficult.

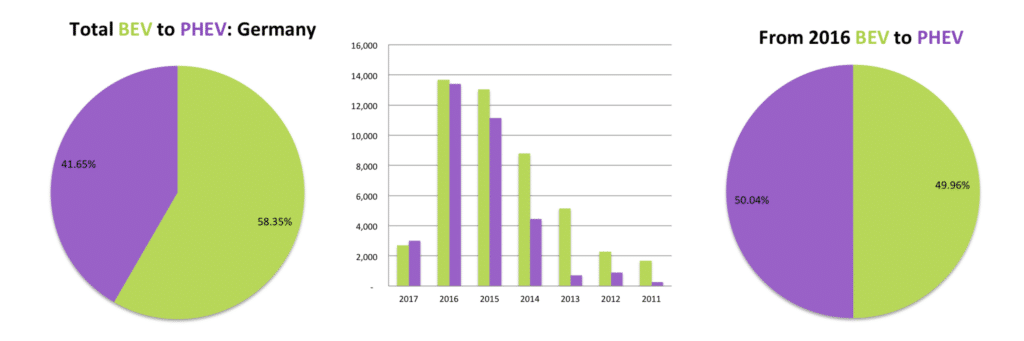

It would be surprising not to see PHEV’s beating BEV’s in the world’s 8th largest market for EV’s. Germany is home to BMW, Mercedes and VW, all brands that missed the boat on electric vehicles, now trying to catch a fast train on the back of PHEV’s. The three charts above clearly show how the release of plug-in hybrid variants of existing models since 2014 helped increase the sale of electric vehicles. Like in other European markets, the consumer is spoiled for choice in Germany.

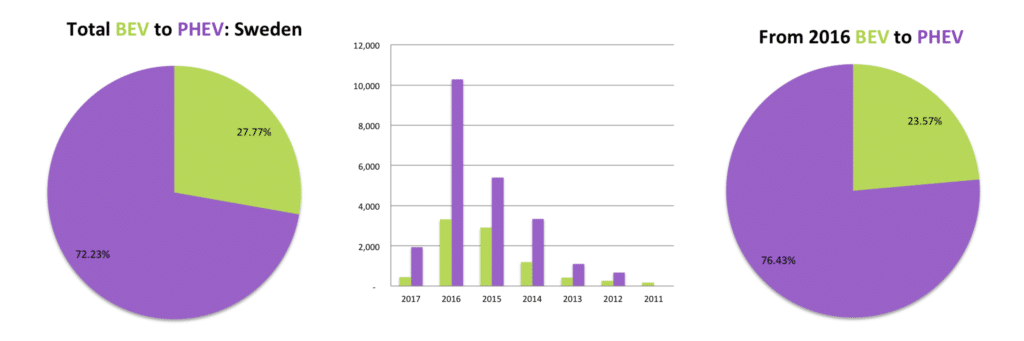

Sweden, number nine on the list of the Top 10 EV Markets and the home of Volvo also shows a big affinity for PHEV’s. The Mitsubishi Outlander again has a significant portion of the EV market, with a 25% market share of all EV’s sold. There is a significant drop between the number eight position of the Top 10 EV Markets and that of the ninth, with a 50,000 unit drop from 80,000, leaving very little to write home about. None the less Sweden commands the fourth position on the list of EV’s as a percentage of total vehicle registrations, with 3.5% of all new vehicles registered to be an EV in 2016.

Canada in many ways mirrors the USA in trends, obviously at a much smaller scale. Just five models represent nearly 75% of all EV sales in the country, being the Chevrolet Volt, Tesla Model S, Nissan Leaf, Tesla Model X and the Smart ForTwo ED. The popularity of the Smart ForTwo makes it clear why Daimler decided to only sell electric versions of the micro car in the country.

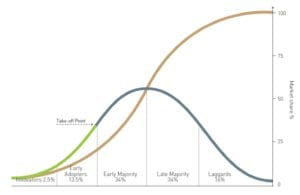

Saving the best for last. Norway, the darling of the EV sector, number three on the list of Top 10 EV markets and number one the list of EV as a percentage of new vehicle registrations. The country is now officially a growth market, reaching the take-off point for the technology, and a clear example of our thesis that PHEV’s are gaining on BEV’s. EV sales in Norway as a percentage of the total fleet for the year 2016 was at a record 29.1%. The prospects for 2017 looks even better, as in January the percentage of EV’s registered achieved a record-breaking 37.5%. At the same time, PHEV’s outsold BEV’s for the first time. Looki ng deeper into the data and drilling down into the model mix two things are starting to emerge, namely:

ng deeper into the data and drilling down into the model mix two things are starting to emerge, namely:

- European automakers have finally caught on to the electric vehicle idea and since 2014 are bringing more models to market through the easy route of providing plug-in hybrid variants of existing models, which;

- Targets the early majority, those consumers that might still be skeptical on issues such as range and charging but not wanting to lose out thereby choosing the perceived “safety” of a PHEV.

We can expect this trend to continue until there is a wider choice of BEV models for the consumer and charging infrastructure expanded. Let’s hope that this trend is not just another way for Big Auto to hijack and derail the drive to zero emission vehicles. In the meantime we should be grateful, that although not hardcore, PHEV’s still introduce new drivers to the pleasure of driving in full electric mode, thereby making them want a BEV next time they buy.

Notes on the data used for the study:

- BMW i3 data has been split 50/50 between PHEV and BE as we don’t have exact data for the sales of BMW i3 and BMW i3REx

- 266,080 units, mostly from Chinese sales data (254,001 units) is undefined, due to the difficulty in getting complete data from the country has been excluded. If one should argue that they are all PHEV’s, BEV’s would still be higher in China and the World.

- All the country data is complete until February 2017, except for the UK. Please comment if you have a good source for UK data.

LATEST IN DEPTH COUNTRY EV SALES REPORTS AVAILABLE IN OUR SHOP

No Results Found

The page you requested could not be found. Try refining your search, or use the navigation above to locate the post.

TOOLS TO COMPARE ELECTRIC VEHICLES

We have designed some cool tools to compare electric vehicles. Our tools include a mobile app, charging cost calculator and EV selector. Use wattEV2Buy’s proprietary tools to find the ideal EV for your requirements and determine the cost of charging EVs.

Not sure which model EV to choose?

wattEV2Buy’s easy to use EV Select tool helps identify which electric vehicle is perfect for your specific requirements. EV Select compare electric vehicles battery electric range over various vehicle types. Within four clicks you can get the perfect luxury sedan able to drive your required distance on battery power.

Unsure what the charging cost will be?

wattEV2Buy’s easy to use Charging Cost Calculator compare electric vehicles charging cost in your state and relate it to equivalent gasoline cost. The charging cost calculator also allows you to be specific and customize your electricity cost in kWh and provide results in miles and kilometers, making it usable all over the world.

Top 5 EV News Week 32 2020

Top 5 EV News Week 32 2020 | Cadillac Lyriq unveiled. Yet another Chinese EV startup IPO. Three new EV models launched this week.

Top 5 EV News Week 31 2020

Top 5 EV News Week 31 2020 | Successful IPO for CHJ Auto, Kandi finally enters the USA, Mitsubishi pays the cost for failing EV strategy.

Top 5 EV News Week 30 2020

Top 5 EV News Week 30 2020 | Chengdu Auto Show, Hozon Neta IPO, VW invest in China, eVito Tourer for sale